A loss ratio is a quick way to evaluate the financial health and profitability of an insurance company. The calculation is used by both insurers and by external parties, such as regulators, lenders and consumer advocates to monitor and assess performance. This article explains how to calculate the ratio and what insights you can gain from it. Also, we look at some initiatives that insurers can undertake to improve their loss ratio.

What is Loss Ratio?

The loss ratio represents the relationship between total premiums earned and actual losses incurred over a given period of time. It reveals how much an insurance company spent on paying claims and other expenses compared to the premium received.

It is a metric that specifically measures the profitability of insurance companies.

How Do You Calculate a Loss Ratio?

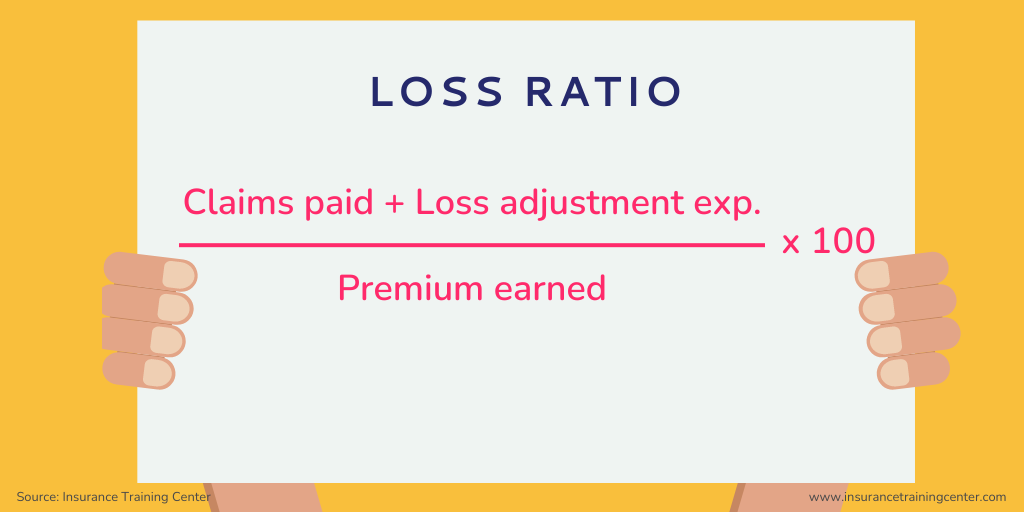

Loss ratio = ((insurance claims paid + loss adjustment expenses)/Premium earned) x 100

Formula Breakdown:

Insurance Claims Paid

It is the amount of money paid by insurers for claims made by the insured when the risk insured against occurs.

Adjustment Expenses

These are expenses incurred in the process of investigating, verifying, and settling claims.

Premium Earned

This is the amount of money paid by clients to insurance companies to cover risk.

Loss Ratio vs Combined Ratio

The loss ratio measures the overall amount of incurred losses to the total amount of earned premiums, whereas the combined ratio measures the total amount of incurred losses and expenses to the total amount of earned premiums. In other words, when calculating the combined ratio, it accounts for other administrative and miscellaneous expenses incurred during the course of examining claims and paying premiums.

The loss ratio and the combined ratio are used as indicators of financial stability of insurance companies. Using the combined ratio provides a holistic view of an insurance company’s performance.

What Does the Loss Ratio Mean?

The health and profitability of an insurance company can be quickly assessed using the loss ratio. When claims payments are less than premiums collected, insurance companies are making profits.

The insurance company runs the risk of going out of business if the opposite happens frequently.

When it exceeds 100%

In this situation, the insurance company is in an unfavorable position. It means that the insurance company is losing money on its policies.

When it is equal to 100%

It means that the total amount of premiums collected equals the total amount of claims and expenses. It makes neither profits nor losses from its policies.

If it is less than 100%

It means that the insurance company keeps a portion of its premium after claims are paid. This is a sign of profitability. The lower the ratio, the higher the insurance company’s profitability.

Sample calculations

Example 1. Loss Ratio for a Single Account

A cosmetic store pays $5,000 in premium for their fire insurance policy, and a fire disaster causes $6000 damage. The ratio for that one year is $6000/$5000 or 120%.

Interpretation

The result does not look good for the insurance carrier and the policyholder because the loss ratio is above 100%.

When the insurer reviews the history of the policyholder and the loss ratio has frequently exceeded 100% , it means they have paid out more in claims than they have earned in premiums from the policyholder. The insurer may decide to increase the premium or cancel the renewal of the policy.

Example 2. Loss Ratio for a Portfolio

Let’s say company ABC collected premiums of $150,000 in a given period and paid out claims of $60,000 with an incurred adjustment expense of $20,000. The loss ratio will be calculated by adding the losses incurred in claims to the adjustment expenses and dividing by the premium earned as shown below.

($20,000+$60,000)/$150,000 ×100 = 53%

Interpretation

The ratio is below 100% indicating that the portfolio is in a strong financial position.

How is Loss Ratio used?

By insurance companies

Insurance companies look at loss ratios when making management decisions.

For example:

- when setting target premiums or to determine if a rate change is necessary;

- to compare different product lines and determine which are more profitable; and

- to assess its performance against other carriers.

The ratio may even be included in employee performance management and incentive programs, with employees given optimal targets to meet.

By regulators, investors, lenders, rating agencies, and consumer advocates

Regulators may set minimum loss ratio requirements on certain insurance products to prevent excessive profits. If an insurer breaches the minimum ratio, the regulator may require it to refund policyholders. Alternatively, a high ratio may signal solvency problems.

Consumer advocates compare loss ratios across different insurers to evaluate performance. Consumer advocates would argue that a high ratio is best for consumers, as this indicates that the insurer is returning most of the premium in claim payouts and not overcharging customers.

Investors, regulators, lenders, and rating agencies track loss ratios as part of their assessment of insurers’ financial health. You’ll find the ratio in analyst reports.

What is an Acceptable Loss Ratio?

The answer varies from insurance provider to insurance provider.

The type of insurance, the size of the book of business, and the classification of claims payments, reserves, and expenses can all affect the loss ratio calculation. Each sector in the industry has a different definition of an acceptable loss ratio. Compared to other sectors, some have a higher ratio. For instance, the loss ratio for health insurance providers is higher than for property and casualty providers. Therefore, when comparing loss ratios from one insurer to another, it is important to understand the raw data used in the calculation and the mix of business included in the analysis.

3 Ways to Improve the Loss Ratio

1. Accelerate claims processing

In a post-COVID era, digitization of claim processes and self-service help to accelerate claims processing. Research shows that insurers often lose money and clients when they drag their feet in upgrading outdated systems that cannot serve customers in today’s digitalized era.

Delays in processing claims can worsen situations, leading to an increase in the expenses to be incurred in settlement. Insurers spend a huge portion of revenue on claims processing. Not only that, the company’s profitability and sustainability are determined by how effectively it handles claims processing. It is therefore imperative for insurers to put in place an effective system for claim processing.

2. Invest in underwriting excellence

Underwriting excellence has become a necessity to stay competitive.

Investing in underwriting excellence necessitates underwriters developing technical capacity. The underwriters must sufficiently understand the factors that affect the risk covered. This will result in effective pricing that fairly accounts for the inherent risks. Otherwise, insurers would continue to incur losses resulting from underpriced policies.

Also, insurers can make underwriting more efficient by investing in technological advancements that automate tasks. A 2019 McKinsey report revealed that underwriters spend 30% to 40% of their time manually handling administrative tasks. Automation of tasks will accelerate speed and efficiency in processes.

3. Increase clients’ satisfaction and retention

The interactions your clients have with your business can have a big impact on their level of satisfaction and, ultimately, retention. Clients need a quick response the most during the claim processing phase.

According to a 2022 report by Accenture, based on surveys covering 25 countries, “one-third (31%) of the claimants were not fully satisfied with their home and auto insurance claims-handling experiences over the past two years. Of this 31%, six in 10 (60%) cited settlement speed issues and 45% cited issues with the closing process. Dissatisfaction around the claims experience is a key reason driving customers to switch insurers. Nearly one-third (30%) of dissatisfied claimants said they had switched carriers in the past two years, and another 47% said they were considering doing so.”

Automating claim processes and training staff to handle clients in the most respectful and professional manner will provide reassurance to clients. Clients will have a positive impression of your business when you meet and exceed their expectations. This results in client satisfaction, repeat patronage, and retention.

The general public has the impression that insurance companies sell policies and generate significant profits. In reality, insurance companies only make a profit when the money paid for claims and adjusted expenses is less than the premiums collected or earned. The loss ratio is a metric that measures profitability of insurance companies. It provides information on an insurance company’s financial standing.

Key Takeaways:

- The loss ratio is a quick way to evaluate the financial health and profitability of an insurance company.

- Insurance companies make money when claim settlements are less than premiums earned. If the opposite occurs frequently, there is a chance that the insurance company will go out of business.

- The combined ratio takes into account administrative and miscellaneous expenses incurred during the course of examining claims and paying premiums. It provides a holistic view of an insurance company’s financial standing.

- What is an acceptable loss ratio varies according to the type of insurance.

- Accelerating claims processing, investing in underwriting excellence, and increasing client satisfaction and retention can help to improve the loss ratio.