General liability (GL) insurance is a type of business insurance that provides financial protection against claims from third parties for bodily injury, property damage, and advertising-related harm. It covers legal expenses, medical costs, and settlements and is essential to ensure that businesses can handle unexpected incidents without facing devastating financial losses.

Here are some important things to note:

- Any type or size of business could be subject to third-party claims

- Even frivolous claims can be costly

- GL covers a lot but it doesn’t cover everything

Read below to learn more about this vital business insurance.

What is General Liability Insurance?

General liability insurance (GL insurance), provides financial protection against common liability risks associated with running a business. This insurance policy covers legal fees, medical expenses, and damages that result from a third party’s bodily injury, property damage, and advertising injuries caused by the insured business’s operations, products, or services. General liability insurance helps business owners mitigate the financial burden of lawsuits and claims that can arise during day-to-day operations.

You’ll find GL often referred to as Commercial General Liability (CGL) insurance. And in some jurisdictions, such as Australia and the UK, Public Liability insurance is the comparable insurance.

Public Liability Insurance vs. General Liability Insurance

While we often use the name, Public Liability insurance, interchangeably with General Liability insurance, there are differences between the two insurances:

- Public liability insurance primarily covers third-party claims related to bodily injuries and property damage occurring in a business’s premises or due to its operations. It may not, however, cover personal and advertising injury.

- General liability insurance (common in Canada and the USA) generally provides broader coverage, including product liability, advertising injuries, and reputational harm, making it a more comprehensive insurance for businesses.

General Liability and Public Liability Insurance are essential for protecting businesses from the financial impact of lawsuits and claims related to injuries or damages caused by their operations. Having this insurance in place helps ensure that businesses can handle unexpected incidents without facing devastating financial losses.

What does General liability insurance cover?

Here are the most common areas of coverage for GL policies. Review your policy insuring agreements to learn which apply to your own policy.

- Legal defence and settlements – legal fees and settlement costs are covered if your business is sued for claims related to covered risks, such as Third-Party Bodily Injury, Third-Party Property Damage, Advertising Injury, Products Liability, or Completed Operations as outlined in your General Liability policy. However, if the claim is unrelated to these covered perils, such as professional negligence or intentional misconduct, the insurer will not cover the legal defense or settlement costs.

- Third-Party Bodily injury – medical expenses, legal fees, and potential settlement costs if a customer, client, or third party is injured on your business premises.

- Third-Party Property damage – repair or replacement costs if your business activities cause damage to someone else’s property. This is particularly relevant for businesses that operate in clients’ homes or commercial spaces.

- Advertising injury – legal costs associated with defending against claims if your business is sued for libel, slander, invasion of privacy, or misappropriation of advertising ideas.

- Products liability – related costs if your business involved in manufacturing, distributing, or selling products is subject to claims arising from injuries or damages caused by defective products. Note, most GL policies exclude product guarantee or warrantee costs and the cost to recall defective products. Businesses need product liability insurance for this.

- Completed operations – costs for liability claims for bodily injury or property damage from incidents that arise from work or services after it’s been finished; crucial for businesses like contractors or manufacturers. This safeguards against claims that might emerge long after the project is done.

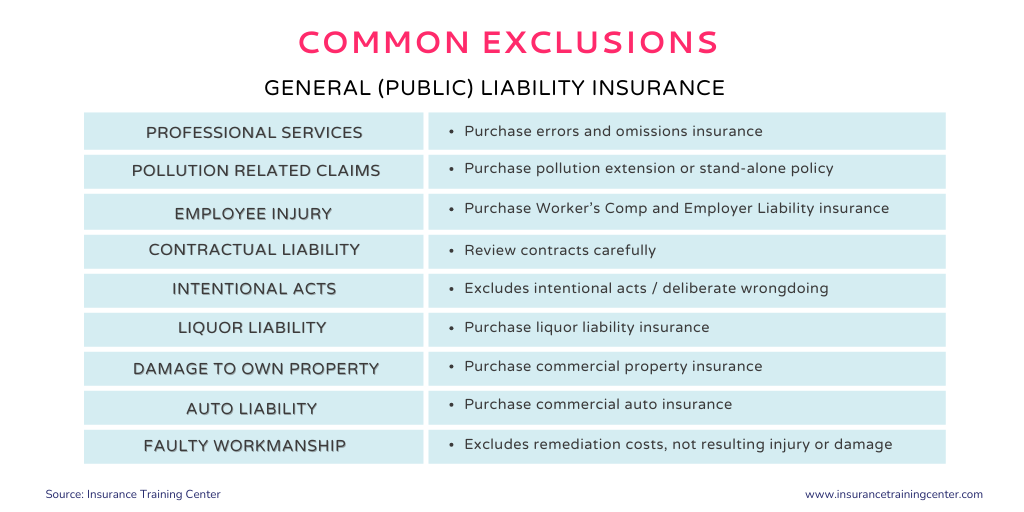

What does General Liability Insurance not cover?

While GL insurance provides broad protection, it does not cover every type of risk a business may face. Subject to the policy’s exclusions, definitions, and terms and conditions, GL insurance policies generally won’t cover the following:

- Professional services. Purchase separate Errors and Omissions (E&O) insurance if you offer professional services, such as legal, medical, or financial advice.

- Pollution related claims. Consider an extension or a stand-alone policy if you have pollution exposure, such as environmental contamination or toxic spills.

- Employee injury. Obtain Workers’ Compensation and Employers Liability policies to provide medical benefits and wage replacement for employee injuries or illnesses that occur as a result of their employment.

- Contractual liability. Review contracts carefully as you policy may exclude some contractual obligations unless the liability would have existed without the contract.

- Intentional acts. Claims resulting from intentional acts or deliberate wrongdoing by the insured are excluded.

- Liquor liability. Purchase liquor liability insurance for claims arising from alcohol-related incidents if you’re involved in manufacturing, selling, or serving alcohol.

- Own property damage. Obtain commercial property insurance to protect against losses related to buildings, equipment, and inventory under your care, custody, or control.

- Auto liability. Obtain commercial auto insurance to cover these claims arising from the ownership, use, or operation of vehicles.

- Faulty workmanship. Review your policy, the faulty workmanship exclusion typically excludes coverage for the cost of repairing, reconditioning, or replacing the faulty work itself, but it does not exclude coverage for any resulting personal injury or property damage.

Why buy General Liability insurance?

Here are some compelling reasons why businesses of all sizes should consider purchasing GL insurance:

- Protect against common risks. Businesses face liability risks in their day-to-day operations, from accidents that cause bodily injury, to damage to a third party’s property. GL insurance helps cover legal expenses, court costs, and settlements arising from incidents like slips and falls, property damage, or even advertising injuries or frivolous claims.

- Legal compliance. In some jurisdictions, businesses are legally required to have specific types of liability insurance. For example, in the UK, the Employers’ Liability (Compulsory Insurance) Act 1969 mandates that businesses carry Employers’ Liability insurance. While GL insurance itself is not usually a legal requirement, workers comp or employers liability insurance often is, which is often tied to a GL policy.

- Obtaining permits and licenses. Some businesses must show proof of GL insurance to obtain necessary permits and licenses. This is especially true in industries such as construction, event management, and any business that interacts heavily with the public.

- Client contracts requirement. Many clients, landlords, and business partners require proof of general liability insurance before entering into a contract or lease agreement. This provides protection not only for your business but also for the other parties involved in the contract.

How much does GL insurance cost?

To price a policy, an insurance company assesses what risk it would be taking on by providing that policy. Here are some key factors that impact GL insurance policy pricing:

Policy coverage. The more comprehensive the coverage, the higher the premium is likely to be. Thus, coverage elements such as higher liability limits, fewer exclusions, and lower deductibles can increase the cost of the policy.

Claims history. A business with a history of frequent or severe claims is seen as a higher risk. Therefore, it may face higher premiums.

Insurance market conditions. The insurance market operates much like a commodity market, where supply and demand for risk coverage heavily influence pricing.

Key takeaway

General liability (GL) insurance is an essential investment for businesses aiming to protect against common legal and financial risks. Whether you run a small business or manage a large enterprise, having the right insurance policy is vital. While GL insurance doesn’t cover every risk, businesses can add complementary policies to ensure comprehensive protection. Understanding the coverage, exclusions, and costs of GL insurance helps business owners make informed decisions and avoid potential gaps. By securing the right combination of policies, they can safeguard their operations from unexpected liabilities.

Ultimately, general liability insurance should be viewed as a foundational policy for every business. It plays a key role in mitigating risks and supporting long-term success. Businesses with GL insurance can operate confidently, knowing they are protected from incidents that could otherwise lead to significant financial loss.

More resources…

Learn about other liability insurances: