Image: Lloyd’s building on Lime Street in London; an innovative high-tech office block dubbed the inside-out building because of its Bowellism architecture.

Lloyd’s, often referred to as Lloyd’s of London, is an insurance marketplace that began centuries ago in London, England, and is now the most well-known insurance body in the world.

In 1936, 20th Century Fox released a movie titled, ‘Lloyd’s of London’. According to the Internet Movie Database (IMDb), this movie is only ‘slightly based on history’. Be that as it may, as a backdrop to its romantic storyline, the movie provides an interesting take on the goings on at Lloyds in its early days (1770 – 1805). Lloyd’s Coffee House, syndicates, the move to the Royal Exchange on Cornhill, capital from individual members, etc.

What is so compelling about Lloyd’s of London, an insurance market, that Hollywood thought it worthy of the movies? And what has made it so effective that it continues to thrive as a global insurance marketplace today? After 335 years?

Before we answer those questions, let’s find out what Lloyd’s is all about…

What is Lloyd’s of London?

Lloyd’s is an insurance and reinsurance marketplace located in London, England. It has a strong reputation for its shared risk approach to doing insurance, its global reach, and its financial strength.

Lloyd’s is what is called a subscription market. It facilitates risk sharing among the different underwriters in Lloyd’s marketplace via subscription underwriting. This is a process through which two or more insurers collaborate to underwrite a single risk. Should a claim occur on the resulting insurance policy, each insurer pays out their pre-agreed percentage. They are each individually responsible. Insurance risk is placed via subscription policies when the coverage that the insurance buyer requires is more than any one underwriter is willing to carry. Because of this, Lloyd’s is often seen as the place where insurance buyers and their brokers go when they have hard-to-place risk. But Lloyd’s is much more than that.

In 2022, Lloyd’s market wrote more than £46.7 billion in gross premium. While Lloyd’s market has more than 200 lines of business, over half of the 2022 GWP (gross written premium) was from property and casualty insurance with another third, from reinsurance.

The early days of Lloyd’s

Lloyd’s has a long history as a hub of insurance activity. It began in the late 1600s at a London establishment called Lloyd’s Coffee House, run by a Mr. Edward Lloyd (1648 – 1713). At that time, coffee was new to the UK and coffee houses were on the rise, they were trendy places to gather, share news, and transact business. The first known reference to Lloyd’s Coffee House is from 1688. As like attracts like, over time, Lloyd’s grew to be a regular spot for sailors, ship owners, and merchants. Global trade was booming and soon Lloyd’s Coffee House was a hub for the latest shipping news. With time, it also became the place to obtain marine insurance with business men renting tables from which they conducted their underwriting business.

Edward Lloyd was a coffee man, not an insurance man. He did, however, facilitate the beginning of a new and powerful marine insurance marketplace. During Edward Lloyd’s proprietorship, Lloyd’s Coffee House gained such a great reputation that after his passing, the name of the shop, and in turn the marketplace, remained as is.

This was the start of Lloyd’s the insurance marketplace. The Lloyd’s of that time was very different from the Lloyd’s of today. It was not until 1771, that the subscription market was formalized. And one hundred years after that, Lloyd’s was incorporated by an act of parliament, the Lloyd’s Act 1871.

Insuring the Titanic

If you take a tour of the Lloyd’s building in London, some of the first documents you see on display are the insurance slips for the Titanic. A “slip” is a document that outlines the details of an insurance policy.

The Titanic, which sank on its maiden voyage in April of 1912, was one of the many ships insured by Lloyd’s. The Titanic was insured for £1,000,000, covering the hull and machinery. No one underwriter was willing to take on the entire risk. Instead, the placing slip was shopped around. And, within three days, the insurance broker for the Titanic, Willis, Faber & Co., managed to fully place the risk. 12 companies plus more than 50 Lloyd’s syndicates subscribed to the slip, each taking on a portion of the risk. The placement slip on display at Lloyd’s shows a hand written list of amounts together with the signatures of those who subscribed. Of immense importance is the fact that, despite the massive loss when the ship sank, claims were paid in full within 30 days.

