Employee dishonesty coverage is insurance protection for employers, in the event an employee steals from them. This coverage is commonly not a standalone coverage but rather, is an insuring agreement within a commercial crime insurance policy. Employee theft is a very real issue faced by many employers. It’s important that all employers understand this insurance coverage and how it works so that they are equipt to use it should the need arise.

Read this article to learn more about this coverage, where you can find it and how it works.

What is Employee Dishonesty Coverage?

Employee Dishonesty Coverage is insurance protection that

- covers losses resulting from dishonest acts by employees

- responds when an employee steals money, securities or other property from their employer

Employee dishonesty coverage is also referred to as ‘Employee Theft Coverage’ or ‘Fidelity Coverage’, depending on the insurance company. The term ‘fidelity’ references the expectation of a loyal relationship between employee and employer.

Employee dishonesty coverage vs. Commercial crime insurance

Commercial crime insurance is a type of property insurance for commercial organizations designed to cover the loss that an organization suffers from damage to, or destruction or disappearance of, its own property as a direct result of crime.

Employee dishonesty coverage is an insuring agreement found within a commercial crime insurance policy.

A commercial crime insurance policy covers both crimes committed against the organization by its employees (employee dishonesty coverage) and crimes committed against the organization by those who are not employees. However, it does so separately. The policy commonly covers crimes committed by employees under an ’employee theft’ or ’employee dishonesty’ insuring agreement. Crimes committed against the organization by others are covered elsewhere in the insurance policy under different insuring agreements.

The insurance industry often uses the terms Commercial Crime Insurance, Employee Dishonesty Coverage, and Fidelity Insurance interchangeably. However, they are not actually the same.

What does employee dishonesty coverage cover?

The intent behind the employee dishonesty coverage is to provide financial protection to an employer in case an employee steals from the employer. The breadth of coverage varies from insurance policy to insurance policy.

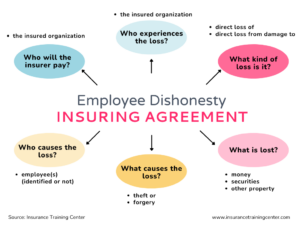

The insuring agreement

Each insurance company writes its policies differently. To learn what may be covered under the Employee Dishonesty Coverage in your insurance policy you will need to review your policy’s insuring agreements.

Here’s an example employee dishonesty insuring agreement:

The Insurer will pay the Insured Organization for the Insured Organization’s direct loss of, or direct loss from damage to, Money, Securities, and Other Property with an Insured Organization sustains, directly caused by Theft or Forgery committed by an Employee, whether identified or not, acting alone or in collusion with other persons.

So what does that insuring agreement really say? That single paragraph contains a lot of very specific information. It clearly states:

- Who the insurer will pay and who experiences the loss? The insured organization;

- What kind of loss it? Direct loss of, or direct loss from damage to;

- What is lost? Money, securities, and other property;

- What causes the loss? Theft or forgery; and

- Who causes the loss? an employee, whether identified or not, acting alone or in collusion with other persons.

Use the above framework to dissect the Employee Insuring Agreement in your own insurance policy. This process will help you to better understand what crimes the policy may and may not cover.

Employee dishonesty coverage terms

When examining your insurance policy, it is also important to pay attention to key terms such as “direct loss” or “manifest intent”. Both of these terms are used to define how and when the policy will respond.

Direct Loss

To trigger (activate) an employee dishonesty claim, the insured organization needs to show that it has been deprived of something; it has suffered a loss by an employee and that loss is:

-

- a direct result of the crime; and

- measurable and financial.

Crimes against an organization can also indirectly result in loss – and an indirect loss would not be insurable under a commercial crime policy. For example, loss of income while conducting the theft or fraud investigation.

Manifest Intent

Beware that some insurance policies require that a second condition be met in order to activate coverage: manifest intent. Insurance policies that require manifest intent effectively have a narrower scope of coverage than other policies because they exclude employee crimes that result from negligence or incompetence.

What is not covered by employee dishonesty coverage?

In addition to reviewing the policy insuring agreement, buyers also need to look through the full policy wording. Here you’ll find definitions, exclusions and terms and conditions that provide greater detail on what the policy will and will not cover. Exclusions spell out those circumstances that the policy will exclude from coverage.

Here are 8 standard exclusions that apply to employee dishonesty coverage:

- Theft by the organization or its owners or partners

- Losses that are reported too late – typically 60 days after becoming aware of the loss

- Improper, negligent, or incompetent actions so for instance a calculated inventory shortage

- Indirect or consequential loss

- Loss of data or trade secrets or confidential information

- Voluntarily parting with money, for instance, social engineering fraud

- Loss due to government action for instance seizure of property

- Loss that is covered by other insurance or coverage extensions, such as cyber insurance and client coverage

What else should I know about employee dishonesty coverage?

A particular challenge with employee theft is that there can be a lag between the time the employee starts stealing from the organization and the time the employer discovers the theft, and reports the loss to the insurance company.

Insurance buyers should be aware that insurance companies write commercial crime policies, and therefore employee dishonesty coverage, in two ways, loss sustained or loss discovered:

- Loss Sustained: This type of policy requires that the crime happen and be discovered during the policy period in order to be covered by the policy. If the loss happened before the policy period began, it may be covered IF the organization has had crime insurance in place continuously and without lapse since that time.

- Loss Discovered: With this approach, the requirement is for the loss to be discovered and reported to the insurance company during the policy period however, it does not matter when the loss took place.

Be aware of the coverage implications when transitioning from one policy type to another, and avoid any coverage gaps. We discuss this in greater detail in the Commercial Crime Insurance Fundamentals course.

Employee dishonesty claims examples

Here are some real-life examples of employee theft cases that we have gathered from news articles:

Example 1:

The controller of a family-run packaging firm stole $200,000 and bankrupt the company. The employee worked with the company from 2012 to 2017, and during that time she pocketed $195,000 – enough to send the company into bankruptcy. The scam involved her issuing herself and her husband 189 different credit card refunds and providing the company owners with false financial statements.

Example 2:

An employee at a business in Saskatoon, Canada stole $1.1 million worth of merchandise. The employee took the goods over a period of 5 years and sold them for a personal profit.

Example 3:

Three employees embezzled $128M worth of gas oil over a decade of employment. The scheme involved siphoning more than 300,000 tonnes of gas oil and selling it to foreign vessels at a lower price. As part of the scheme, they brided independent surveyors to conceal the crime.

Example 4:

A maintenance supervisor working at a pharmaceutical manufacturing facility stole $854,000. The employee received reimbursement for fictitious purchases and travel expenses. The employee was responsible for fixing broken equipment and buying new equipment. Over a number of years, the employee used his personal credit card to buy equipment and supplies and submitted fake receipts with inflated amounts to his employer for reimbursement. He submitted expenses for travel and other purchases that he never incurred. For example, he bought and returned equipment at Home Depot, and submitted the expense.

Key Takeaways:

- Employee dishonesty coverage protects employers from financial loss in the event that employees steal from them.

- This coverage is part of a commercial crime insurance policy.

- Employee dishonesty coverage is written on either a loss discovered or loss sustained form.

- Read the whole policy, not just the insuring agreements. The definitions, exclusions, and terms and conditions all impact what the insurance policy will and will not cover.