Combined Ratio: Meaning, Importance, Examples, and How to Improve it

Key Takeaways

- The combined ratio(CR) is a metric for evaluating the profitability and financial health of an insurance company.

- To get the CR, divide the total sum of incurred losses and expenses by the earned premium.

- There is an inverse relationship between the ratio and profitability. The higher the ratio is, the lower the profitability of the insurance company and vice versa.

- The limitation of the combined ratio is that it does not factor in the investment income of a carrier and thus may not provide accurate information about the profitability of the insurance company.

- Supporting underwriters, improving efficiency in claim processing, and reducing acquisition and administrative costs are some ways to improve the CR.

What is a Combined Ratio?

The combined ratio is one of the most important ratios used in evaluating the profitability and financial health of an insurance company. It also provides a comprehensive insight into how well an insurer underwrites policies.

Besides insurers, there are other industry stakeholders that use the combined ratio. Regulators use it to perform regulatory oversight. Investors use it to determine if an insurance company is managing its risk appropriately and can pay claims.

How do You Calculate a Combined Ratio?

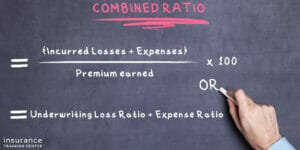

There are 2 ways to calculate the combined ratio – either way, you’ll end up with the same result:

- Divide the sum of incurred losses and expenses by the earned premium.

Combined Ratio = ((Incurred Losses + Expenses) / Earned Premium)*100 - Sum the underwriting loss ratio and the expense ratio.

Combined Ratio = Underwriting Loss Ratio + Expense Ratio

Formula 1 Breakdown:

Incurred Losses

These are the losses related to claims.

Expenses

This is the amount of money the insurance company spent on business expenses.

Premium Earned

This is the amount of money paid by clients to insurance companies to cover risk.

Formula 2 Breakdown:

Underwriting Loss Ratio (also called “loss ratio“)

This ratio results when dividing the incurred losses (see above) by the net premium earned.

Expense Ratio

This ratio results when dividing the underwriting expenses, so salaries, commissions etc., by the premium written.

Why is the Combined Ratio Important?

The combined ratio is the metric that gives information about the outflows from an insurance company (expenses, incurred claims and related losses) on its earned premium. It gives investors, analysts, and consumers a comprehensive view of how much an insurer pays out in claims and the operational efficiencies of the insurance company.

There is an inverse relationship between the combined ratio and the company’s profitability. A combined ratio that is below 100 percent, shows that the company is making profit.

When the company’s combined ratio is higher than 100 percent, it shows that it’s paying out more than it’s receiving.

Hence, the goal of insurance companies is to maintain a low combined ratio.

Sample calculations

Example 1. Formula 1

Let’s say, APY Insurance Company, earned $900 in premiums and paid out $700, the incurred loss. With another $50 in operating expenses, the company would have a combined ratio of ((700 + 50) / 900) x 100= 83.3%.

Interpretation:

The combined ratio is below 100, meaning APY insurance company received more in premiums than it paid in claims and expenses. APY is in a healthy financial state.

Example 2. Formula 2

Here’s an example using the second approach: BLK Insurance Company has an underwriting loss ratio of 63.3% and an expense ratio of 31.5%. Therefore, the combined ratio for this insurer is 94.8%.

Interpretation:

Although the BLK Insurance Company has a combined ratio that is higher than that of APY Insurance Company, the ratio is nevertheless below 100 so it is making a profit. Taken one step further, we can now calculate that the underwriting profit for BLK Insurance Company is 5.2% (100%-94.8%).

Limitations of the Combined Ratio

Even though the combined ratio is a very useful indicator in the insurance sector, it still has limitations, some of which are highlighted below:

- Although the combined ratio is used to evaluate the financial state of an insurance company, it doesn’t include a prominent part of the company’s income, which is investment income.

- Typically, when the combined ratio exceeds 100%, the insurance company is making a loss. But there may be instances when the ratio exceeds 100% and the insurance company will still make a profit. This is because the company could generate profit from investing its premiums, which are not accounted for in the calculation of the combined ratio. This means that the CR does not reflect the true state of an insurer’s profitability.

- A policyholder may believe that the insurance company’s financial situation is excellent due to the CR, which might be false. It is possible for management to manipulate the combined ratio in the financial statements to provide a false view of a company’s profitability.

The Difference Between the Combined Ratio and the Loss Ratio

An insurance company uses both ratios to assess its profitability. Now let’s look at the 2 ratios and how they differ:

To calculate the loss ratio, you divide the total incurred losses by the total collected premiums. A low ratio indicates a high level of profitability for the company, while a high ratio indicates a loss. When the company has a consistently high ratio, it means that it’s in a bad financial state because it’s paying out more in claims than it’s receiving in premiums.

While the combined ratio compares the total amount of incurred losses and expenses to the total amount of earned premiums, the loss ratio compares the total amount of incurred losses to the total of earned premiums. In other words, when calculating the loss ratio, it does not account for other administrative and miscellaneous expenses incurred during the course of examining claims and paying premiums.

The loss ratio and the combined ratio are used as indicators of financial stability of insurance companies. Using the combined ratio provides a holistic view of an insurance company’s performance.

3 Ways to Improve the Combined Ratio

It’s important for insurance carriers to know how to improve the combined ratio so as to unlock revenue opportunities.

Here are 3 effective ways to do so:

1. Support the Underwriting Function

Investors’ and consumers’ confidence will be quickly eroded if the pricing of risks is not done correctly. Underwriters perform the critical and delicate function of risk pricing. They wade through a sea of data to determine the price of a policy and the extent of its coverage. A better understanding of what they are insuring will result in a more accurate assessment of the risk.

With the business landscape of the insurance industry becoming more and more unpredictable, supporting and improving underwriting effectiveness is a necessity. According to this McKinsey report, the underwriting function can be optimized by improving the capabilities of underwriters (formal training) and investing in advanced analytics solutions, which can improve pricing accuracy.

2. Improved efficiency in claims processing

An improvement in efficiency in claims processing will increase operational efficiency. For example, according to McKinsey research, “One US P&C insurer uses chatbots to guide customers through a full claim-filing process via a smartphone app. The workflow from start to payment only takes a few minutes, and the chatbot handles the conversation with the customer, orchestrating data and events to facilitate customer interaction.”

Mckinsey suggests the following actions that insurers can take to improve their claims processing efficiency:

- “Find opportunities to capture the most important data during the first notice of loss

- Standardize intake procedures to reduce rework

- Optimize claims processing through standard work and job aides

- Reduce inbound demand”

Quicker and more efficient claim processing will reduce your loss and expense ratio, increase revenue, and leave your customers feeling satisfied.

3. Reduce procurement and administrative costs.

Procurement and administrative costs make up a huge part of insurers’ expenses. Making a few modifications can reduce these costs and improve revenue.

The Mckinsey report makes the following recommendations:

- “Optimize preferred vendor networks by identifying vendors offering the best quality services.

- Eliminate or reduce redundant hardware/software

- Negotiate improved rates for key service areas, especially where contracts are close to expiration”

The Bottom Line

Different stakeholders in the insurance industry use the combined ratio in evaluating the profitability of an insurance company. However, the combined ratio is limited in evaluating profitability because it does not consider the investment income of insurance companies. Therefore, it may not provide the true financial state of a carrier.