Fiduciary Liability Insurance is an errors and omissions insurance for fiduciaries of pension plans and employee benefit plans. It protects them from financial loss resulting from claims of mismanagement, errors, or omissions in plan administration.

Here are some important things to note:

- Fiduciaries hold legal liability for what they do in the performance of their roles as fiduciaries

- FLI protects against errors and omissions whereas ERISA bonds protect against fraud and dishonesty

- Even allegations cost money to defend

- Know your insurance coverage options and how to use your policy when you need it.

What is Fiduciary Liability Insurance?

Fiduciary Liability Insurance (FLI) is a type of errors and omissions insurance specifically designed for fiduciaries of pension plans and employee benefit plans. Its purpose is to protect fiduciaries from the financial loss that can result when claims are made against them alleging mismanagement, breach of duty or administrative errors or omissions.

Watch a video:

Which organizations need FLI?

Every organization that offers a benefit or pension plan for its employees should have fiduciary liability insurance in place.

Many people think twice before agreeing to take on plan fiduciary duties such as sitting on their company’s pension committee, because along with the prestige of the role comes enormous personal liability. Plan administrators and sponsors have legal liability for what they do, or don’t do, in the management of pension and employee benefit plans. They are held to exacting standards of conduct dictated by legal statutes, such as Canada’s Pension Benefits Standards Act R.S.C. 1985 and the USA’s Employee Retirement Income Security Act of 1974, as well as by common law and contract law. Any actual or alleged breach of duty, error, or omission, could result in a financially devastating lawsuit threatening the personal assets of plan fiduciaries as well as the business. Fiduciaries cannot afford to be uninsured!

Potential claims against fiduciaries

A fiduciary is a person or organization that owes the duties of good faith and trust to another and is bound ethically to act in the other’s best interest. Plan fiduciaries hold positions of trust and are legally liable for what they do in their roles as fiduciaries. Even when mistakes are not made, allegations may arise against plan fiduciaries, companies, pension and welfare plans.

Here are some examples:

- Improperly advising plan participants

- Failing to make adequate disclosure

- Inaccurate or lack of reporting to plan members

- Failing to operate the plan prudently and for the exclusive benefit of plan participants

- Failure of the fiduciary to act in the best interests of all classes of plan members

- Failing to make benefit payments due under the terms of the plan

- Delinquent employer contributions

- Imprudent investment decisions or not investing according to the terms of the plan

- Failing to diversify plan assets

- Conflict of interest in investment of plan assets

- Inappropriate loans using plan assets

- Failing to manage plan overfunding or underfunding according to the terms of the plan

- Failing to properly value plan assets or to hold plan assets in trust

- Inappropriate or excessive management fees paid by plan participant accounts

- Premature termination of the plan

Are you a fiduciary?

In the case of pension and employee benefit plans, fiduciaries include both plan administrators and trustees (those responsible for managing pension and employee benefit plans), and also plan sponsors, (the corporations or employers that offer such plans).

View a free preview lesson: Who is a fiduciary?

FLI policy coverage

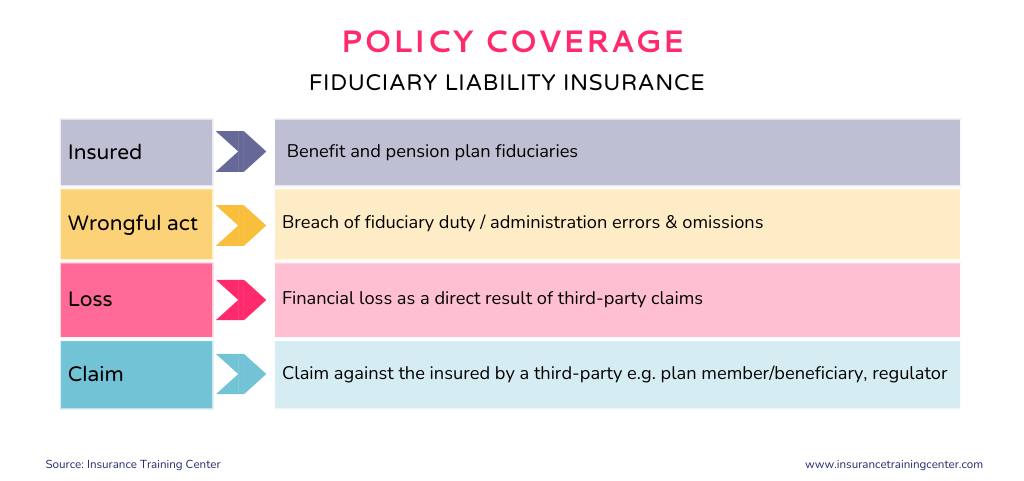

Fiduciary liability insurance covers the financial loss suffered by the insured as a result of a third-party claim against the insured arising from an alleged wrongful act.