Learn more about the Titanic from Lloyd’s.

How does Lloyd’s market work?

At a very basic level, Lloyd’s is like most any market. It is a space where suppliers gather to proffer their wares and buyers come to purchase what they need. If you buy insurance or reinsurance from Lloyd’s market, your insurance policy will be issued by Lloyd’s, not by a specific underwriter or group of underwriters within the market. Those who agree to share the risk, will sign for their share on the Lloyd’s issued policy.

This approach means that market participants can utilize Lloyd’s global network of licenses to write insurance in many different countries. Consider, for instance, the insurance requirements of a large global organization. Lloyd’s is licensed to sell insurance in 80 countries and, for reinsurance, Lloyd’s is licensed in more than 200 countries. Lloyd’s global reach is a powerful draw for buyers with multi-national insurance requirements.

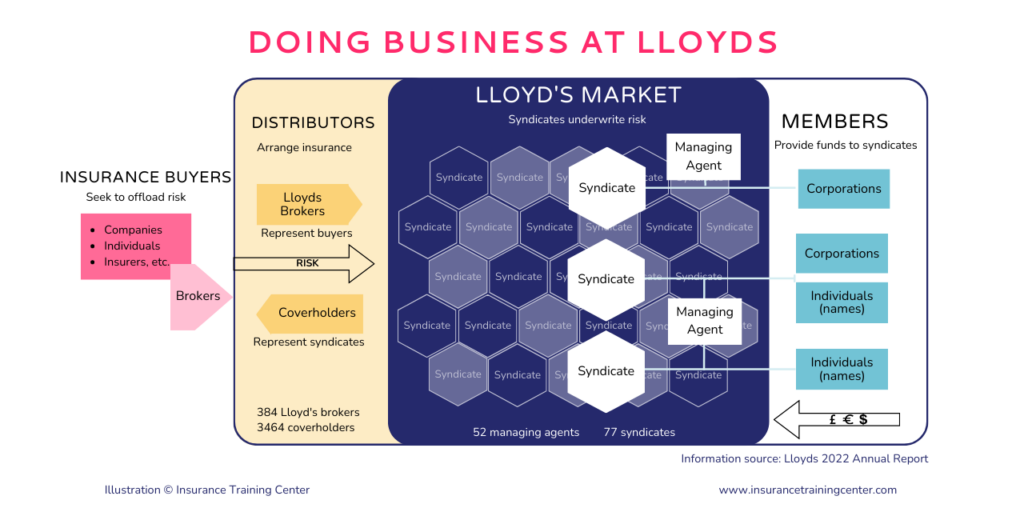

When business is transacted at Lloyd’s it involves:

- Insurance buyers – they have risk they need to offload; risk that they may be sued, a bridge may fail, a space shuttle may disintegrate, a famous guitarist’s hands may be permanently injured, etc.

- Distributors – intermediaries who connect the buyers and the market.

- The Lloyd’s Market – they underwrite the risk, providing insurance cover in exchange for a fee.

- Members – they provide capital to the market, a financial backstop so that the market can provide insurance to cover the buyer’s risks.

Lloyd’s market participants

Insurance Buyers

Policy holders

Without buyers, there is no business. Insurance policy buyers have risk that they need covered by insurance. They tend to go to Lloyd’s market when what they need is a niche insurance product or a large amount of insurance coverage, something they can’t get elsewhere. They may be turned down by traditional insurance companies because of their risk profile or niche industry. Lloyd’s is known to insure the weird and wonderful. If you have heard of celebrities insuring various body parts, for example, a singer’s legs, or a guitarist’s hands, Lloyd’s is likely where they obtained that insurance! Insurance buyers include companies, individuals and also insurance companies.

