Insurance ‘premium‘ is the fee charged by an insurance company in exchange for carrying the risk that is defined in the insurance policy contract. How does the insurance company record insurance premiums in its financial statements to accurately reflect insurance operations and profitability? In this article, we take a close look at one aspect of premium accounting, ‘earned premium‘ . ‘Earned premium’ is the portion of an insurance premium that the insurer has ‘earned’ and can therefore recognize as revenue on its financial statements.

Here some of the questions you’ll be able to answer after reading this article:

- Why do insurance companies measure earned premium?

- What is the difference between earned premium and written premium?

- How can we use earned premium to understand the profitability of an insurance company?

What is ‘earned premium'(EP)?

‘Earned premium‘ is an accounting term that refers to the amount of insurance premium that the insurer ‘earned’ during an accounting period by providing risk coverage. Earned premium is considered revenue.

What does it mean to ‘earn’ premium?

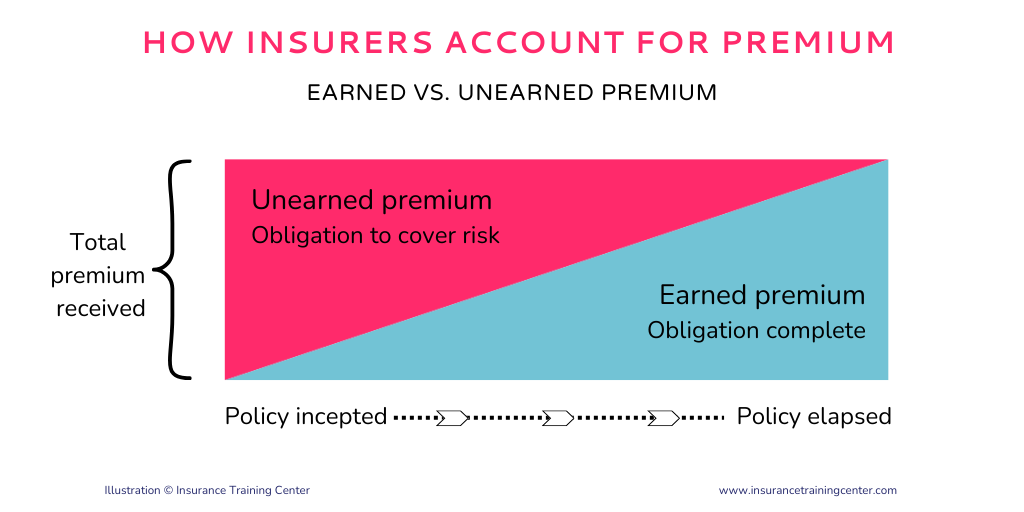

Customers purchase insurance policies to obtain risk coverage for a certain period of time, say one year. During that time, the insurer assumes risks on behalf of the customer , the policyholder, in exchange for a sum of money, the premium. When you buy an insurance policy and it has not yet come into effect, the insurer has not yet provided any of the risk coverage service. Because it hasn’t provided any coverage, it has not yet earned the premium. Rather, it still owes the contracted risk coverage that it will deliver in the future.

Once the policy period is under way, the insurer begins to earn the premium. Now, let’s say, you’re half way through the policy – the insurer has now been covering your risk for a while and has technically been ‘earning’ some of that premium that you paid. The insurer has ‘earned’ some premium because it has already provided some of the insurance coverage for the policy, for example, the first 6 months of a 1 year insurance policy. Once the insurance policy contract has ended and the insurer is no longer obligated to assume the agreed financial risk, then the insurer recognizes the full premium amount as revenue.

EP and insurance profitability

Insurance premium is a source of revenue for an insurer, just as product sales provide revenue for retailers. In order to be profitable, retailers need to get more revenue from product sales than they pay out in costs. Likewise, in order for insurers to be profitable, the amount of premium they collect must exceed the amount they payout for claims.

The challenge:

When you make a purchase from a retailer, let’s say some food items in a supermarket, you pay and receive the purchased product at once, then the transaction is complete. With insurance, while you may pay the entire premium up front, the risk coverage that you’ve purchased is not delivered all at once but rather over a period of time.

So how can we assess an insurer’s profitability when, although the premium has been received:

-

- the service (risk coverage for the agreed time period) has not yet been fully delivered? And

- the cost of claims is still unknown?

How earned premium works:

When policyholders pay premiums in advance for insurance coverage, the payment is entered into the insurer’s books as unearned premium. The insurer does not consider premiums paid to be earnings because the insurer has an outstanding obligation to the insured for the contract. Afterall, if a covered claim is filed, the policyholder will receive compensation from the insurer. However, if the period of coverage stipulated in the contract expires, no claims occur, and the insurer determines there is no longer an obligation to assume any financial risk, then it can record the premium as earnings, meaning revenue. It becomes ‘earned premium’.

The obligation to assume any financial risk is dictated not only by the policy period but also by the terms and conditions of the policy contract. For instance, the financial exposure to the insurer is different on a claims-made policy vs. on an occurrence basis policy. Depending on the policy, the insurer’s obligation to the policyholder may in fact extent long beyond the end of the policy period. You can read more about occurrence and claims made policies here: Occurrence vs. Claims Made Policies Explained.

EP in insurance accounting

In an insurance company’s financial statements, you’ll find ‘earned premium’ on the income statement (profit and loss statement) under revenue.

A company’s income statement is a key part of its annual financial statements. The income statement shows the company’s revenue and expenses over a specific period of time and whether or not the company has made a profit or incurred a loss during that time. Earned premium is a major component of an insurance company’s revenues, along with investment income and other income.

How to calculate earned premium

Because we use an insurer’s financial statements to assess the organization’s profitability, getting this number right is important.

There are several methods for calculating earned premium, depending on the policy type, duration, and insurer’s practices.

Here are the most common methods:

-

- the accounting method, and

- the exposure-based method.

The accounting method

The accounting method is the most common approach that insurers use. This ‘Pro-rata’ approach is a straightforward time-based calculation that spreads the insurance premium paid over the life of the insurance policy. This method assumes that the risk to the insurer does not vary over time and that it ends when the policy period is over.

Earned Premium = Total Premium/365* Number of days elapsed

Here’s an example:

An insurer received a premium of $3,500 on a policy. The policy has been in effect for 80 days.

Using the above formula: ($3,500 ÷ 365 x 80)= $767.12

To date, the amount of premium that the insurer ‘earned’ by the is $767.12.

The exposure method

The exposure method takes a totally different ‘Non-pro-rata’ approach. Rather than looking at the passage of time, it assesses the portion of the total premium that was exposed to loss, based on various risk factors and historical data. This is a much more complex calculation. Insurers use this method in situations where the risk of loss is much higher or varies over time, such as with a seasonal risk.

Why is EP important?

Earned premium is that portion of the total premiums the insurance company has collected for which it has already provided risk coverage. Let’s take look at why it is important to differentiate between earned and unearned premium on the insurance company’s accounting books.

- Financial position – Enables accurate financial reporting by aligning revenue recognition with the associated costs.

- Performance monitoring – Used in calculating key performance metrics such as the company’s loss ratio and combined ratio.

- Strategic decisions – Provides input into strategic decisions such as for product, pricing, and underwriting.

- Regulatory compliance – Regulators require insurers to report earned premium in statutory filings as it directly relates to the company’s profitability and ability to pay claims.

Related terms

Earned Premium vs. Written Premium

When an insurance company sells an insurance policy, it records the amount of premium that it charged for that policy in its books. During a financial year, or a quarter, an insurance company will issue (write) many policies. The total amount of premium from the policies written in that period of time is called the Written Premium. Written premium does not consider whether or not the insurer has actually received the total amount of premium that it billed. Nor does it consider how much of the contracted risk coverage the insurer has provided to date. If a policy is written within the period, it is included.

Let’s say Klip auto insurance company gains 500 new customers in a year. With each contract requiring customers to pay $2,000 in premiums, the written premium becomes $1 million (500 customers x $2,000).

Insurance companies use written premium as a performance metric. By comparing the written premium from different accounting periods, the company can evaluate sales activity and underwriting volume. Interested in learning how much premium a particular insurer wrote last year? Try looking in the company’s notes to the financial statements or the management discussions.

Unearned Premium vs. Earned Premium

Unearned premium is the opposite of EP. While earned premium is the premium amount that the insurer can recognize as earnings because it has already provided the risk coverage, unearned premium is different. Unearned premium is premium that the insurer cannot yet recognized as earnings because it is still providing the contracted risk coverage.

UEP is usually refunded as a result of the early termination of an insurance policy, whereas the insurer cannot refund the earned premium.

Earned Premium vs. Minimum Earned Premium (MEP)

It’s very important that policyholders understand Minimum Earned Premium. Minimum earned premium is a non-refundable portion of an insurance premium that an insurer retains when the client cancels coverage before the the policy expiration date. The MEP may be a set amount or a set percentation of the total premium. MEP is also known as Minimum Retained Premium.

Policyholders cancel insurance contracts before the policy expires for a variety of reasons – perhaps their circumstances change so they no longer need the policy, or they decide to switch insurers. Insurance companies often set a minimum earned premium to help manage the risk of early cancellation. MEP serves as a source of revenue to cover the administrative costs associated with underwriting and selling the policy. Insurers also use MEP to discourage policyholders from canceling a policy before the expiration period.

So, for example, if a automobile insurance premium is $8,000 per year and the policy indicates a minimum earned premium of $2,000, the insurer will be able to retain $2,000, even if the client cancels just a few months into the policy period. If the minimum earned premium is high, policyholders are less likely to cancel their coverage early.

Rates for minimum earned premium tend to vary widely. In some cases, an insurance policy may be subject to a 100 percent of the total premium. It’s important for insurance buyers to know the cost and implications of canceling a policy before purchasing the policy.

Typically, insurers will recognize minimum earned premium as revenue once a policyholder cancels the policy. Unlike earned premium, MEP is independent of any risk coverage.

Key Takeaways

- Insurance premium is not profit until the insurer has earned it by providing the contracted risk coverage.

- Earned premium (EP) corresponds to the portion of an insurance policy that has already elapsed.

- Earned premium is calculated using either a pro-rata or non-pro-rata approach to align earnings with risk.

- Earned premium indicates the insurer’s ability to generate revenue from policies in effect, giving insight into profitability.

More…

Learn about unearned premium: