Employment Practices Liability Insurance (EPLI) is an insurance policy that protects organizations, directors, and managers against claims arising from an insured’s injury-causing employment practices, such as discrimination, defamation, or sexual harassment.

Here are some important things to note:

- Complainants may be employees, past, present or future

- Claims can be complex and costly

- It’s important to understand your level of risk

- Know your insurance coverage options and how to use your policy when you need it.

What is employment practices liability insurance?

Employment Practices Liability insurance protects the insured organization from financial loss that results from claims arising from their real, or alleged, injury-causing employment practice. It is a ‘named perils‘ insurance that is typically offered on a ‘claims made‘ basis. Insurance professionals often refer to Employment Practices Liability Insurance as EPLI or EPL.

Don’t confuse EPLI with employer’s liability insurance. These are two very different insurance coverages. Employer’s liability insurance covers organizations against claims by employees who sue them for a job-related injury or illness. On the other hand, EPLI only responds to employment practices-related suits.

What are employment practices?

‘Employment practices’ refers to all actions, processes, and procedures related to the work environment. This starts with the hiring process, through ongoing employment, to termination, and even after employment has ceased. Organizations must take every reasonably possible step to ensure that all their employment practices comply with all employment-related regulations in their jurisdiction of employment. When organizations fail to comply or allegedly fail to comply with these regulations, complaints or lawsuits can arise.

Here are some examples of injury-causing employment practices:

- Wrongful termination

- Discrimination

- Defamation

- Sexual harassment

What do EPLI claims look like?

What’s unique about employment practices liability is the complexity of the claims and how emotionally charged they can be. It’s important to understand the following about EPLI claims:

1. Claims can be complex and evolve unpredictably

When an organization experiences a property damage event, for example, a fire, it does not take long to determine the cause, extent of the damage, and the size of the loss. When an insured receives a written demand arising from an alleged wrongful employment practice however, the situation can be much more complex. The claim needs to be investigated and the allegations need to be proven. There is discovery, a lawsuit, or tribunal adjudication. There may be appeals, and, at times additional allegations may appear. A single sexual harassment or discrimination claim, for example, may encourage others to come forward. What at first appeared to be small and manageable may turn out to be much larger, and very costly to defend.

2. Claims can involve reputational risk

EPLI claims are emotionally charged, can be sensational, and may even turn into a public relations nightmare. For the insured, the direct financial impact may be the least of their concerns, eclipsed by a need to keep the claim from becoming public.

Understand that insurance isn’t a solution to such a problem but rather, it is an aid to help the insured get through the process of dealing with the claim. As with any insurance, an insured needs to know what to buy and how to use their policy when they need it.

Why buy employment practices liability insurance?

There are two main reasons that organizations buy EPLI:

- Financial safeguard – that is, for balance sheet protection. Even when organizations do everything right, acusations from past, present or future employees may still arise, and these may be costly to defend.

- Expertise and service – insurance companies know how to assist when things go awry, that is their area of specialty.

Who needs employment practices liability insurance?

It’s simple to say that all employers should buy EPLI because they have employees. Yet not all employers have the same risk profile when it comes to employment practices; therefore, their insurance needs are also not the same.

Here are some of the factors that impact an organization’s risk of wrongful employment practice allegations:

- Size of the organization

- Country of operation

- Industry

- Employee turnover

- Investment in employment practice risk management.

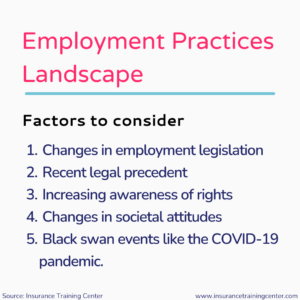

Note that an organization’s EPLI risk profile is dynamic. It may not stay the same over time as the organization grows, evolves, expands into new territories, restructures or shifts into a new industry.

Risk may also increase when there is a shift in the broader employment practices landscape. For example, the rise of the #MeToo movement, the increase in remote working, gender identity and washroom access, and cannabis legalization.

What does employment practices liability insurance cover?

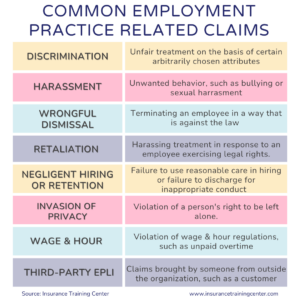

EPLI is a ‘named perils’ (defined perils) insurance. This means that the insurance coverage is limited to claims arising from perils that are named in the policy.

EPLI perils are injury-causing employment practices. EPLI does not provide coverage for injury-causing employment practices themselves, but rather, for the financial loss that the organization experiences as a result of claims that arise from those injury-causing practices. Such financial losses can include defence costs, damages, or settlement.

EPLI covers financial loss that the insured employer experiences because of a claim made against it as a direct result of a real or alleged named peril.

You will find the standard list of perils named varies by insurance policy. Insurance buyers should know what their options are and ask for what they need to ensure they buy adequate coverage. Some insurance companies also offer a number of optional insuring agreements. For example, wage & hour and third-party employment practices liability insurance are typically sold as separate insuring agreements rather than included in the standard EPLI policy.

What is not covered by an EPLI policy?

Insuring agreements state what the policy intends to cover and are subject to the policy’s exclusions, definitions, and terms and conditions. An insurance buyer needs to understand the perils listed under “employment practices wrongful act” (or similar term) and applicable exclusions of an EPLI policy. The last thing you want is to believe there is coverage when in fact there is none due to a coverage exclusion.

Here are some common EPLI coverage exclusions:

- Prior or pending claims (including prior notice, or prior knowledge)

- Bodily injury or property damage

- Contractual liability

- Conduct

- Duties under the law

- Nuclear/Radioactivity

- Exclusions for which insurance or extensions are available such as employee benefits, wage & hour, and third-party employment practices liability.

Insurance buyers should always review their insurance carefully. Ask for more information where necessary to ensure a clear understanding of policy coverage.

How much does employment practices liability insurance cost?

For the insurance company to price an EPLI policy, it needs to assess what risk it would be taking on by selling that policy.

The following factors may impact the policy price:

- the policy liability limit, breadth of coverage, exclusions, terms, and retention(s) or deductibles;

- characteristics of the organization buying the policy such as company size, number of employees, revenue, industry, claims history; and

- the quality of the organization’s employment practices.

In general, the following characteristics increase the risk exposure:

- A large workforce

- A public-facing business operation, such as retail or entertainment

- Limited human resource policies, procedures, or training

- High employee turnover

- Geographical location – operating in part or fully in a highly litigious jurisdiction

- Previous EPLI claims

You cannot easily control or change the characteristics of an organization or its industry. However, you can invest in good employment practices. The quality of an organization’s employment practices risk management will be considered by insurance companies for EPLI underwriting and insurability. And it will affect policy coverage and premium. Especially for those organizations planning to buy EPLI, invest in sound risk management first – then call for insurance.

Key Takeaways:

- EPLI protects the insured organization from financial loss from claims that arise from real or alleged injury-causing employment practices.

- EPLI is a named perils insurance and is usually offered in a claims made form.

- Read the whole policy, not just the insuring agreements. The definitions, exclusions, and terms and conditions all impact what the insurance policy will and will not cover.

- A lot of factors impact policy price. Influence what you can – ensure you have good risk management in place.

More related resources:

- EPLI: Discrimination, the most common peril resulting in claims

- Third-party Employment Practices Liability Insurance

- 5 Things you need to understand when buying EPLI

- EPLI Underwriting: key risk factors and policy considerations

- Wrongful Act Explained

- A Buyer’s Guide to Employment Practices Liability Insurance