IBNR (Incurred But Not Reported) refers to the estimated cost of insured losses that have already happened but have not yet been reported to the insurer.

Insurance claims are not always reported immediately. Even when they are, the full cost may remain uncertain for months or years, depending on the claim. To prepare for this uncertainty, insurers use mechanisms like IBNR (Incurred But Not Reported) and IBNER (Incurred But Not Enough Reported). These provisions help insurers estimate the cost of claims that have already incurred but are either still unknown or not yet fully developed.

Understanding IBNR is more than knowing its definition. It means grasping how insurers use it, why it matters, and what role it plays in evaluating financial stability, pricing, and long-tail risk. Whether you’re a broker, underwriter, other insurance professional or insurance buyer, this article gives you the clear and practical explanation that you need.

What is ‘Incurred but not Reported’ (IBNR)?

Incurred But Not Reported (IBNR) is an insurance industry accounting term for a specific category of claims: those that have occurred but have not yet been reported to the insurance company. These are real financial obligations, even though the insurance company has no knowledge of the individual claims at the time of financial reporting.

Purpose of IBNR: The ensure the insurer is financially prepared for claims that are expected to exist but haven’t been reported yet.

What are IBNR claims?

When an insurer issues a policy, it commits to covering valid claims. However, it cannot predict exactly when those claims will occur or how much they will cost. Insurance companies prepare financial statements are specific reporting dates, such as month-end, quarter-end, and year-end and need to make allowance for those unreported claims on their statements. IBNR claims are losses that have already occurred before a financial reporting date but have not yet been reported to the insurer as of that date.

Insurers estimate the cost of these expected but unreported claims and set aside reserves to meet those obligations. This estimate becomes part of the insurer’s financial statements and capital planning.

What is the IBNR reserve?

To account for IBNR claims, insurers establish a financial provision called the IBNR reserve. This is the amount of money they set aside to pay for those future, unreported claims. It is not a sales or underwriting figure. Rather, actuaries calculate it using financial and statistical models, and accountants record it as a liability on the insurer’s balance sheet.

Here’s an example showing how it works:

A product malfunction caused an injury in December. The insurer closes its books on December 31. The claim has not yet been reported. The IBNR reserve at year-end includes an estimated amount for claims of this type based on prior reporting patterns. When the claim is reported the following February, the claim is removed from IBNR and recorded as a reported claim.

How insurers use IBNR in practice

Insurers use IBNR to:

- Reflect the true financial cost of all incurred claims, even unreported ones

- Set aside sufficiant capital to remain solvent and meet future obligations

- Support premium pricing decisions based on expected claims patters

- Comply with accounting rules and insurance law

- Provide a complete view of liabilities to regulators, auditors, and investors.

IBNR is not about predicting individual events. Rather, it’s about responsibly preparing for the reality that not all claims are known at fianancial reporting.

Case reserves: How they differ from IBNR

When a claim is reported, the insurer sets a case reserve. This is an initial estimate of the specific claim’s cost. Case reserves change over time as new information becomes available. While IBNR reserves cover unreported claims, case reserves apply to reported claims with uncertain final outcomes.

Where does IBNER fit in?

Not all reported claims are fully developed. For some claims, the final cost will exceed the original estimate. This is where IBNER comes in: Incurred But Not Enough Reported.

Example: Alex reports a workplace injury. The insurer pays $500 and sets a $600 case reserve. Later, complications arise and the total payout increases to $2,000. The difference between the original reserve and the final cost, the $900, is IBNER. It accounts for the underestimation of reported claims. This additional cost is not part of IBNR, because the claim was already reported.

Together, IBNR and IBNER make up a major portion of an insurer’s incurred-but-unpaid loss reserves. They capture both unknown claims and underestimated ones.

What does “Reported” mean in IBNR?

In the context of IBNR, “reported” means the insurer has been formally notified of a loss. This may come from:

- The policyholder,

- A third party claimant,

- A broker or agent,

- A legal filing, such as a lawsuit or a demand letter.

Until the insurer receives official notice, the claim is considered unreported, even though the loss itself has already occurred.

Who uses IBNR and why it matters

IBNR is more than just an internal actuarial calculation. It is a critical part of how insurers manage risk and demonstrate financial stability. Acutaires calculate it behind the scenes, but once estimated, IBNR becomes an important component of an insurer’s external financial reporting.

Insurers are legally required to include IBNR reserves in their financial statements. These reserves appear as liabilities on the balance sheet and are closely reviewed by:

- Regulators, to verify solvency and compliance,

- Auditors, to confirm the accuracy of financial statements,

- Rating agencies, to assess financial strength,

- Reinsurers and investors, to evaluate the insurer’s ability to manage long-term obligations.

IBNR tells stakeholders what liabilities are expected to emergy; not just what is currently known, but also what is statistically expected.

Legal and accounting requirements

Insurers are legally required to maintain IBNR reserves under both accounting standards and insurance law.

For example, Article 13 of the New York Insurance Law requires insurers to maintain reserves for all losses incurred, whether reported or unreported, including related settlement expenses.

“Every insurer shall … maintain reserves in an amount estimated in the aggregate to provide for the payment of all losses or claims incurred on or prior to the date of statement, whether reported or unreported, which are unpaid as of such date and for which such insurer may be liable, and also reserves in an amount estimated to provide for the expenses of adjustment or settlement of such claims.” – Article 13, Section 1303 of the New York Insurance Law

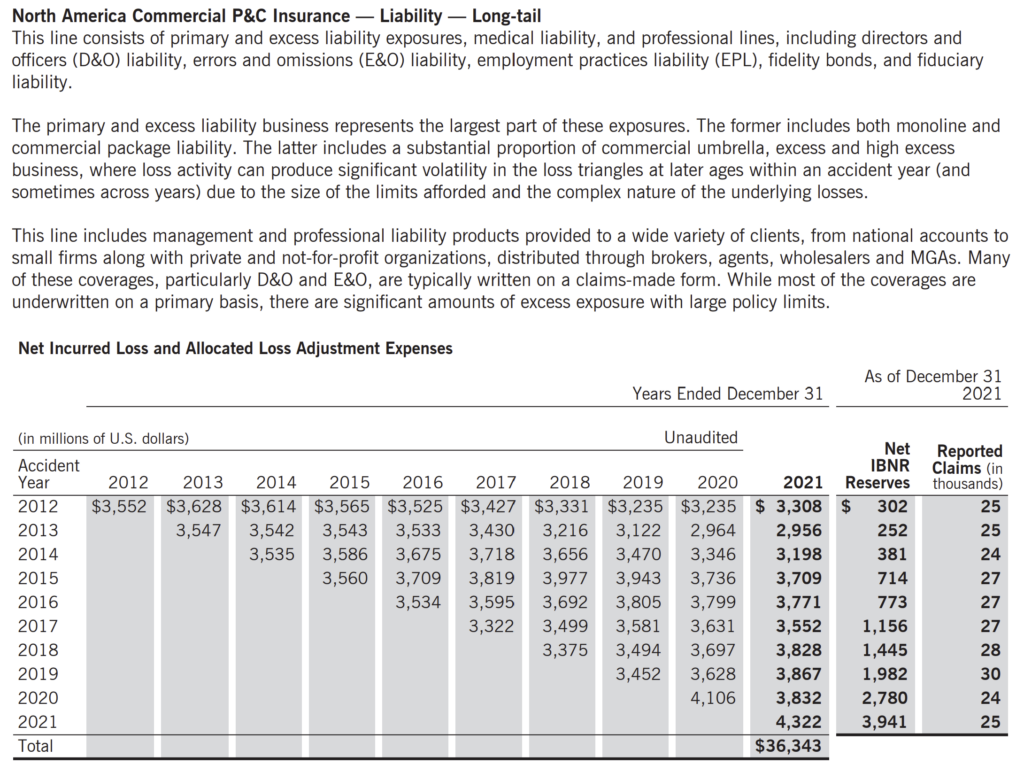

Public insurers, such as Chubb, disclose IBNR reserves in their financial statements, reflecting the portion of claims liability that remains unpaid and unreported as of the reporting date.

For example, here is an excerpt from the Chubb Insurance 2021 Annual Report:

How is IBNR reserve calculated?

Actuaries use statistical and mathematical models to estimate IBNR. They consider factors such as:

- Historical claims frequency and severity,

- Reporting lags and settlement delays,

- Policy types and limits,

- Claim development patterns.

IBNR exists because claim notification is rarely instantaneous. IBNR is especially critical in long-tail lines of insurance (e.g. general liability, directors & officers liability, professional liability), where claims can take months or years to surface.

Why IBNR is important?

Accurate IBNR reserving ensures that insurers

- Have enough capital to pay future claims

- Comply with solvency and regulatory requirements

- Avoid overstating profits or understaing liabilities

- Earn confidence from brokers, clients, investors, and rating agencies.

If IBNR is miscalculated, it can distort an insurer’s financial condition and lead to poor decisions.

Why brokers should understand IBNR

Brokers don’t calculate IBNR themselves, but IBNR influences the pricing, capacity, and claims handling decisions that directly affect their work. A solid grasp of IBNR helps brokers to:

- Evaluate an insurer’s financial strength and reserving discipline, especially in long-tail lines of insurance

- Understand insurer pricing decisions, which often reflect reserve adequacy and claims experience

- Explain claim reporting delays to clients, helping manage expectations and improve transparency

- Build trust with clients and underwriters by demonstrating informed awareness of how claims are managed behind the scenes.

In short, IBNR signals how well an insurer anticipates future obligations and that insight can help brokers make better placement decisions and guide clients more confidently.

Key takeaways

- IBNR represents claims that have occurred but have not yet been reported to the insurer.

- A claim is “reported” once the insurer is officially notified as required by the policy.

- IBNR reserve is an internal actuarial estimate and a required part of financial reporting.

- IBNER adjusts for the underestimation of reported claims.

- Brokers should understand IBNR and IBNER to assess insurer strength, pricing accuracy, and claims management discipline.

Terms in this article

Learn more…