Knowledge Library

What would you like to learn today?

Filter by

Understanding IBNR is more than knowing its definition. It means grasping how insurers use it, why it matters, and what role it plays in evaluating financial stability, pricing, and long-tail risk.

Run-off insurance refers to the coverage arrangement used when an insured has ceased operations or stopped providing professional services but remains exposed to claims arising from past acts.

Professional Indemnity Insurance (PI insurance) covers claims arising from providing professional services, including allegations of negligence, errors, omissions, or breaches of professional duty, that result in financial loss to a client or third party.

E&O insurance protects professionals from claims alleging errors, omissions, or negligence in their services. Also called professional liability insurance or professional indemnity insurance.

Understand the difference between admitted and non-admitted insurance, how they work across borders, and what they mean for policyholders, brokers, and global programs. Includes real-world examples and practical insights.

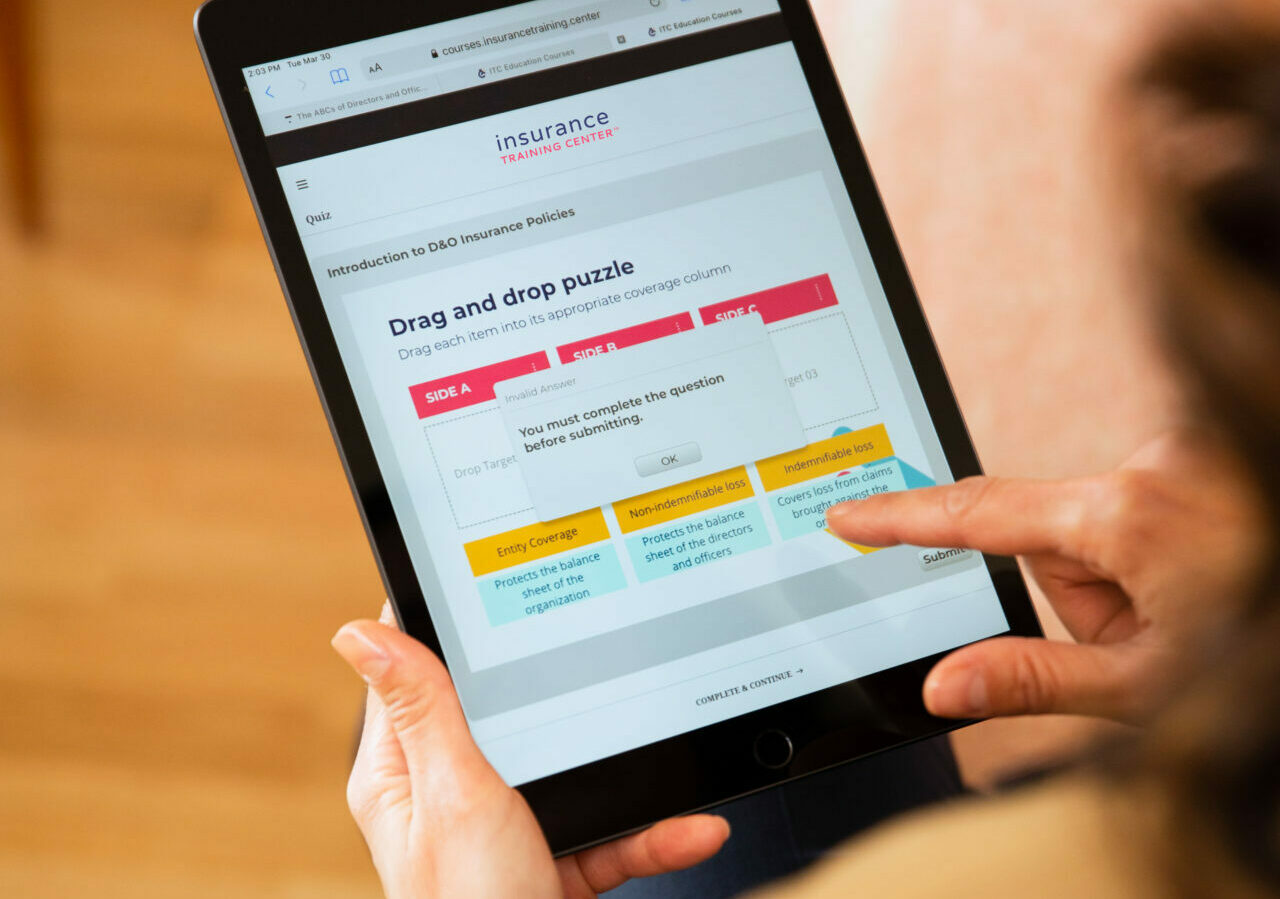

Want to learn more?Take a course!

ITC courses use real-life examples and interactive exercises to help you understand and apply what you learn. Sign up today to gain new technical knowledge and practical skills.