An ERISA bond (or ERISA fidelity bond) is an risk management instrument that protects the benefit or pension plan for which it is purchased, from loss due to dishonesty or fraud by the plan’s fiduciaries.

The Employee Retirement Income Security Act (ERISA), was enacted in the U.S.A. in 1974 to assure that employees participating in private sector pension and benefit plans, and their beneficiaries, receive the benefits that the plans promise to them. When ERISA was launched it formalized and substantially increased the potential liabilities of plan fiduciaries. The Act governs how employee benefit and pension plans are managed and also requires that all organizations that have USA employee benefit or pension plans purchase an ERISA bond and provide evidence of cover to the regulator.

So what is an ERISA bond? How does it work? What does it cover? How does it differ from insurance policies? And what does the buying process look like?

This article answers those questions and more.

What is an ERISA bond?

An ERISA bond is an insurance fidelity bond that is specifically structured to meet the requirements set out by the USA’s Employee Retirement Income Security Act (ERISA).

If you have employees in the United States, the following information is important for you!

ERISA was enacted in 1974 to safeguard the interests of employees and their beneficiaries who rely on employee benefit and pension plans. In response to concerns that plan funds were being mismanaged and abused, the Act:

- Set out rules and standards of conduct for the plans and plan fiduciaries; and

- Required that all people who handle plan assets be covered by a fidelity bond that meets the specifications set out in the Act.

The required fidelity bond is commonly referred to as an ERISA fidelity bond, or simply, an ERISA bond. The U.S. Department of Labor enforces and administers ERISA.

What does an ERISA bond cover?

An ERISA bond functions as a risk management tool, much like an insurance policy. It financially protects the benefit or pension plan for which it is purchased from loss due to dishonesty or fraud by the plan’s fiduciaries. That is, if someone acting in a fiduciary position for a plan embezzles or steals from the plan, the ERISA bond offers indemnification up to the coverage maximum stated in the cover. Examples of crimes covered by the bond include:

- Embezzlement

- Forgery

- Larceny

- Misappropriation

- Theft

- Wrongful abstraction

- Wrongful conversion

- Willful misapplication

How does an ERISA bond work?

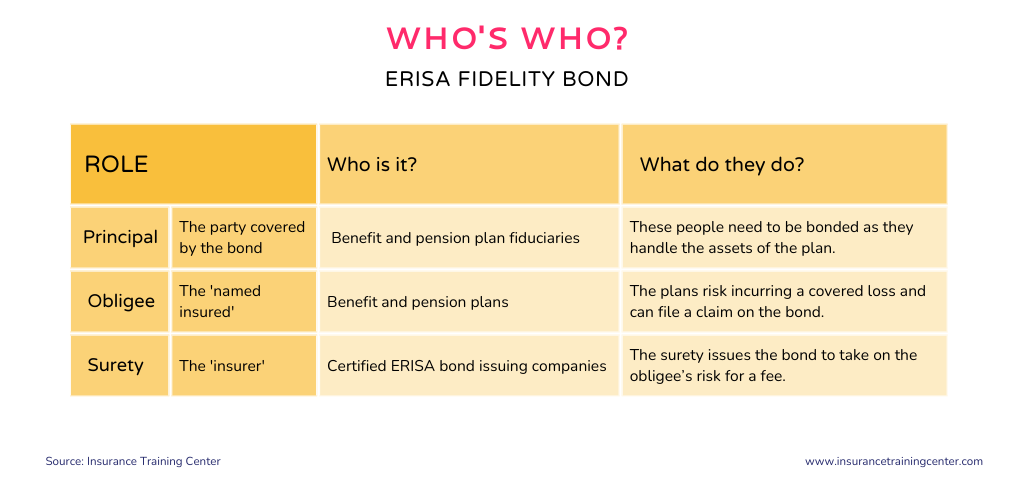

An insurance bond is a contract between three parties, the principal, the surety and the obligee. With a fidelity bond, which is a type of insurance bond, the surety issues the bond as a guarantee that the principal will be faithful and trustworthy in delivering on their obligations to the obligee. The purpose of the fidelity bond is to protect the employer or other entity, in this case, the plan, from financial loss resulting from dishonesty and fraud by the principal, the plan fiduciary. The bond is an agreement that, if such a situation were to occur, the surety would step in to cover the loss up to the amount of the bond.

Who needs to be bonded?

Who is the principal on an ERISA bond? Section 412 of ERISA spells out who is and who is not required to be bonded. In Section 412 [1112](a) the Act states:

“Every fiduciary of an employee benefit plan and every person who handles funds or other property of such a plan (hereafter in this section referred to as ‘‘plan official”) shall be bonded as provided in this section;…”

Section 412 also describes a number of exceptions so it’s important to review the Act very carefully and obtain professional guidance to ensure you’re making the correct coverage decisions.

Fiduciaries owe the duties of good faith and trust to plan members and beneficiaries and are responsible for acting in their best interest. Fiduciaries include the plan administrators and trustees, those persons responsible for managing the plan, and also plan sponsors, the corporations or employers that offer such plans.

ERISA bonds vs.

Fiduciary liability insurance

Do NOT confuse ERISA fidelity bonds with fiduciary liability insurance, they are not at all the same. Look through the differences highlighted below and you will see that these two risk management tools are actually complementary.

1. Coverage

-

- ERISA bonds financially protect the plan from loss as a result of fraud or dishonesty commited by those who manage the plan. The coverage is for crime.

- Fiduciary liability insurance protects fiduciaries of the plan against claims of breach of fiduciary duty such as mismanagement. The coverage is for errors and omissions.

2. Protected party

-

- ERISA Bonds protect the plan

- Fiduciary liability insurance protects the fiduciaries of the plan and may protect the plan

3. Legal requirement

-

- ERISA bonds are required by law

- Fiduciary liability insurance is optional

Organizations with plans that require ERISA bonds can also benefit from purchasing fiduciary liability insurance. While ERISA bonds are mandatory for many plans, fiduciary liability insurance is optional but recommended for plan sponsors and fiduciaries.

ERISA bonds vs.

Commercial crime insurance

So, as ERISA bonds are cover for crime – would a commercial crime insurance policy suffice in place of an ERISA fidelity bond?

Commercial Crime Insurance covers the loss that an organization suffers from damage to, or destruction or disappearance of, its own property as a direct result of crime. Some Commercial Crime policies include an extension called employee benefit plan/pension administrator’s coverage. This extension covers direct loss to the plan of money, securities, and other property as a direct result of theft or forgery by an employee, trustee, plan administrator, or fiduciary.

An ERISA fidelity bond is similar to the employee benefit plan extension on a commercial crime insurance policy. Both protect the plan, and in turn the participants and beneficiaries of the plan, from loss as a result of crime. Where they differ is that the ERISA bond is structured to meet the regulatory requirements spelled out by the Act whereas the extension is not.

What does the Act require?

Section 412 of ERISA also spells out specific coverage requirements for ERISA fidelity bonds.

Limits

The bond value must be set once a year at the beginning the plan’s fiscal year. A person must be bonded for at least 10% of the total plan assets for which they or their predecessor were responsible during the previous year. For example, for someone managing a plan with $3,000,000 in assets, the minimum limit would be $300,000. The minimum bond amount is $1000 and the maximum is $500,000. For bonds covering more than one plan may require a larger amount. If plans include the employer’s securities, the maximum amount is $1.000,000.

Deductibles

An ERISA fidelity bond cannot have a deductible. It must cover right from the first dollar of loss.

Bond type

An ERISA bond must be in a form approved by the Secretary of the Treasury. That includes: individual bonds, schedule bonds, and blanket bonds. Schedule and blanket bonds are bonds that cover multiple principals on one bond.

Bond issuer

ERISA bonds can only be purchased from a surety or insurer that has been granted authority to issue such a bond by the U.S. Department of Treasury.

Buying an ERISA bond

Who needs an ERISA bond?

Most organizations with an employee benefit or pension plan and employees in the USA need to obtain an ERISA bond. There are some exceptions such as unfunded plans, governmental plans and church plans.

IMPORTANT:

When buying an ERISA bond, ensure that the bond clearly identifies the specific plan or plans as named insured so that, should a covered loss occur, the plan can make a claim on the bond.

How much does an ERISA bond cost?

The cost for an ERISA bond is typically a small percentage of the total bond amount. Your class of business and the number of principals to be covered will also impact price.

How do I buy an ERISA bond?

Contact your insurance broker for assistance or go direct.

Generally, to buy an ERISA bond, you will submit an application to a surety company, insurance company, or surety bond broker listed on the Department of Treasury’s list of recognized sureties and published in Department Circular 570. The list allows you to compare prices among hundreds of reputable service providers to find the ideal fit.

The typical buying process goes as follows:

Determine the amount of coverage you need

This will depend upon the number of plans you have, the amount of assets held by the plans, the number of persons requiring bonding.

Find a bond provider

Compare the rates, coverage, and reputation of different providers before making a decision.

Fill out an online application form

Once you’ve chosen a provider, you’ll need to fill out an application. Provide information about your plan (the plan’s legal name, prior loss history if applicable, contact information, number of trustees, etc.). The provider may also require you to undergo a credit check and provide other documentation.

Receive a quote

After the provider reviews your application and supporting documents, they will provide you with a quote for the bond premium.

Buy the bond

If you agree to the quote, you can purchase the bond by paying the premium to the provider. The provider will then issue the bond, which will provide coverage for your plan.

ERISA bonds typically expire after one year, so you’ll need to renew your bond annually to maintain coverage.

Finding more information

About ERISA

U.S. Department of Labor: https://www.dol.gov/general/topic/health-plans/erisa

Employee Benefits Security Administration

(Agency of the DOL): https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/erisa

Certified sureties

Bureau of the Fiscal Service: https://www.fiscal.treasury.gov/surety-bonds/