Knowledge Library

What would you like to learn today?

Filter by

What directors can do to avoid litigation or to be in a position better to defend themselves if they are sued.

Want to learn more?Take a course!

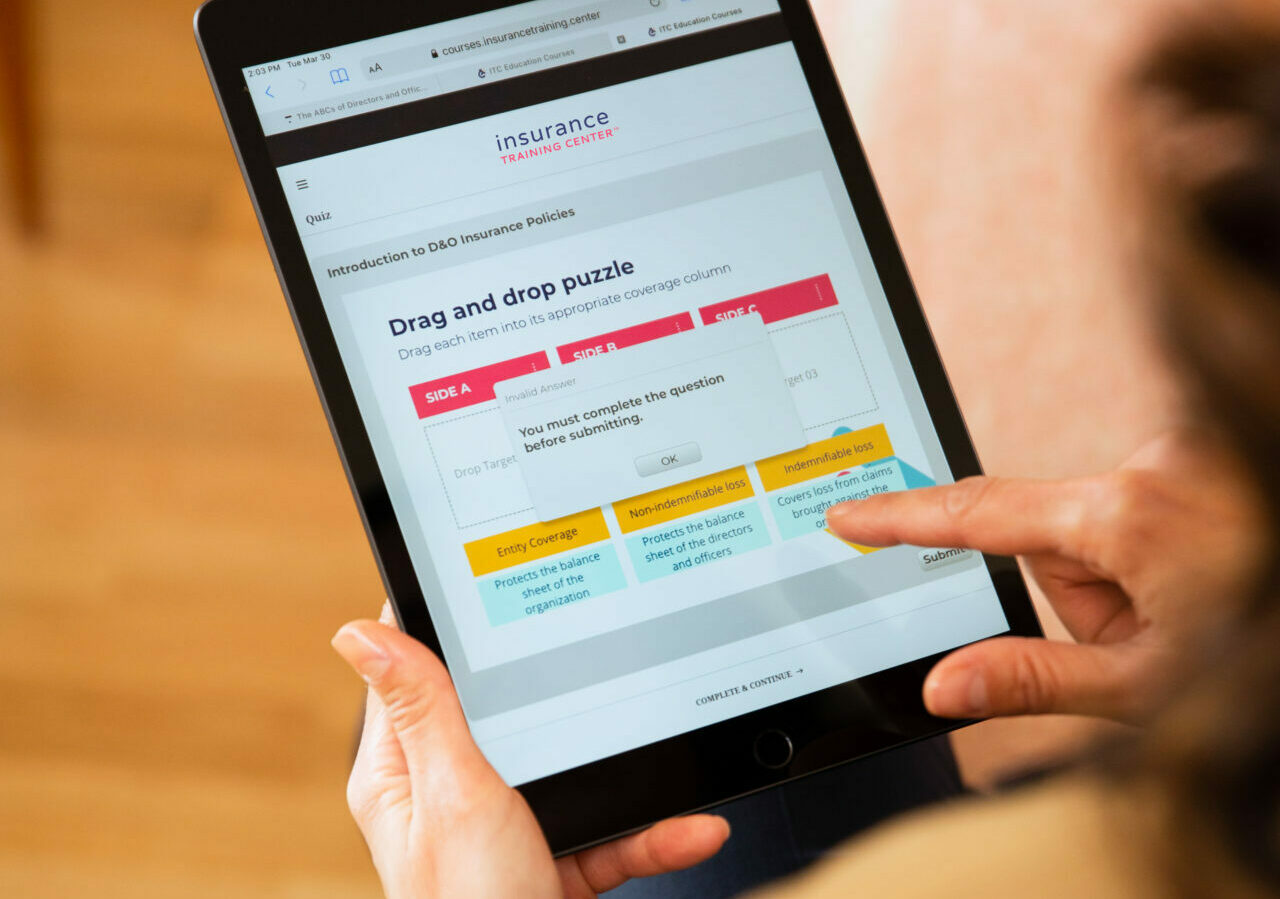

ITC courses use real-life examples and interactive exercises to help you understand and apply what you learn. Sign up today to gain new technical knowledge and practical skills.