Employment Practices Liability Insurance (EPLI) provides protection against financial loss from claims related to workplace misconduct, including discrimination, wrongful termination, and harassment. Insurance underwriters evaluate multiple risk factors when determining an organization’s eligibility, premium, and coverage terms. Brokers and insurance buyers must understand these underwriting considerations to negotiate the best possible coverage.

This article outlines the key factors that affect EPLI underwriting, the role of corporate policies in risk assessment, and how insurers structure policies to manage exposure.

Key risk factors in EPLI underwriting

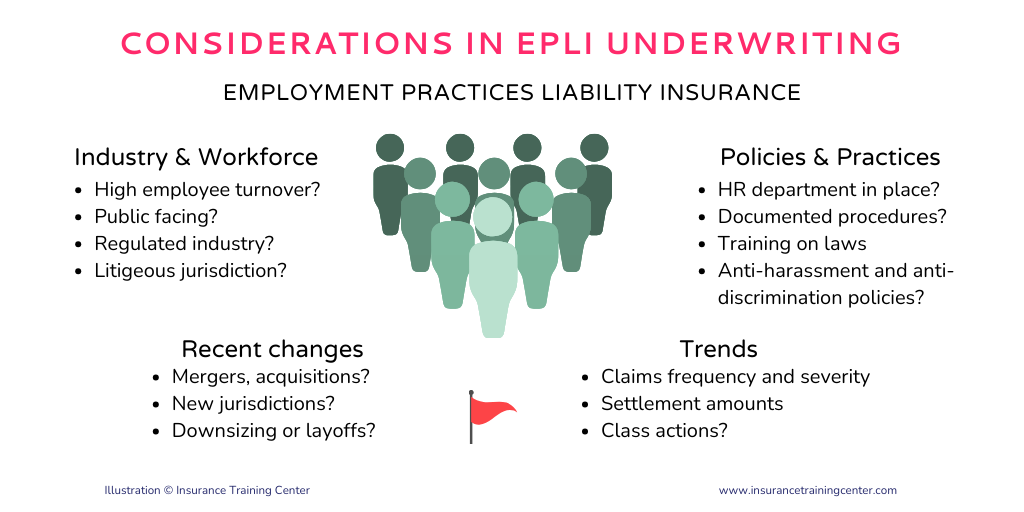

When assessing Employment Practices Liability Insurance (EPLI) risk, underwriters focus on three primary areas to determine a business’s exposure and pricing: industry and workforce composition, organizational changes, employer policies and risk mitigation practices, and claims history and litigation trends. Certain industries—especially those with high employee turnover or operations in litigious jurisdictions—carry greater EPLI risk, while workforce size and structure further impact exposure. Insurers also evaluate whether the company has strong, documented HR policies and effective risk management practices to reduce liability. Finally, an organization’s claims history and broader litigation trends provide critical insight into potential future risks, influencing coverage terms and retention levels.

Industry and workforce composition

Not all businesses face the same level of EPLI risk. Certain industries have an inherently higher likelihood of employment-related claims due to their work environment, operational structure, and litigation exposure.

-

- Businesses with high employee turnover, such as retail, hospitality, and healthcare, are more prone to wrongful termination claims.

- Public-facing companies in customer service, food service, or entertainment industries have increased exposure to third-party discrimination and harassment claims.

- Highly regulated industries, such as financial services and healthcare, face additional scrutiny regarding workplace policies and compliance.

- Companies operating in jurisdictions with employee-friendly labor laws (e.g., California, New York) often face increased litigation risk.

Organizational changes

Significant business shifts can impact EPLI risk. For example:

-

- Mergers and acquisitions can lead to workforce integration challenges and claims.

- Expanding into new jurisdiction exposes companies to new employment laws.

- Layoffs and downsizing may lead to increases in wrongful termination and discrimination claims.

Employer policies and risk mitigation practices

Underwriters assess whether a company has implemented effective employment practices risk management to prevent claims. Organizations with structured HR policies and strong compliance measures tend to receive better coverage terms and lower premiums.

Key underwriting considerations include:

-

- Whether the company has a documented anti-harassment and anti-discrimination policy.

- The presence of formal hiring, termination, and disciplinary procedures.

- Whether employees receive annual training on employment laws and workplace behavior.

- The existence of a structured HR department with a clear chain of command for reporting workplace issues.

Employers who invest in risk management and compliance programs often qualify for preferred EPLI terms with lower deductibles and broader coverage.

Claims history and litigation trends

A company’s past EPLI claims and litigation history significantly impact its underwriting profile. Insurers review:

-

- Frequency and severity of past employment-related claims.

- Settlement amounts and whether claims indicate systemic HR issues.

- Industry-wide litigation trends and class-action lawsuits affecting similar businesses.

A history of frequent claims raises red flags for underwriters, often leading to higher premiums, policy exclusions, or coverage limitations.

Structuring an EPLI policy

Stand-alone EPLI vs. endorsement coverage

EPLI coverage can be structured as a stand-alone policy or as an endorsement to a broader liability policy (such as a Directors & Officers (D&O) or Business Owner’s Policy (BOP)).

- Stand-alone EPLI policies provide higher limits, broader coverage, and more tailored underwriting.

- EPLI endorsements are often more affordable but have reduced coverage, shared limits, and additional exclusions.

Retentions, deductibles, and coinsurance

- Retention: The amount the insured pays out-of-pocket before policy coverage takes effect.

- Deductible: A set amount deducted from the total claim before the insurer pays out.

- Coinsurance: A shared risk mechanism where the insured covers a percentage of the claim, usually after the deductible is met.

Key takeaways

- Underwriters assess industry, workforce composition, and claims history when pricing EPLI insurance policies.

- Companies with structured HR policies and documented employment practices often receive more favorable terms.

- High-risk businesses in litigious states or industries with high turnover tend to pay higher premiums.

- Frequent past claims or class-action lawsuits can limit coverage availability and increase retention levels.

- Employers who proactively manage employment risks can qualify for better EPLI terms through comprehensive HR training and compliance measures.

Learn more, read:EPLI Explained