Non-Lloyd’s brokers

Many insurance buyers work with an insurance broker to design and source the insurance solutions they need to transfer financial risk. In many instances, the buyer may not have access to all the insurance options or may not know the nuances of the different insurance products. Insurance brokers represent the buyer.

Read More: What is a broker? (an insurance broker)

Distributors

Coverholders

Lloyd’s coverholders are third-party entities that have been given binding authority by a managing agent. This authorizes them to quote and bind policies on behalf of the managing agent’s syndicate, subject to certain terms and conditions. These terms and conditions are laid out in a binding authority agreement, set out by the syndicate.

Lloyd’s coverholders operate on behalf of one or more syndicates rather than operating on the insured party’s behalf as a broker does. According to Best’s Rating of Lloyd’s 2022 (p14), coverholders account for about 33% of Lloyd’s gross written premiums. At time of writing there were 3476 Lloyd’s coverholders. Access Lloyd’s market directory to see a current list of Lloyd’s coverholders.

Lloyd’s brokers

Lloyd’s brokers are not unlike other insurance brokers. Their responsibility is to their client, the insurance buyer. An insurance broker’s job is to source appropriate insurance policies for their clients. A Lloyd’s broker does this by being the intermediary between the insurance buyer and Lloyd’s syndicates. Often, they will work with multiple syndicates at Lloyd’s to find the best solution for their client. In addition to their insurance broker license, Lloyd’s brokers need to be registered with the Corporation of Lloyd’s to be allowed to work with Lloyd’s syndicates. Access Lloyd’s market directory to see a current list of Lloyd’s brokers.

Lloyd’s Market

Syndicates

Lloyd’s syndicates are groups made up of one or more “members”, that are formed for the purpose of taking on insurance risk. They are not legal entities. They include underwriters whose role is to determine what risk is acceptable to their syndicate and with what terms. Some syndicates specialize in certain types of risk. Lloyd’s 2022 annual report recorded 77 syndicates.

You may notice that many well-known insurance companies have formed their own Lloyd’s syndicate. Forming a Lloyd’s syndicate provides insurers with an additional channel for accessing the insurance market.

Read More: What is an Underwriter?

Managing Agents

A managing agent is a person or company that works for a syndicate managing its day-to-day operations. For example, they are responsible for hiring and overseeing the underwriting staff and managing the syndicate’s infrastructure. Managing agents may work for one or more syndicates. Members may only underwrite insurance through a managing agent. Access Lloyd’s market directory to see a current list of managing agents at Lloyd’s.

Members

Members are investors. They provide capital to support the syndicates’ insuring business. In return, they receive their proportional share of the profit or loss (should claims exceed premiums). Lloyd’s members include corporations as well as some individuals (also known as ‘names’).

For the market to work, insurance buyers must be confident that claims can be paid. Lloyd’s is known for its financial strength. Members’ capital functions as a financial backstop, held in trust for policyholders. Providing even more financial support, Lloyd’s also holds assets centrally, including a fund, as yet an additional backstop. Lloyd’s capital base is carefully structured to withstand catastrophic events.

