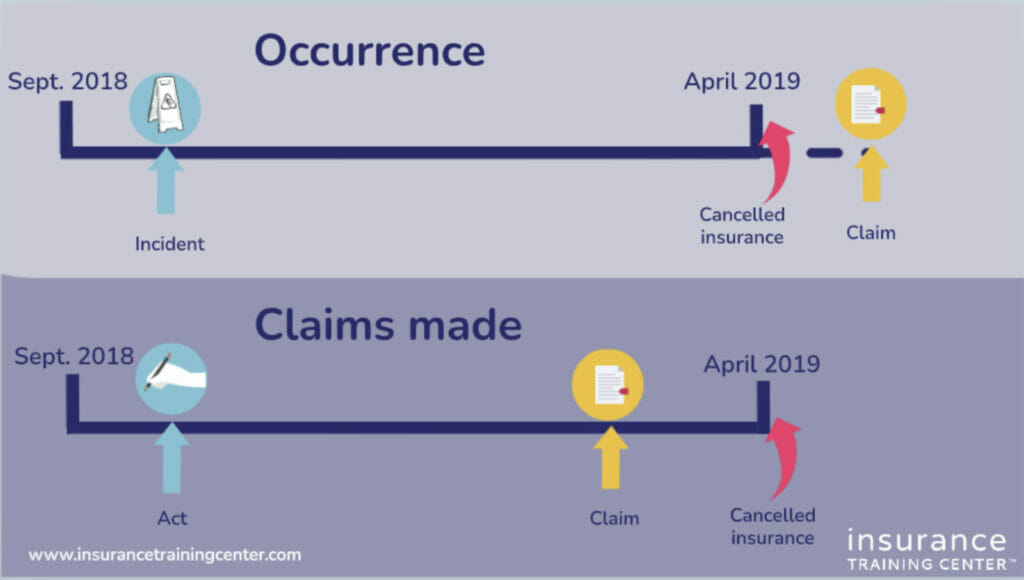

Liability insurance policies are structured to respond to claims in either of two ways: on an occurrence basis or on a claims made basis. The key difference between the two is in the mechanism the policy uses for activating coverage, that is, what needs to occur, and when, in order for a claim to be considered for coverage.

Insurance buyers need to be aware that the mechanism for activating coverage behind an occurrence vs. a claims made policy is completely different. Without understanding how each type of policy works, insureds may be left without insurance coverage at the time of a loss. It is also imperative for brokers that they can explain the coverage implications of each type of policy and for the insured to know what type of coverage they have in place.

What do we mean by ‘occurrence basis’ or ‘claims made basis’?

Insurance policies are said to be “written on” an occurrence or claims made basis. “Written on” refers to the policy language and the conditions or rules set in the policy that determine when coverage may apply. The ‘basis’ of a policy will determine which claims are covered and which are not covered. When it comes to ‘occurrence basis’ vs ‘claims made basis’, the difference has to do with timing – specifically, the timing of the event that gives rise to a claim, and the timing of the resulting claim for damages that is made against the insured.

Event: refers to a wrongful act, event, incident or accident, or error that caused harm to a third party

Claim: refers to the written demand or claim made against the insured for causing harm to someone (not to be confused with “claim” submitted to the insurance company)

What if the event that gave rise to a claim occurred during the policy period, but the claim for damages wasn’t made against insured until after the policy was no longer in effect? Alternatively, what if both the event and the claim against the insured occurred within the policy period?

Essentially, for a claim to be considered for coverage, an occurrence-based policy needs to be active when the act or incident occurs; claims made policies have to be active when the claim is made.

What is an occurrence policy and what is a claims made policy?

Occurrence policy:

