Run-off insurance: What is it and How Does it Work?

Run-off insurance is a critical consideration for businesses and professionals that are closing, restructuring, retiring, or undergoing a change in ownership. While operations may end, legal liability often does not. Claims related to past acts can arise years after a professional has ceased operations or completed their work.

For example, a director remains liable for decisions or actions taken during their tenure, even after resignation, subject to applicable statutes of limitation. Likewise, an architectural firm that sells its practice to another firm can still be held responsible for errors or omissions on projects completed before the sale. The transfer of ownership does not eliminate liability for past work. Run-off coverage is needed to protect against future claims tied to prior activities.

This article explains what run-off insurance is, why it matters, how it works, and how it differs from extended reporting periods (ERP) and tail coverage, with practical examples across multiple lines of insurance.

What is run-off?

The term ‘run-off’ in insurance describes a status or situation, not an insurance product. It refers to the period after a business or professional stops operating or providing insured services, when no new work is being performed and no new risks are being created, but legal liability from past acts still exists.

In other words, run-off is the state of exposure that remains after operations end.

Run-off typically occurs when a company:

- winds down operations or becomes insolvent,

- is acquired or merged,

- replaces a board of directors, or

- when a professional retires.

In practice, the term ‘run-off’ is often used interchangeably with ‘run-off insurance’, even though they are not the same. Run-off describes the exposure, run-off insurance is the coverage arrangement used to address it.

What is run-off insurance?

Run-off insurance is an insurance solution designed to address liability exposure that remains after a business or professional has ceased operations or stopped providing insured services. While active operations may end, claims related to past acts can still arise, sometimes years later.

Run-off insurance allows an insured to maintain coverage for claims arising from wrongful acts that occurred prior to the date operations ceased. Coverage continues for past acts while no new exposures are being created, meaning no new professional services, operations, or insured activities are undertaken.

Run-off insurance:

- Covers past acts only

- Does not cover new activities

- Allows claims arising during the run-off period to be reported (typically through an extended reporting period)

- Does not reset policy limits, terms or conditions.

It is associated with claims-made policies, such as Directors and Officers liability insurance (D&O) and professional liability / errors & omissions (E&O) insurance. These policies only respond to claims that are first made and reported while the policy is active, or during an applicable reporting extension – see ERP below).

Importantly, run-off coverage does not insure new activities. It applies solely to liabilities arising from past acts.

Pricing, duration, and availability vary by insurer, jurisdiction, and line of business, and are influenced by factors such as claims history, industry, and applicable limitation periods.

Why run-off insurance matters?

The key rationale for run-off insurance is that liability does not end when operations end. An organization or professional may no longer exist in an active sense, but legal claims can still be brought based on historical actions.

For example:

- A lawyer who has retired may later face a claim from a former client alleging negligence in legal advice provided years earlier.

- A technology firm may wind down, but its software or systems may continue to be used by clients, creating ongoing exposure if defects or errors later result in loss.

- A company that has wound down and laid off all employees may later face an employment practices claim from a former employee alleging wrongful termination or discrimination that occurred before the closure.

- A company completes a merger or acquisition and terminates its pension plan. Years later, former plan participants bring a claim alleging mismanagement of plan assets or breach of fiduciary duty that occurred before the transaction.

- A business sells its operations and distributes proceeds to shareholders. After closing, tax authorities or counterparties allege unpaid taxes, contractual breaches, or misrepresentations made during the sale process.

In these situations, run-off insurance helps ensure that coverage remains available to respond to claims arising from past acts, even though no new work is being performed.

Why run-off insurance is needed?

Run-off insurance is often required when an organization or transaction creates ongoing liability exposure after operations end. In many cases, an insurance policy already exists but needs extended reporting. In other cases, no prior insurance applies, and a new run-off policy must be put in place. Both situations address the same problem. Liability can survive long after the business changes or closes.

Run-off of an existing policy

Many professional and management liability policies are written on a claims-made basis. Claims-made policies respond only to claims first made and reported during the policy period, as long as the wrongful act occurred after the retroactive date.

Common claims-made policies include:

- Directors & Officers (D&O) Liability

- Professional Liability / Errors & Omissions (E&O)

- Employment Practices Liability (EPL)

- Technology E&O / Cyber-related professional liability

- Fiduciary Liability

A claims-made policy may be placed into automatic run-off following a material change such as a merger or sale (as stipulated in the policy’s terms and conditions). Coverage for new acts stops at that point, and only claims arising from prior acts may be reported during the run-off period. Once a claims-made policy expires or is canceled, coverage ends unless reporting rights are extended.

Occurrence-based policies operate differently. They respond based on when the injury or damage occurred, regardless of when the claim is reported. These policies typically do not require run-off arrangements.

Because claims-made policies stop responding when they expire or enter run-off, run-off insurance allows claims related to past acts to be reported after operations have ended.

Representations and Warranties insurance

In some cases, there is no existing policy to extend. This is common in mergers and acquisitions where exposures arise from tax matters, contractual obligations, or representations made in the sale agreement.

Representations and Warranties insurance places a new policy into force. The policy runs off from closing and responds to claims alleging breaches of representations, warranties, or other specified obligations that existed before the transaction.

This form of run-off protection fills gaps where no prior insurance applied and shifts post-transaction risk away from sellers and buyers.

How does run-off insurance work?

Run-off insurance is a coverage arrangement used when an insured has ceased operations or insured activities. In practice, it is typically implemented by:

- Placing the existing policy into run-off status, meaning no new activities are covered

- Applying an extended reporting period (ERP) to allow claims arising from past acts to be reported

- Negotiating the length and terms of the run-off period, particularly following a merger, acquisition, or when insured activities permanently cease. This includes determining whether coverage will extend for one, three, six years, or on an unlimited basis, and how those options align with applicable statutes of limitation and ongoing risk exposure.

