When you purchase an insurance policy and pay the entire insurance premium up front, the insurance company owes you risk coverage for the entire contracted term. How does the insurance company record insurance premiums in its financial statements to accurately reflect that obligation? How does the insurance company ensure that it has funds available to refund you if you cancel early?

In this article, we take a close look at one aspect of premium accounting, ‘unearned premium‘. ‘Unearned premium’ is the portion of an insurance premium for which that the insurer owes an obligation to the policyholder and must therefore recognize as liability on its financial statements.

Here some of the questions you’ll be able to answer after reading this article:

- When does premium cease to be ‘unearned premium’?

- Why do insurance companies need to measure unearned premium?

- How can we use that unearned premium information to understand an insurer’s financial status?

What is ‘Unearned Premium’ (UEP)?

‘Unearned premium’ (UEP) refers to the portion of insurance premium paid to an insurance company that the insurer has not yet earned because the company has not yet provided the associated risk coverage. When a policyholder purchases a new policy and pays the full premium amount upfront, the insurer provides the risk coverage over time, for the duration of the policy. At first, the insurer has received the premium but has not yet ‘earned’ the premium.

If the policy has a 12-month term (the most common), once 4 months have passed, then 8 months of coverage still remains on the policy term and the associated portion of the premium is the ‘unearned premium’. The policyholder expects to receive that 8 months of risk coverage and the insurance company must be prepared to provide it. As time progresses and coverage is provided, the unearned premium amount decreases until the policy expires at which time all the premium has been earned.

Let’s look at an illustration:

Klip Insurance Company has a client that purchased a 3-year policy. The premium for this policy is $15,000 ($5,000 annually). The client paid the entire amount to Klip upfront. At the end of the first year into the 3-year policy, Klip will have earned $5,000. The insurer’s unearned premium will be $10,000.

UEP in insurance accounting

Unearned premium liability

The insurance company records unearned premium as a liability on its balance sheet because it owes risk coverage in exchange for that premium. In the event that a policyholder (or the insurer) cancels coverage before a policy period has elapsed, the insurer may owe a refund to policyholder for the remaining unearned premium.

Recording the UEP liability enables the insurer to:

- Track its refund liability. There are situations in which an insurer many need to refund premium to the policyholder. For example, if a policyholder downgrades or cancels coverage before the end of the policy term. Or if the insurer is no longer able to provide coverage, for example, due to a regulatory change.

- Defer revenue recognition so that the premium revenue can be matched with the associated expense.

Consider a multi-year policy. The expense of delivering on the policy does not all occur in year one so recognizing all of the premium in year one would not provide an accurate financial picture.

Unearned premium is an obligation to policyholders. While the insurer may receive the entire premium amount upfront, that does not all immediately translate to revenue because the insurer has not yet provided the associated service, the risk coverage.

Let’s look at an example:

If a client pays $2400 to Klipp Insurance Company for coverage that will last for two years. The paid premium will be debited from the cash account and recorded in the unearned premium revenue account. Klipp insurance will debit the unearned premium revenue account and credit the revenue account each subsequent month to transfer $100 of the liability to the revenue account.