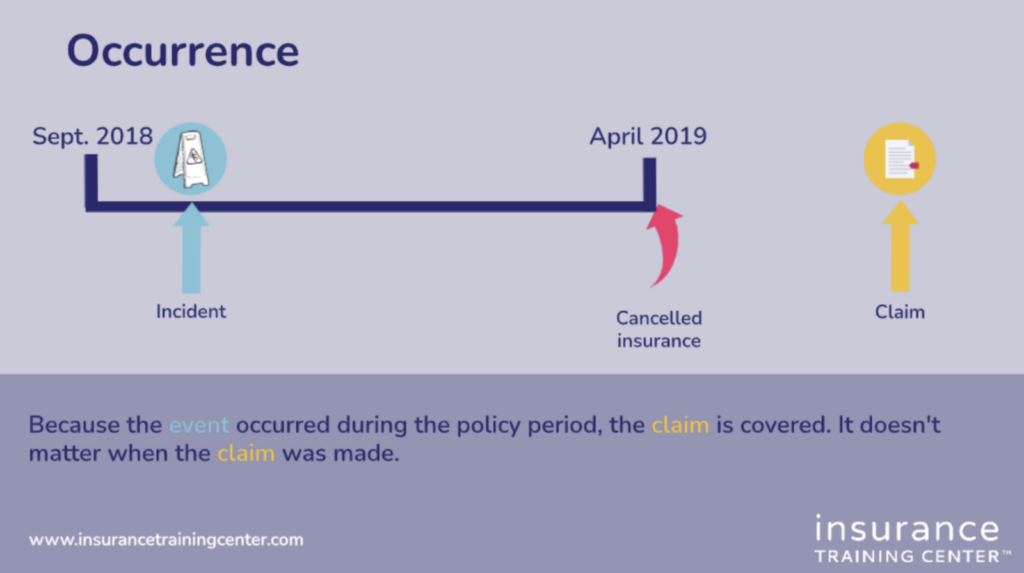

An occurrence policy covers claims arising from acts or incidents that occurred during the policy period, regardless of when the claim is made. For policies written on an occurrence basis, the timing of when the claim is made doesn’t matter, it could be years later. What matters, is when the act or incident that gave rise to the claim took place. Commercial General Liability policies are written on an occurrence basis; some other insurances such as Media Liability are often offered as both occurrence based and claims-made policy wordings.

Do I have tail* exposure if I have an occurrence policy?

With an occurrence policy, you have coverage for the loss as long as the act or incident occurred during the policy period. This means you can report the claim at any time after the policy has expired and still have coverage.

*Tail: refers to the timeframe beyond the expiry of a policy so, after the end of the policy.

Occurrence policy claim example:

Sue and Joe owned a restaurant. One snowy winter afternoon, a customer walked into the restaurant, slipped, and fell. Unknown to Sue and Joe, their customer broke her wrist and had a series of complications that led to reconstructive surgery. The following spring, Sue, and Joe got an offer to sell their restaurant and so they did. The sale completed and Sue and Joe canceled their insurance without hesitation. A year later, the customer sued for damages claiming Sue and Jo were negligent in keeping their premises dry and safe. Sue and Joe successfully submitted the claim to the insurance company and got covered for the loss. The Commercial General Liability policy that they had place at the time of the incident was an occurrence based policy.

Claims made policy:

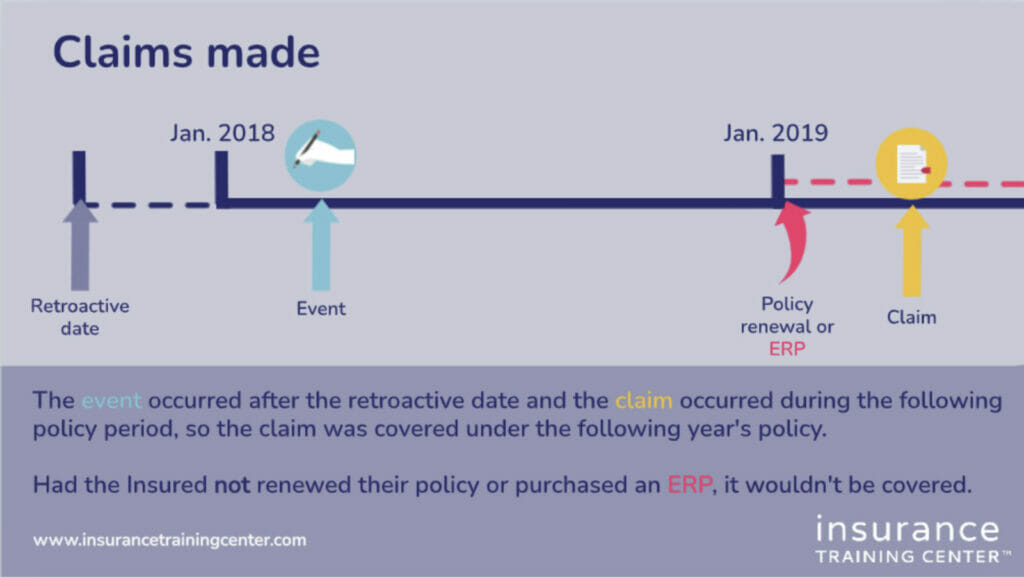

A claims made policy covers claims made during the policy period. The event that gave rise to the claim could have happened at any time, as long as the claim (or the written demand) was made during the policy period, and reported to the insurance company as required by the policy.

It is extremely important to understand the basis on which your policy is written because of what’s referred to as “tail exposure” on claims-made policy. Tail exposure exists when a policy is not renewed, or is canceled for any reason. This leaves the insured unprotected against future claims (for past acts/events).

Claims made policy claim example:

An architect has a professional liability policy in place with an effective date of January 1, 2018, to January 1, 2019. The professional liability policy is written on a claims made policy.

The architect engages in a project in February 2018. The architect makes a design error. By the time the error is discovered, the building project is well underway and the cost of rectifying the structure to bring it up to code has reached $85,000. The building owner sues for professional negligence in April 2019. Fortunately, the architect had renewed his insurance policy. The claim was reported and covered by the architect’s 2019-2020 professional liability insurance policy.

Key provisions in a claims made policy vs. an occurrence policy

Every insurance policy comes with rights and obligations for both the insured and the insurance company. There are some key provisions in a claims-made policy that you will not find in an occurrence policy. These deserve extra attention. These provisions are part of the mechanism that makes claims-made policies work for the insured and for the insurance company.

Retroactive Date:

If your claims made policy has a retroactive date, you have a cut-off date after which acts are covered. Any acts that occurred before the retroactive date will not be covered. Check the retroactive date on your declarations page at policy renewal and, particularly, when replacing coverage. Avoid resetting the retroactive date as a reset date essentially removes coverage for any past acts.

Some insurance companies provide “full prior acts coverage”. This means there is no retroactive date and coverage is available for all past acts as long as the policy is active.

Warranties:

Claims made policies may contain a warranty statement in the application questionnaire or in the policy itself. Give warranties the attention they deserve. A warranty may read like this:

“no person or entity proposed for coverage is aware of any act, error or omission which might result in a claim”,

The applicant is given the option to answer ‘Yes’ or ‘No’. Omitting facts or information can result in coverage disputes or a claim denial. The insurance company may even rescind the policy. It is wise to work with counsel and your insurance broker to disclose any incidents or report any potential claims.

Claims reporting requirements:

Claims made policies have strict requirements concerning when a claim should be reported to the insurance company. There is also the difference between claims-made policies and claims made and reported policies. Claims-made and reported policies require that both the claim and the reporting of the claim (by the insured to the insurer) occur during the policy period. Claims made policy reporting requirements will vary depending on the insurer. Nevertheless, the expectation is typically for the insured to report the claim “as soon as practicable”. Alternatively, the policy may give a specific window of time in which the insured can report the claim after it has been made.

Reporting potential claims:

What should an organization do if it becomes aware of a potential claim but the claim is yet to be received? Some policies specifically state that they will accept a detailed written notification of an anticipated claim as a reported claim. However, the notification must provide sufficient information. A potential claim notification must include specifics such as:

- the names of the expected claimant and the insured defendant,

- the date and description of the wrongful act(s), and

- the reason for anticipating a claim.

In these situations, seek advice from your insurance broker and work with legal counsel to prepare the written notification for the insurer.

Extended reporting period:

Tail exposure is always something to keep in mind when purchasing a claims made policy. This doesn’t mean an insured has to purchase a policy perpetually. The insurance market offers a solution for tail exposure called an extended reporting period or “ERP”. ERP covers that tail exposure by granting a set amount of time after the policy has ended, in which to report claims. ERPs are commonly purchased for anywhere from 1 to 6 years.

Let us be clear: an ERP is not the same as a policy renewal. An ERP does not cover any wrongful acts that occur after the ERP is executed. Coverage applies only to claims that are made for acts that occurred during the policy period prior to the ERP.

Occurrence vs claims made claim example:

An independent contractor named Sheila provides services to a client under a one-year contract. Sheila purchases an insurance policy for the one year that she’s working for her client.

With an occurrence policy, all acts or incidents that take place during the policy period and her contract period would be covered. Even if the client made a claim against Sheila years later, her policy would cover her. This is because the act that gave rise to the claim occurred during the policy period.

With a claims-made policy, Sheila would be covered only if her client made a claim against her during that policy period. The time that she is under contract. Without a policy renewal in place, if her client made a claim against her the following year, Sheila would be uninsured. Sheila has tail exposure; she has exposure to potential lawsuits after her contract has ended.

How do I choose between an occurrence and a claims made policy?

It’s easy to look at those examples and think, “great, I’ll take the occurrence policy please”. Unfortunately, it doesn’t quite work like that. While there are some policies that offer you the option of selecting a claims made or an occurrence wording, it’s not always the case.

General liability policies are commonly occurrence-based policies while management liability policies tend to be written on a claims-made basis. Certain policies like Media Liability can be either claims-made or occurrence, depending on the insurer. Keep in mind that occurrence vs. claims made concerning liability policies. First-party losses use different language, for example, loss “discovered” or loss “sustained”.

Directors & Officers Liability, Employment Practices Liability and Miscellaneous Professional Liability insurance are examples of policies that are offered on a claims-made basis because of the long tail exposure. Insurance companies specifically design the policies this way so they can underwrite and be compensated for taking on the risk.

Be informed an informed buyer. Make the right purchasing decision for your business, and successfully access coverage should a claim arise.

Key Takeaways

- Insurance buyers, you need to be aware of what type of policy you have: occurrence or claims made

- Occurrence policies cover acts or incidents that happened during the policy period

- Claims made policies cover claims that are made during the policy period

- Know your rights and responsibilities as an insured

- Be an informed insurance buyer to ensure you have the right coverage at the time of a loss.