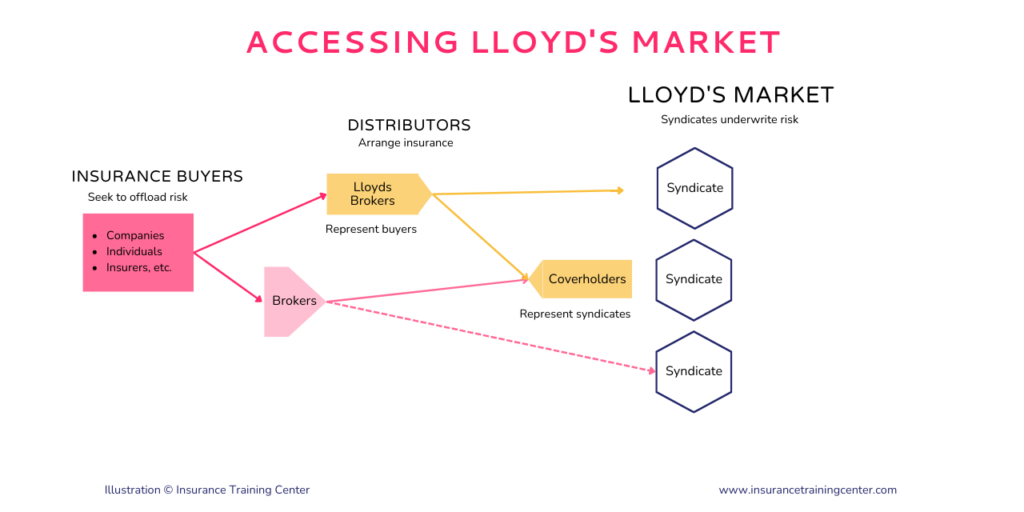

How to buy insurance from Lloyd’s

There are several ways that an insurance buyer can access the Lloyd’s market:

1. Through a Lloyd’s broker

A registered Lloyd’s broker has gone through a number of checks and has paid a registration fee that allows them to access the Lloyd’s marketplace. While it is possible now for non-Lloyd’s brokers to access Lloyd’s, think of being a Lloyd’s broker as having a pre-clearance check at an airport, they have already been cleared to do business with any of the syndicates. Depending on the insurance required, a Lloyd’s broker may also collaborate with a coverholder to access their specialized expertise.

2. Through a non-Lloyd’s broker

Insurance buyers can also access Lloyd’s of London through a non-Lloyd’s broker. The non-Lloyd’s broker has two options:

A. Through a Lloyd’s coverholder

Your insurance broker can go through a Lloyd’s coverholder to secure an insurance policy. There are more than 3000 Lloyd’s coverholders to choose from. Some offer an underwriting niche or speciality products. There is also variation in the degree of autonomy they have to act on a syndicate’s behalf. Depending on the binding agreement in place, coverholders may underwrite risk, develop policy documents and even handle claims in-house.

B. Directly (without an intermediary)

This option is more complicated.

A non-Lloyd’s broker can work directly with a Lloyd’s syndicate only if they have a Terms of Business Agreement (TOBA) with the managing agent. This requires that they meet certain requirements set out by Lloyd’s, and that the managing agent chooses to work with the broker. Note that a managing agent may be extra cautious if the broker is marketing subscription business as managing agents need to be comfortable with the non-Lloyd’s broker processing and transacting the subscription business.

Why go to Lloyd’s of London?

Insurance buyers and their brokers turn to Lloyd’s because, as a strong market built on risk sharing and trust, it has become the place to go find insurance for:

- risks that require specialized underwriting expertise.

- risk in other geographies that require global access.

- unique risk that requires customized coverage.

- sizable risk that requires financial strength and risk sharing.

As to our first question: what is so compelling about this insurance market, that Hollywood thought it worthy of the movies? Perhaps the answer is the stories it tells. With its long underwriting history and origin in marine insurance, Lloyd’s market has witnessed many major world events, early international trade, the rise of new technologies, changing governments and borders. And it may also have something to do with Lloyd’s innovative structure that allows it to insure the otherwise uninsurable, like the Titanic, and offering car insurance back in 1904 – those make great stories too.

Learn more about Lloyd’s

There are many resources available on Lloyd’s, both past and present. Here are just a few:

- Lloyd’s of London (Lloyds.com)

- Association of Lloyd’s Members (alm.ltd.uk)

- Best’s Rating of Lloyd’s 2022, AM Best September 2022

- Herschaft, Jeremy. (2005) Not Your Average Coffee Shop, Lloyd’s of London. Tulane Maritime Law Journal. Pp 169 – 185.

- Wright, Charles and Fayle, C. Ernest. (1928) History of Lloyds. London, UK; McMillan and Company.