Coverage enhancements

- Anti-Clawback Protection

- Health Care Reform Penalty Coverage

- HIPAA Penalty Coverage

- Independent Fiduciary Fees

- Labor Management Relations Act (“LMRA”) Coverage

- Pension Crisis Fund

- Fact-Finding Investigations

- Voluntary Compliance Program Coverage

Coverage exclusions

- Pending or prior proceedings

- Conduct

- Assumed liability under contract

- Bodily injury / property damage

- Discrimination

- Duties under law

- Exclusions for which other insurance or extensions are available such as pollution,

wage and hour.

A note on FLI vs ERISA fidelity bonds

Do NOT confuse fiduciary liability insurance with ERISA fidelity bonds, they are not at all the same. They are both important and complementary risk management tools for pension and employee benefit plans. However, FLI covers claims of errors and omissions and expressly excludes criminal activity whereas ERISA bonds cover loss from theft and fraud, not errors and omissions.

Learn more, read a comparison here: Understanding ERISA Bonds

What to look for in a FLI policy

The typical fiduciary liability insurance policy is a 12-month third-party liability policy written on a claims-made basis with prior wrongful acts cover. These insurance policies are highly customizable and generally offer worldwide cover.

FLI insuring agreements

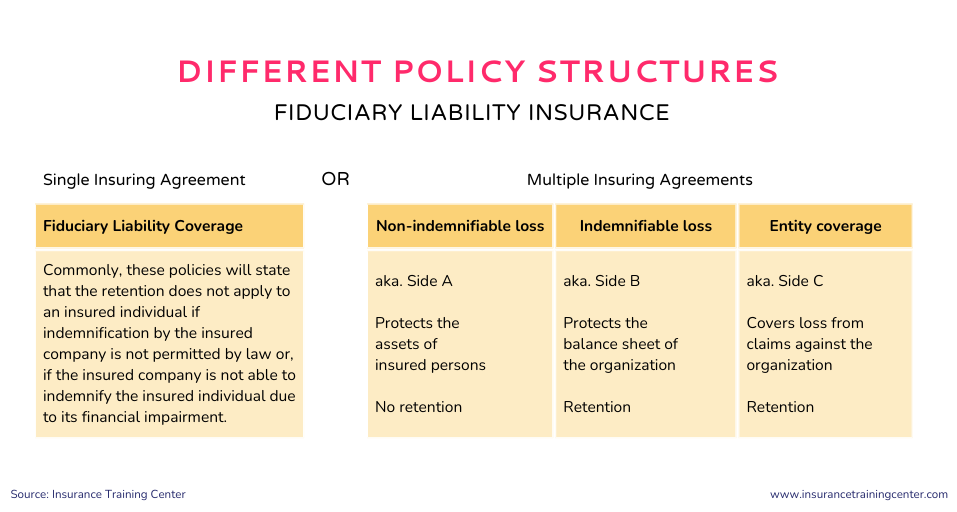

A FLI policy includes one or more standard insuring clauses and may also include coverage extensions to build out the bespoke insurance policy needed by the buyer.

Fiduciary liability insurance policies are typically structured in one of two ways, a single fiduciary liability coverage agreement or a set of insuring agreements resembling that commonly found in a Directors and Officers Liability (D&O) insurance policy i.e. separate agreements for each of non-indemnifiable loss, indemnifiable loss and entity coverage.

Liability limits

It’s important to understand how coverage is structured on your insurance policy. The policy declarations, usually the first page of the policy, will list the policy limits. The general terms and conditions will explain how the liability limits work. Here are some of the things to look for:

An FLI policy may have:

- a limit per loss as well as an aggregate limit.

- sublimits – These place restrictions on the amount of coverage available for a specific type of loss; i.e., for all voluntary compliance/correction program costs, for penalties under the pension program act.

- shrinking limits – ‘Limit reduced or exhausted by defence costs’. Should defence costs consume the entire limit, any subsequent costs or damages would be the responsibility of the insured, not the insurance company.

Types of plans covered by FLI

Fiduciary liability insurance is commonly referred to as Pension Trustee Liability insurance (or PTL) in EMEA (Europe, Middle East and Africa) and in the UK. From the name, one might assume that it only covers liability related to pension plans, but that is not typically the case. FLI (or PTL) can cover a broad range of plans. Pension and employee benefit plans take on various forms and have many different names. The types of benefits plans that are commonly covered by fiduciary liability insurance include:

- Plans subject to ERISA

- Pension plans

- Profits sharing plans

- 401K

- Employee Stock Ownership Plan (ESOP)

- Disability income (long-term, short-term)

- Hospital-surgical-medical insurance

- Accident insurance

- Dental and vision care insurance

- Life insurance

- Supplemental unemployment

- Tax Reform Act Stock Ownership Plan (TRASOP)

- Certain severance pay plans

- Prepaid legal service