Common run-off scenarios:

Professional Liability Insurance: merger or acquisition

When a company is acquired, liabilities from past professional services do not disappear. Claims may arise after the transaction closes.

For example, a business operating in the professional engineering space will typically have professional liability insurance in place. When that business is sold, the acquiring organization may be exposed, economically or contractually, to professional liability claims related to the acquired company’s past activities.

Commonly insurance is used to address this exposure as follows:

-

- The acquired company’s professional liability policy is canceled or placed into run-off

- Run-off coverage is arranged to protect against claims arising from pre-acquisition acts

- The acquiring entity places its own coverage for ongoing operations

This approach helps clearly separate pre- and post-transaction liabilities.

Not-for-profit D&O: a new board is put into place

When a not-for-profit organization appoints a new board of directors, claims may later arise relateing to decisions made by the previous board.

To address this exposure, it is common to:

-

- Place the prior D&O policy into run-off and apply an extended reporting period to allow claims arising from acts of the former directors and officers to be reported after the policy ends

- Limit coverage under the run-off policy to wrongful acts committed during the former board’s tenure

- Issue a new D&O policy for the incoming board to cover ongoing and future governance activities

This structure avoids ambiguity over which policy responds to a claim and ensures that both the previous and the new boards are protected for claims related to activities that occurred during their respective terms.

Miscellaneous Professional Liability: retirement or cessation of practice

Retiring from a profession or closing a practice does eliminate legal liability. Former clients, patients, or stakeholders may still bring claims years later.

Similarly, professionals such as lawyers, accountants, consultants, engineers, and medical practitioners may face claims years after services were rendered. Run-off insurance allows retired professionals to:

-

- Protect themselves from claims related to past work

- Avoid maintaining a full active policy

- Secure coverage for a defined reporting period

If you are a professional, such as a lawyer, accountant, or consultant, and you are no longer practicing, run-off insurance can provide protection for claims arising from past activities.

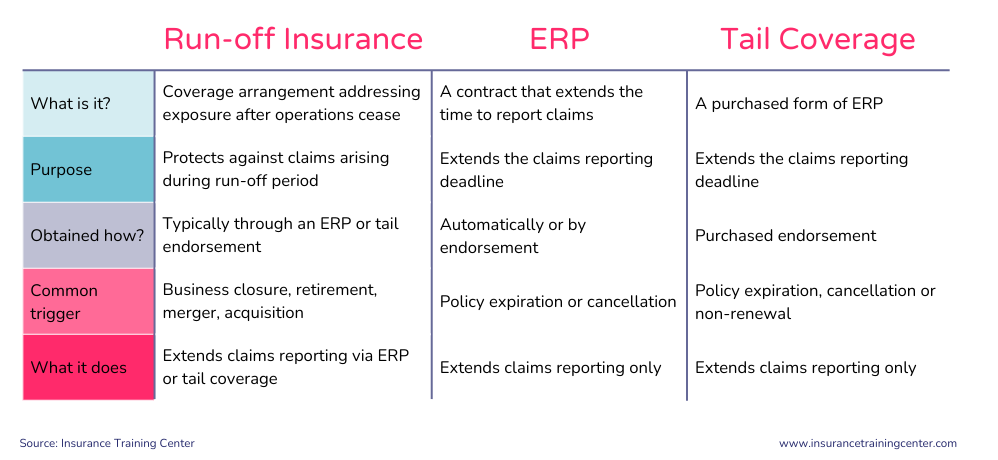

Run-off insurance vs. Extended Reporting Period vs. Tail coverage

The terms run-off insurance, extended reporting period (ERP) and tail coverage are closely related and often used interchangeably. However, they refer to different aspects of claims-made insurance coverage.

While all three relate to claims arising from past acts:

- run-off insurance reflects the post-operations exposure, whereas

- ERP and tail coverage are the mechanisms used to extend the time to report claims

Run-Off Insurance

Run-off insurance refers to the coverage arrangement used when an insured has ceased operations or stopped providing professional services but remains exposed to claims arising from past acts. It addresses liability exposure after operations or insured activities end. This coverage is usually put in place through an extended reporting period (ERP) or tail endorsement following events such as a business closure, retirement, or merger. Run-off insurance applies only to historical activities and does not cover new work.

Extended Reporting Period (ERP)

An Extended Reporting Period (ERP) is a contractual provision that extends the time to report claims after a policy expires or is canceled, either automatically or by endorsement. The ERP allows an insured to report claims after a claims-made policy has ended, provided that the wrongful act occurred before the policy termination date. An ERP does not extend coverage for new activities, it only extends the reporting timeframe.

Tail Coverage

Tail coverage is simply a purchased form of ERP, it is not a separate policy, but rather, it is an endorsement that extends the reporting period beyond the policy’s expiration, often for a defined number of years. The term ‘tail coverage’ is used primarily in North America.

In summary:

- Run-off insurance addresses the exposure after operations or insured activities have ended

- ERP describes the mechanism that extends reporting time

- Tail coverage is the purchased version of an ERP

Many policies include a short automatic ERP (such as 30–60 days). Longer reporting periods, commonly one, three, or six years, must usually be negotiated and purchased as part of a run-off insurance arrangement.

Key Takeaways

- Run-off insurance addresses liability exposure that remains after operations, professional services, or governance responsibilities end or change.

- It applies to claims-made policies and protects against claims arising from past acts, not new activities.

- Run-off insurance is commonly used for business closures, retirements, mergers and acquisitions, and board changes.

- It is usually put in place by extending the time to report claims through an ERP or tail endorsement.

- Without run-off insurance, claims made after a policy ends may not be covered, even if the act occurred earlier.

Terms in this article

More…