Fiduciary Liability and the importance of protection

Fiduciary liability claims occur when individuals or organizations responsible for managing pension and employee benefit plan assets, such as pension fund administrators or corporate sponsors (plan fiduciaries), fail to fulfill their legal obligations to act in the best interests of beneficiaries. Plan fiduciaries hold positions of trust and are legally accountable for their actions. They must meet strict standards of conduct imposed by legal statutes, as well as common and contract law. Failing to meet these standards can result in lawsuits and penalities. Compliance can be challenging as legal requirements change due to legislation and court rulings. Even when fiduciaries follow all rules, they may still face allegations of a breach of duty. Robust legal protection is essential.

Learn more: Fiduciary Liability Insurance Explanation & Video.

Fiduciary liability claims often involve negligence, mismanagement, or lack of due diligence in overseeing investments. As financial markets grow more complex, fiduciaries face increasing scrutiny. Many investments, including cryptocurrencies, carry high risks. Legal actions stress the need for ongoing oversight, transparency, and governance compliance. These measures help protect investors, retirees, and other stakeholders from unnecessary financial harm. Several high-profile cases show how fiduciary failures result in serious legal consequences. Some cases end in major settlements or judicial rulings. These cases highlight the rising expectations for those managing financial assets. Fiduciaries must exercise caution and diligence in decision-making. This article explores the risks fiduciaries face and examines three real-world fiduciary liability claims.

Claims examples

Failure to conduct due diligence before investing

Our first case is a class-action lawsuit filed in Canada.

In January 2025, a class-action lawsuit was filed against the Ontario Teachers’ Pension Plan (OTPP) concerning its investments in the now-defunct cryptocurrency exchange, FTX. The lawsuit, submitted to the Ontario Superior Court of Justice in Toronto, alleges that the OTPP board breached its fiduciary duty by failing to conduct adequate due diligence before investing approximately US$95 million in FTX. The plaintiffs, representing the plan’s 340,000 active and retired teachers, seek reimbursement for the losses incurred from this investment. Click here to learn more about the case.

Breach of fiduciary duty re. climate change risk

AU: McVeigh v. Retail Employees Superannuation Pty Ltd (2019)

In 2018, Mark McVeigh, a member of the Retail Employees Superannuation Trust (REST), filed a lawsuit against REST in the Federal Court of Australia. He alleged that REST’s trustees failed to adequately consider and disclose the financial risks posed by climate change to the fund’s investments, thereby breaching their fiduciary duties under the Superannuation Industry (Supervision) Act 1993 and the Corporations Act 2001. The lawsuit sought to compel REST to provide information on how it was addressing climate-related risks. In November 2020, the case was settled out of court, with REST committing to align its investment portfolio with a net-zero emissions target by 2050 and to enhance its climate risk disclosures. Click here to learn more about the case.

Lack of prudence in investing

USA: Tibble v. Edison International (2015)

In this landmark case, the U.S. Supreme Court unanimously held that under the Employee Retirement Income Security Act (ERISA), fiduciaries have an ongoing duty to monitor and remove imprudent investment options within a 401(k) plan. The plaintiffs alleged that Edison International breached its fiduciary duty by selecting higher-cost retail-class mutual funds when identical, lower-cost institutional-class funds were available. The Court’s decision emphasized that the fiduciary’s duty of prudence is not limited to the initial selection of investments but includes a continuous responsibility to oversee and, if necessary, replace unsuitable investments. Click here to learn more about the case.

Common allegations against fiduciaries

Fiduciaries, sponsor companies, and pension or welfare plans may encounter a variety of legal claims that go beyond those illustrated in our three case examples. These allegations often include:

- Mismanagement of plan assets

- Breach of fiduciary duty

- Inadequate investment oversight

- Conflicts of interest

- Failure to disclose risks to beneficiaries

- Errors in plan administration

As fiduciary liability cases continue to shape legal and regulatory frameworks, understanding the risks and implementing protective measures—such as Fiduciary Liability Insurance—can help organizations mitigate financial and reputational damage. The following sections provide examples of real-world claims that underscore the critical importance of diligent fiduciary oversight.

The role of Fiduciary Liability Insurance

Plan fiduciaries hold positions of trust and are legally accountable for their actions. They must meet strict standards of conduct imposed by legal statutes, as well as common and contract law. Failing to meet these standards can result in lawsuits and penalties. Compliance can be challenging as legal requirements change due to legislation and court rulings. Even when fiduciaries follow all rules, they may still face allegations of a breach of duty. Robust protection is essential.

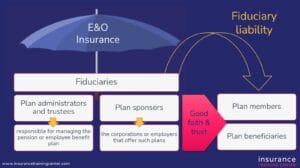

Fiduciary Liability Insurance (FLI) is a specialized form of errors and omissions coverage that protects pension and employee benefit plan fiduciaries from financial losses arising from claims of mismanagement, administrative errors, or breaches of fiduciary duty. While not typically mandated by law, obtaining FLI is often a prudent decision for organizations responsible for pension or benefits plans, as it provides a critical financial safeguard against costly litigation.

Key takeaways

- Fiduciaries are held to high legal standards. Failure to comply can result in lawsuits, penalties, and reputational damage.

- Common allegations against fiduciaries include mismanagement, conflicts of interest, investment oversight failures, breaches of fiduciary duty, and lack of transparency.

- Even if fiduciaries follow all regulations, they may still face allegations of wrongdoing.

- Fiduciary liability insurance (FLI) provides essential financial protection.