We often see insurance policy wordings as pages of legalese, difficult to read, and poorly understood. Nevertheless, those wordings are incredibly powerful and every insurance professional and buyer needs to understand them. On a liability insurance policy, the term, ‘WRONGFUL ACT’ is key. It defines the coverage trigger, the event required to activate policy coverage. In this article, we’ll explain what that means, how to use that information, and what to look for in your liability insurance policy.

Here is what everyone needs to understand about the term ‘wrongful act’ on a liability insurance policy!

What is ‘wrongful act’?

“Wrongful Act” refers to the specific event that triggers coverage under a liability insurance policy.

It is typically defined as an error, omission, or breach of duty by an insured party that leads to a claim against the insured

The term “wrongful act” plays a critical role in liability insurance policies. According to Black’s Law Dictionary, it refers to actions that contravene a legal duty or unjustifiably infringe upon others’ rights. In insurance terms, it is typically an error, omission, or breach of duty by an insured party, resulting in a claim. We commonly associate such acts with liability policies like Directors and Officers (D&O) insurance, Professional Liability Insurance, and Employment Practices Liability.

The definition of “wrongful act” varies from insurance type to type and also between policies from different insurance companies. Therefore, reading and understanding the details on one policy will not guarantee that you understand any other policy. You need to scrutinize each policy wording to ensure that you fully understand its unique aspects.

Why do you need to understand ‘wrongful act’?

The definition of ‘wrongful act’ is very powerful! It establishes the coverage trigger and defines the scope of the insurance policy. Buyers need to understand the meaning of wrongful act in order to know what they are buying. And later on, what coverage they have in place.

In other words, the definition of “wrongful act” helps to determine the circumstances under which the insurance policy will respond. If an action or situation fits within this definition, then it may trigger policy coverage, provided that other policy conditions are also met. The broader the definition, the wider the range of potential situations that the policy could cover. Conversely, a narrower definition would limit the range of covered situations.

Make best use of your knowledge

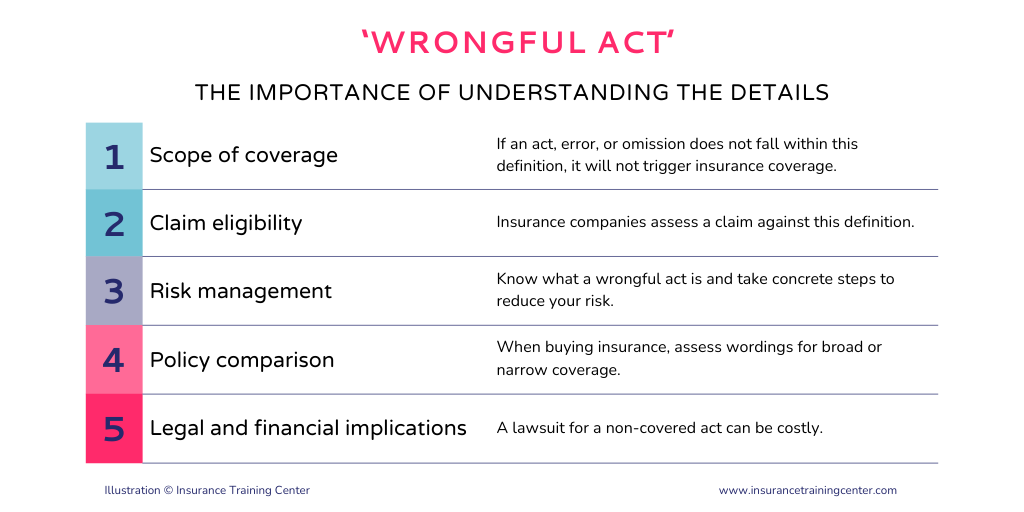

Once you understand the definition of “wrongful act” in a policy wording, there are multiple ways for buyers to use that knowledge. One thing leads to another; understand ‘wrongful acts’ and you’ll understand the scope of coverage, your claim eligibility, you’ll gain insights for risk management, the ability to compare policies, and know where potential costs lie.

- Scope of coverage. The definition of “wrongful act” essentially determines the scope of coverage under the policy. If an act, error, or omission by the insured does not fall within this definition, it will not trigger coverage under the policy.

- Claim eligibility. When you make a claim, the insurance company will refer to this definition to determine whether the claim is eligible for coverage. If the alleged act does not meet the definition of a “wrongful act” as specified in the policy, the claim could be denied.

- Risk management. Understanding what constitutes a “wrongful act” can help the insured party in their risk management efforts. By knowing what actions could potentially lead to claims, they can take steps to avoid such actions and reduce their risk.

- Policy comparison. When comparing different policies or insurers, the definition of “wrongful act” is one of the key factors to consider. Some policies may have a broader definition, providing more extensive coverage, while others may have a narrower definition.

- Legal and financial implications. In case of a lawsuit, understanding the definition of a “wrongful act” can significantly impact the legal and financial outcomes for the insured party. If a lawsuit alleges acts that are not covered as “wrongful acts” under the policy, the insured might have to bear the defence costs and potential damages out-of-pocket.

Therefore, it is crucial for policyholders to read and understand the definition of “wrongful act” in their insurance policy, and to seek professional advice if they have any questions or concerns.

How do “wrongful act” definitions vary?

Let’s look at some examples.

Directors & Officers Liability Insurance

In D&O insurance, wrongful acts can take the form of fiduciary duty breaches, company resource mismanagement, or any action that triggers financial loss or legal complications for the organization. D&O insurance policies aim to safeguard directors and officers from personal losses if they’re sued due to their role in the company.

Here is an example from a D&O policy wording:

WRONGFUL ACT means any act or non-act, including inter alia any neglect or breach of duty, care, or trust, that is actually or allegedly committed or attempted by an INSURED PERSON or any matter which is claimed against an INSURED PERSON due to their status an INSURED PERSON.

The above example seems extremely broad, and this is common. Given the expansive definition of a “wrongful act” in D&O policies, these policies could potential cover nearly all types of conduct. For those familiar with commercial and personal liability policies, this broad definition of a “wrongful act” contrasts significantly with the coverage provided under other commercial and personal liability policies. Commercial and personal liability policies typically require the underlying conduct to be an accident or some form of negligent act for the policy to extend coverage.

So is coverage really this broad under a D&O policy? The simple answer is, NO.

To limit the coverage under a D&O policy, you’ll find constraints in the exclusion clauses and restrictions in the policy’s definition of “Loss”. These temper the expansive coverage that would otherwise be provided by the definition of a “wrongful act”.

Professional Liability Insurance

Professional Liability Insurance, including Miscellaneous Professional Liability policies, interprets wrongful acts as mistakes or negligence leading to a client’s financial loss. For instance, an error in judgment resulting in inappropriate advice could be a wrongful act. Let’s look at how an MPL policy might define ‘wrongful act’. For each of the following examples, we have included the policy’s definition of professional services as those two definitions go hand-in-hand.

Here’s our first example:

“Wrongful Act” shall mean any actual or alleged breach of duty, neglect, error, negligent misstatement, misleading statement or omission committed by the Insured or on the Insured’s behalf solely in the conduct of the Insured’s Professional Business.

“Insured’s Professional business” shall mean one or more of those services provided for others as listed on the in this document.

This next example adds another criterion to the professional services definition:

Example #2:

“Wrongful Act” means any actual or alleged act, error or omission committed solely in the performance of, or failure to perform “Professional Services”.

“Professional Services” means only services performed for others for a fee and which are listed in” the declarations of this policy.

And the third example adds yet another criterion to the professional services definition:

Example #3:

“Wrongful Act” means any actual or alleged negligent error, omission or breach of duty committed in the rendering of or failure to render Professional Services.

“Professional Services” shall mean only those services of the Insured rendered for compensation, commission or other remuneration for the benefit of the insured, to a client, customer or prospective client or customer pursuant to a written agreement defining the scope of such services. “

Among the three examples, there is minimal difference in the way they define wrongful act. In order to qualify for coverage, however, the wrongful act must have occurred during the process of providing professional services. The differences in professional services definitions will directly impact which act can qualify as a ‘wrongful act’ under the policy.

Employment Practices Liability Insurance:

Employment Practices Liability Insurance (EPLI) speaks to wrongful acts as employment-related violations, such as wrongful termination, discrimination, and harassment. These acts typically involve breaches of employee rights or employment laws, that while not deliberate illegal acts, do not align with the legal requirements that are made of employers. Look to the policy definitions in an EPLI policy for what constitutes a wrongful act under that policy. Typical examples include:

-

- Employment discrimination;

- Wrongful termination of employment, actual or constructive;

- Wrongful failure to employ or promote or grant tenure;

- Sexual or workplace harassment;

- Failure to allow an Employee to exercise legal rights;

- Victimization or retaliation;

- Breach of express or implied employment agreement; and

- Employment-related misrepresentation.

Here is an example:

EMPLOYMENT PRACTICES WRONGFUL ACTS means any actual or alleged:

(a) wrongful termination of the employment of (including but not limited to constructive and or unfair

dismissal), demotion of, or failure or refusal to employ or promote any person in relation to the COMPANY; or

(b) discrimination or harassment affecting any employee of, or prospective employee with, the COMPANY; or

(c) retaliatory treatment against an employee of the COMPANY on account of the employee’s exercise or

attempted exercise of his or her legal rights.

and here is another approach:

EMPLOYMENT PRACTICES ACT means any WRONGFUL ACT that concerns any actual or alleged violation of employment law or other legal recognized provision concerning the actual or prospective employment of a natural person with an INSURED COMPANY.

Remember that EPLI is a “named perils” policy. That means it provides coverage for a list of specified risks or “perils” that the policy explicitly defines. You will typically find the details of what the policy covers in the main body under sections titled something like “Insuring Agreements” or “Coverages.” Here the policy will specify the types of claims or “perils” it covers, such as wrongful termination, discrimination, sexual harassment, and other employment-related issues.

However, the definition of a “wrongful act” in the policy also plays a crucial role in defining the scope of coverage. This term usually refers to a wide range of potential misconduct or errors in the workplace that could give rise to a claim under the policy, which may include but are not limited to the “perils” listed in the coverage section.

Remember, while the “wrongful act” definition and the coverage section are both important for understanding what is covered, they do not tell the whole story. Exclusions, limitations, conditions, and other policy provisions can also affect the scope of coverage. It’s always important to read the entire policy carefully and consult with an insurance professional or legal advisor if you have any questions.

Wrongful act vs. illegal act

A wrongful act generally refers to an action, error, or omission that breaches a duty or responsibility causing harm or financial loss. For example, in D&O insurance a wrongful act could involve an alleged breach of reporting regulations, resulting in an organization being summoned before the securities regulator for investigation. However, such an act might not be considered illegal.

An illegal act, on the other hand, refers to an action that is against the law, like fraud, theft, or other criminal activities. Insurance policies typically do not provide coverage for intentional illegal acts. For instance, if a director of a company engages in fraudulent financial reporting, this would be considered an illegal act.

It’s important to distinguish between a wrongful act and an illegal act. Insurance does not and cannot cover anything that is proven to be illegal. However, a D&O policy may respond to an alleged illegal act if, and only if that act is deemed in a final judgement or adjudication to not have been deliberately criminal, fraudulent or dishonest.

It’s important to note that while some wrongful acts may also be illegal, not all wrongful acts are illegal. The specific definition of what constitutes a wrongful act, and what is covered, will depend on the terms and conditions of the individual insurance policy. We always recommend you read the policy documents carefully and consult with an insurance professional to understand the coverage provided.

Before you buy – what to look for

- Is the wrongful act definition broad or narrow?

- How does the definition in one policy option compare to others?

- Are there exclusion clauses that constrain coverage?

- How does the policy’s definition of ‘loss’ impact the breadth of coverage?

- Are there other definitions, such as for ‘professional service’ that impact coverage?

Key takeaways

- Examine your insurance policy definition of wrongful act to understand your insurance coverage.

- Assess the definition in conjuction with the policy’s exclusions, limitations, and conditions.

- Use your knowledge to evaluate your insurance purchase and manage your risk.

- Assume the definition will be different for different policies.

- Remember that wrongful act does not mean illegal act.

More…

Learn about liability insurances: