The Insurance Underwriting Process: What Every Buyer Should Know

Whether you’re a corporate risk manager or a small business owner, understanding the insurance underwriting process is key to securing the right coverage at the right price. Underwriting is more than just a step in buying insurance—it’s the engine that powers insurer profitability and long-term sustainability. In today’s world, the process blends traditional expertise with modern tools like data analytics and AI, helping underwriters assess and price risk accurately.

This guide breaks down everything you need to know about underwriting, from how the process works to what you can do to make your submission stand out. Along the way, we’ll link you to deeper insights on key topics like:

What is Insurance Underwriting?

Insurance underwriting is the process of evaluating a risk to determine if the insurance company will insure it and, if yes, then pricing it. Underwriting began as a manual process based entirely on developed acumen. Today, that process also involves the use of tools such as data analytics and artificial intelligence.

The underwriting process is critical for any insurance company to maintain a healthy loss ratio. It is the core of the business and, along with investment returns, the main driver behind the financial performance. Bad underwriting decisions lead to high loss ratios, meaning the insurance company will end up paying more in insurance claims than what it collects in insurance premiums. By setting an underwriting strategy and investing in underwriting training, insurance companies can reduce the variability in results.

How does the underwriting process work?

Underwriting is a complex process due to the unique characteristics of every risk. In the small and medium-sized enterprise (SME) space, fast underwriting is of the essence, given the small premiums associated with each account. That said, it is difficult to categorize risk and apply a broad underwriting strategy across an entire industry when each risk is different from the next one.

Larger accounts require specialized underwriting and consideration to create a bespoke solution for the client.

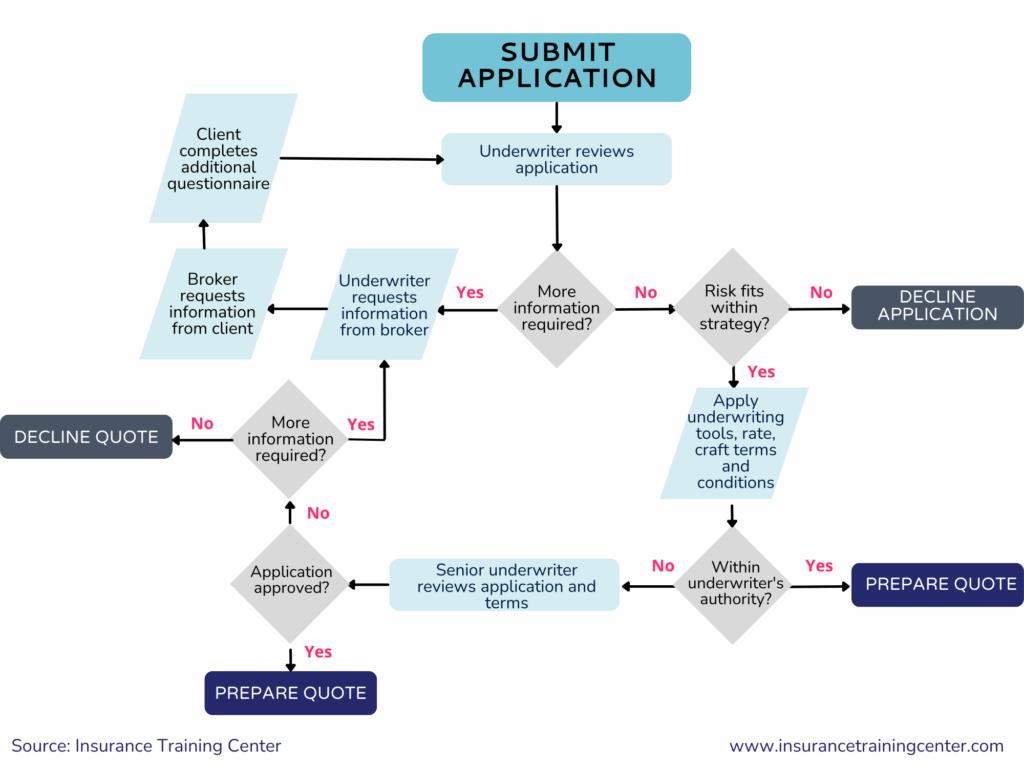

Here’s what you can expect:

- A senior executive who has a good understanding of the corporation’s risk and controls completes an application form.

- The underwriter reviews the application and determines if they have enough information to underwrite the submission.

- The underwriter may reach out to the broker to request additional information if required. The applicant may need to complete additional questionnaires related to policy extensions.

- Once all necessary information is gathered, the underwriter evaluates the risk and determines the pricing, terms, and conditions under which an insurance contract will be offered.

- The underwriter may need to obtain approval internally from more senior underwriters or managers prior to presenting the insurance quote to the broker.

It is wise to provide all the required information with your initial submission to avoid extra back and forth – this will only result in delays and frustration. Be ready to submit all relevant information regarding the risk. For example, a D&O insurance application includes financial statements, actuarial reports for defined benefit plans, the ownership chart, information on board composition, company registration, and bylaws, and a list of all directors and officers applying for coverage.

For large accounts, the submission process may also include meetings. The applicant may need to meet with the insurance broker and, or with the insurance company directly as they will want to verify the information that has been provided in the application.

Make the most of your application

For the insurance company to price and structure an insurance policy, it needs to assess what risk it would be taking on by providing that policy. To that end, any insurance application will ask for detailed information about the applicant and may take some time to complete.

Applicants should be diligent about completing their application. Not only will it provide the insurance company with the needed information, it will also guide the applicant through an assessment of their own organization by highlighting what the insurance company looks for to assess risk. It may be tempting to simply rush through the application and then move on to other tasks but corporations are encouraged to try to look at their answers from the insurance company’s perspective to gain a better understanding of their own organization and its risk.

This is also the time to educate yourself about the insurance policy you are about to purchase. Know that, as part of the underwriting process, the insurer will toggle between pricing and terms. Know what coverage options and policies are available to you. The more you know about that specific type insurance, the better purchasing decision you can make. Ensure the policy you buy is the right fit for you and your organization.

5 Underwriting considerations you should be aware of as an insurance buyer

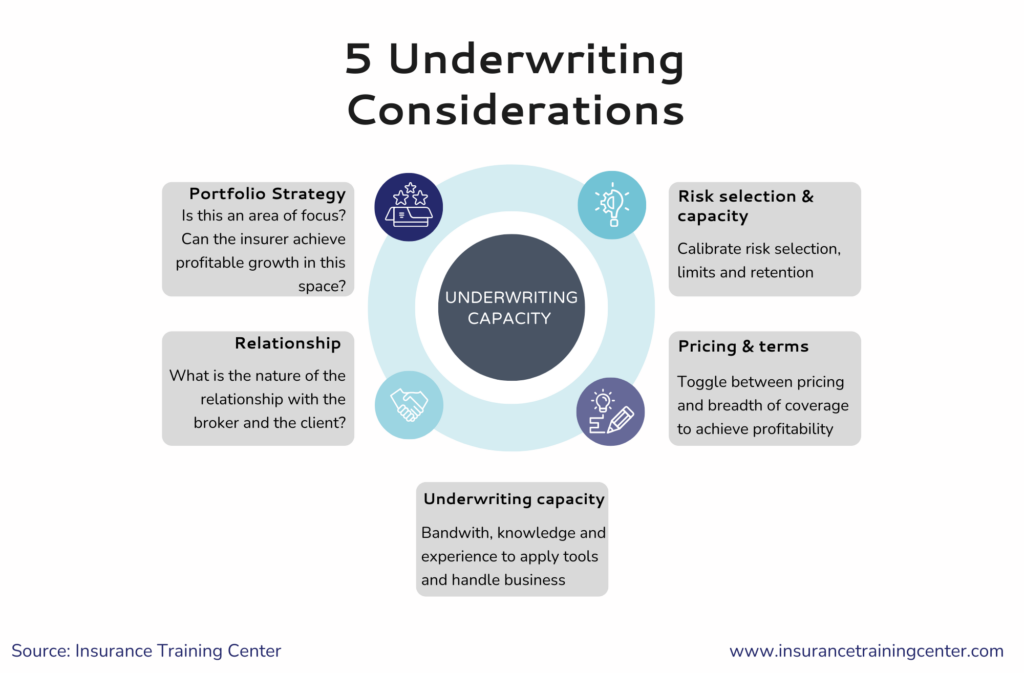

Underwriting has traditionally been more of an art than a science. Underwriters have to balance portfolio growth, profitability and product marketing and, like the rest of us, operate under capacity constraints.

Here are some of the considerations that affect an underwriter’s decision on any given risk:

1. Underwriting capacity

Underwriters juggle their day-to-day duties like the rest of us. They may receive dozens of submissions on a given day and may be forced to prioritize which risks to spend their time on. Make it easy for the underwriter to decipher who and what they are insuring. Work with your broker to ensure that your insurance application is accurate and complete.

2. Portfolio strategy

Insurance companies are ‘for profit’ corporations looking to turn a profit for their shareholders every year. As such, the executive team will review their underwriting strategy, and that strategy may change from year to year. This means that the insurance company may accept your insurance application one year and decline it the following year. This can be frustrating for clients. Do your due diligence when it comes to insurance companies – look for financial strength and stability and profitability in your industry.

3. Relationships

In business, relationships matter. The same applies to the insurance industry. Work with a broker that has strong relationships with a selection of insurance companies. Know your role, the role of your broker, and the role of the insurance company in the buying process, and hold each accountable in their role (including yourself). Whenever possible, meet with the insurance company along with your broker.

4. Risk selection & capacity

In achieving profitability, underwriters need to manage their capacity and exposure. This includes managing risk aggregation and exposure. An example of this is restricting underwriting in flood zones. They may do this declining the risk entirely, reducing limits, or increasing deductibles.

5. Pricing & terms

When it comes to insurance there is no such thing as a good deal. Underwriters toggle between price and terms and conditions. And that’s ok, not everybody wants the Rolls-Royce of insurance, but know what you’re giving up by paying a lower price.

Key takeaways

- Insurance underwriting is the process of reviewing a risk to determine if the insurance company will insure it.

- Profitability is at the core of the underwriting process.

- The underwriting process can be influenced by the amount and quality of the information received.

- Underwriting is an art, and underwriters take many elements into consideration when making an underwriting decision.

More…

Become an underwriter: 8 Steps to Interview Success: Insurance Underwriter