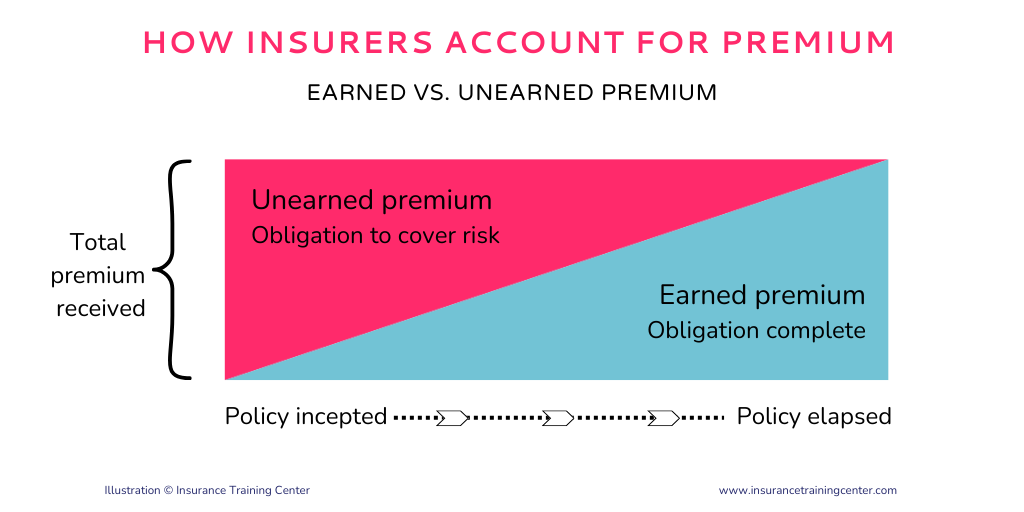

Earned vs. Unearned Premium

Earned premium is the counterpart to unearned premium. While at the beginning of a policy term the premium is unearned, once the policy term begins, the insurer starts providing risk coverage and begins to earn the premium. Earned premium is recognized as revenue on the income statement.

While unearned premium is yet to be recognized as earnings because the policy’s expiration date is not yet due, earned premium is the premium amount that the insurer has already recognized as earnings because the related coverage time has already passed.

Typically, when a policyholder terminates an insurance policy early the insurer will refund the UEP. The insurer cannot refund the earned premium.

Insurance accounting and liabilities

A liability is a claim against assets. An insurer’s liabilities have two components:

- Reserve for the obligation to policyholders – the Unearned Premium Reserve (UPR). This is the sum of all unearned premium on the insurer’s books at a specific point in time.

- Claims by other creditors. This includes things like salaries, operational expenses, taxes payable, outstanding claims payable, etc.

The UPR is the largest liability on an insurance company’s balance sheet. Therefore, understanding it is vital to understanding and tracking the financial status of the insurance company.

Consider for a moment, what if, an insurance company did not track the amount of premium that it had not yet earned, its unearned premium, its liability.

Insurance industry regulators take this very seriously and place very stringent requirements on insurers with respect torecognizing, tracking and reporting unearned premium.

How to calculate unearned premium

There are several methods for calculating earned premium, depending on the policy type, duration, and insurer’s practices.

Here are the most common methods:

-

- the accounting method,

- the pro-rata method, and

- the exposure-based method.

The accounting method

UEP can be calculated by deducting the = earned premium from the total written premium in a given period.

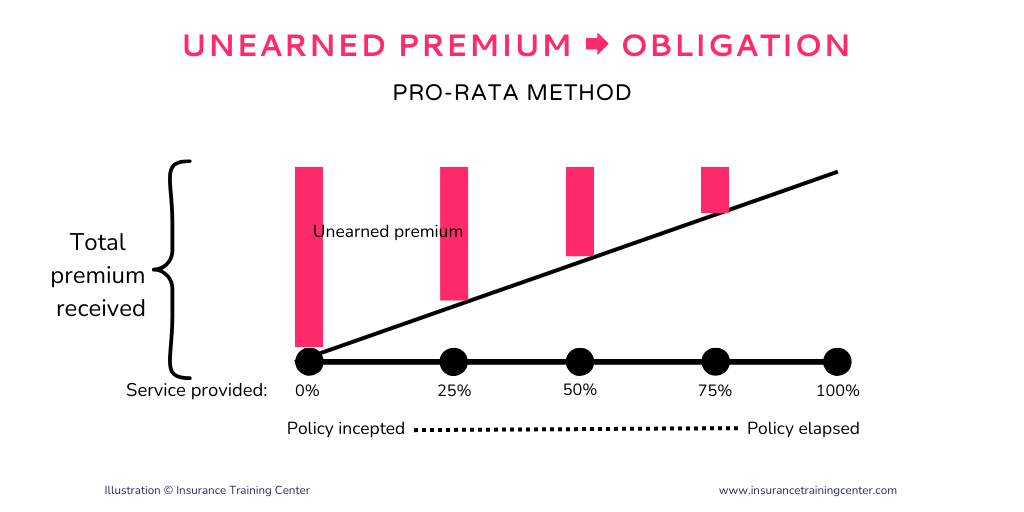

The pro-rata method

This ‘Pro-rata’ method is a straightforward time-based calculation. When we use the pro-rata method, we assume that the level of risk is spread evenly throughout the term of the insurance policy and that it ends when the policy period is over.

For an insurance policy with a 365 day term, the pro-rata calculation would look like this:

Unearned Premium = Total Premium/365 * Number of days remaining in the policy term

The exposure-based method

The exposure-based method draws on various risk factors and historical data. It is a much more complex calculation than the pro-rate method.

If we use the exposure method, we have likely determined that the risk is NOT evenly distributed throughout the term of the policy and so a pro-rata approach would not be appropriate as it would not reflect the variations in risk. Consider insurance for a downhill skiing resort; a grain farm, a concert tour, or a large construction project. For each of these examples, some of the insurable risks are not the same from day to day, month to month, or season to season. The variation could be significant. If an insurer were to use a straight-line, pro-rata calculation in these situations, it would not get an accurate picture of its risk exposure.

By using the exposure-based method, insurers are better able to assess the portion of the total premium that is exposed to loss in situations where the risk of loss is much higher or varies over time, such as with a seasonal risk.

Why is UEP important?

Unearned premium is that portion of the total premiums the insurance company has collected for which it has not yet provided risk coverage. Let’s take look at why it is important to differentiate between earned and unearned premium on the insurance company’s accounting books.

- Financial obligation to policyholders – An insurance company must be prepared to provide the risk coverage that they’ve contracted for in an insurance policy. They must also be prepared to provide a premium refund according to the terms of the policy, when required.

- Regulatory compliance – Insurance industry regulators require earned and unearned premium data for assessing an insurer’s solvency and compliance with statutory accounting principles.

- Financial position – Insurance companies use unearned premium to delay revenue recognition in order to accurately track their future financial obligations.

Related terms

Unearned Premium vs. Earned Premium

Earned premium is the opposite of UEP. Unearned premium has yet to be recognized as earnings because the insurer is still providing the contracted risk coverage. Earned premium however, is the premium amount that the insurer has already recognized as earnings because for that portion of the premium, its risk coverage obligation has expired.

UEP is usually refunded as a result of the early termination of an insurance policy, whereas the insurer cannot refund the earned premium.

Unearned Premium and Unearned Commission

Insurance companies pay commissions to insurance agents and brokers for selling insurance policies. The insurer typically calculates the commission based on the total premium amount and may pay it all at once or in several installments.

Consider a situation where the insurer has paid out the full commission to an insurance agent. Then, half way through the policy term, the policyholder cancels the policy. Now the insurance agent may owe some of that commission back to the insurer. Typically, the amount of commission that the insurance agent must return is the amount that directly relates to the insurer’s unearned premium. If one half of the policy term has passed, the insurance agent will have earned one half of the commission. The remainder will be the agent’s ‘unearned commission’.

Insurance agents and brokers treat unearned commissions much like insurer’s treat unearned premiums. As a liability. Unearned commission represents the amount that the agent or broker many need to repay if a policy is cancelled.

The Bottom Line

Policyholders pay premium in advance for coverage against risk. Insurers categorize premiums as earned or unearned depending on whether the premium is recognized as revenue or liability.

The insurer recognizes the earned premium as revenue because it corresponds to the portion of the policy that has expired. The UEP is recognized as a liability in the insurer’s books because it corresponds to an obligation. The insurer will refund the unearned premium in the event that the insured cancels the policy.

Key Takeaways

- Insurance premium is a liability until the insurer has earned it by providing the contracted risk coverage.

- Unearned premium(UEP) corresponds to the portion of an insurance policy that has not yet elapsed.

- Unearned premium is calculated using either a pro-rata or non-pro-rata approach to align liability with risk.

- Unearned premium and the unearned premium reserve represent the insurer’s outstanding obligation to policyholders.

- Unearned commission is the portion of the insurance commission that has not yet been earned.

More…

Learn about earned premium: