Directors’ and Officers’ Liability Insurance (D&O) protects directors and officers from suffering personal financial loss if they are subject to a third-party claim in the course of their regular duties of managing or overseeing the management of the organization.

Here are some important things to note:

- Directors and officers may be held personally liable should they fail or allegedly fail to fulfill their duties.

- Even allegations cost money to defend.

- Know your insurance coverage options and how to use your policy when you need it.

What is Directors and Officers Liability Insurance?

Directors and Officers (D&O) liability insurance protects directors and officers from financial loss due to third-party claims against them regarding their work as directors and officers. A financial loss may arise from defence costs, judgements, settlements, and fines arising from negligence suits, shareholder actions, and other business-related suits. The third-party claims don’t need to be proven as true, even false allegations can cause financial loss. D&O insurance can be viewed as Management Errors & Omissions insurance.

D&O insurance also protects the organization from loss due to certain types of claims. What type of enterprise claims the insurance policy covers depends on the type of organization insured, i.e., public or private, and policy specifics.

Watch a video:

Why directors and officers need insurance

Directors and officers are personally liable for maintaining certain standards in the work they do as directors and officers. Those standards are set by law and by the organization’s own bylaws. You’ll typically hear reference made to their legal ‘duties’ such as the:

- duty to manage the organization as befits their role;

- duty to be loyal, avoiding conflict of interest situations;

- duty to take care, be diligent, and utilize their skills as required for the role; and

- duty to obey the laws of the land.

Directors and officers are required to perform these duties and may be held personally liable if they don’t. They may also be sued for allegedly failing to fulfill those duties. A third-party may assert that they have suffered because of something that the director or officer did, or didn’t do in their role.

Read more about the legal responsibilities of directors and officers.

Watch a video on the duty to manage.

Potential claims against directors and officers

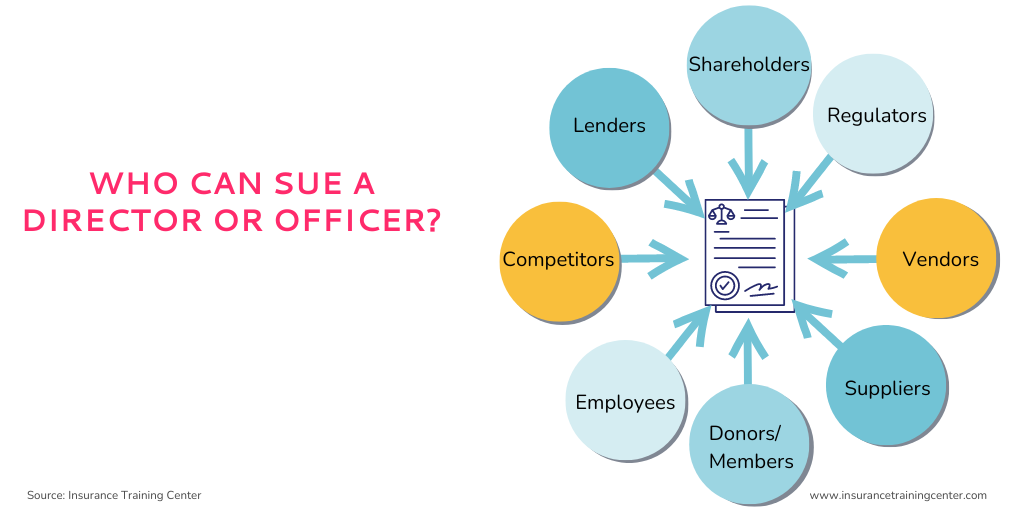

A third party, such as a shareholder, an employee, a customer, regulatory bodies, a competitor, a vendor, can bring a legal action against directors and officers as long as the organization is deemed liable to that third party. The third party can be anyone with a relationship with the organization.

A breadth of different actions and activities can lead to a D&O claim such as:

- Financial disclosures – alleged violations related to misleading future performance or allegations of violations related to missed earnings guidance.

- Breach of bylaws – for example a not-for-profit engaging in activity outside of its legal purpose.

- Negligent mismanagement – carelessness such as failure to monitor staff, permitting unsafe working conditions, failing to manage finances.

- Regulatory investigations – for instance failing to comply with statutory laws and regulations .

- Defamation – communicating false statements that damage someone’s reputation, either libel or slander.

- Employment practices liabilities – allegations of wrongful termination, retaliation (e.g., against a whistleblower), sexual harassment and discrimination.

- Event driven litigation – adverse events such as the Covid 19 pandemic, the #Metoo movement, privacy incidents, and natural disasters can trigger allegations of misdeeds such as mismanagement, misstatements or fraud.

- Pension plan mismanagement – plan underfunding, loss, and administration errors can lead to allegations of failure to meet fiduciary obligations in the management and investment of plan assets.

What is indemnification?

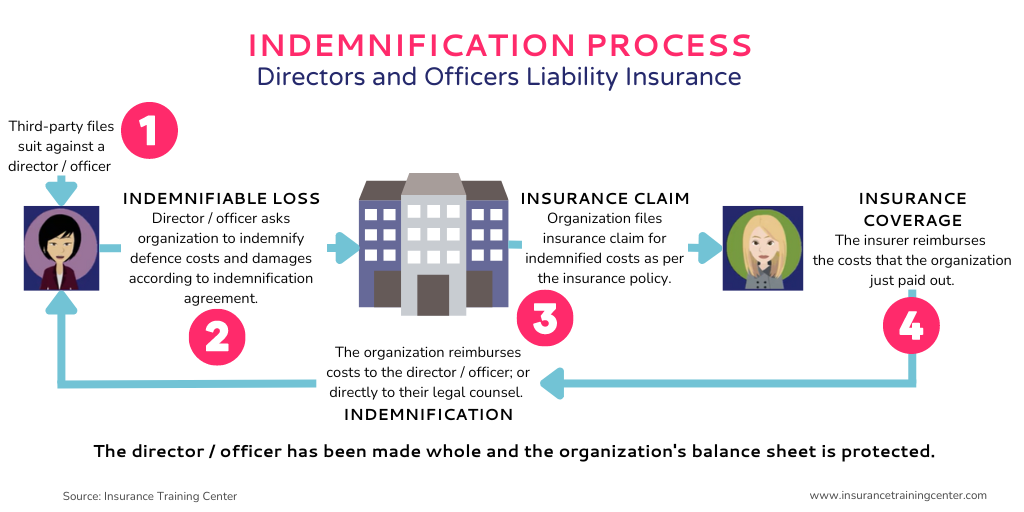

If you want to understand D&O insurance, you need to understand indemnification. Directors and officers are personally liable for the work they do. When they are hit with a claim, that claim is against them, personally and they need to defend themselves. Legal defence costs money. Even if the allegations are later proven false and there is no penalty, they could still be stuck with a substantial legal bill by the time the case is resolved. Without any financial protection, many might consider the prospect of holding a director or senior management position to be too risky.

Organizations need directors and officers. To remove their risk of personal financial loss from claims, corporations agree to indemnify directors and officers if they are subject to a claim. Think of indemnifying as ‘making whole’ or, in this situation, reimbursing the costs or paying the legal fees and penalties on their behalf. By agreeing to do this, the corporation assumes the risk from the directors and officers. In turn, organizations purchase D&O insurance to offload that risk onto an insurance company, for a fee. So, with D&O insurance, risk passes from the directors and officers to the organization, and on to the insurance company.

D&O insurance is important for directors, officers, and also for the organizations for which they work. Without D&O insurance, organizations could face a significant loss when honoring indemnification agreements. And, in situations where they are unable to honor indemnification agreements, their directors and officers would incur that financial loss personally.

With no D&O insurance or other indemnity mechanism in place, organizations could have a difficult time filling those roles with the best people for the job; or with anyone at all.

Watch a video about of the indemnification process.

D&O policy coverage

Insuring agreements

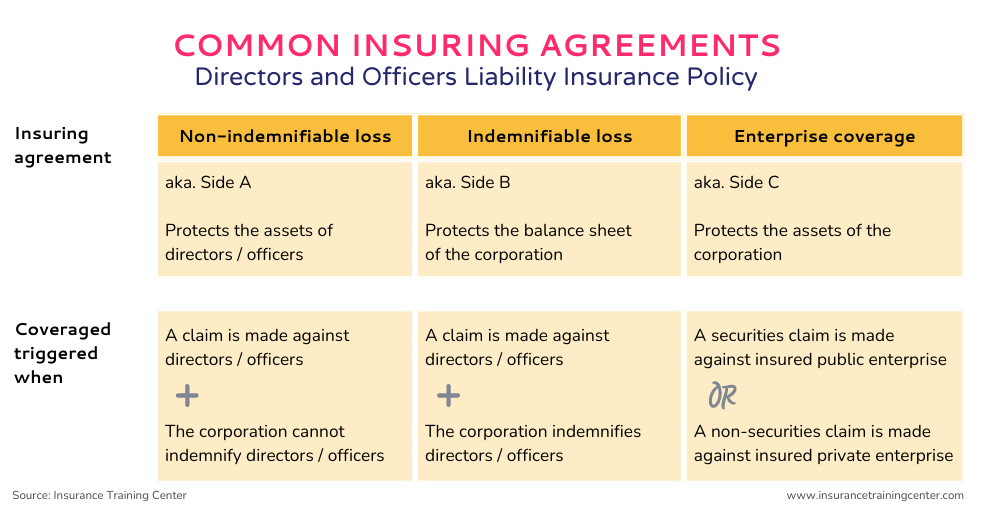

A D&O insurance policy includes of multiple insuring agreements, each structured to address different situations. The most common insuring agreements do the following:

A. protect the assets of directors and officers directly when the organization is not able to do so, i.e., in the case of bankruptcy

B. protect the assets of the organization when it uses its own assets to protect those of its directors and officers

C. protects the assets of the organization when it is directly subject to claims covered by the policy

For public enterprises, the latter, which is called Enterprise coverage, is typically limited to securities-related claims. For private enterprises, enterprise coverage includes loss resulting from claims of various corporate wrongful acts, such as employment practices-related claims.

Read more about how the D&O insuring clauses work.

Coverage extensions

Extensions are separate insuring agreements that buyers can purchase as add-ons to their basic policy to create a bespoke solution. Depending on the insurance policy, some of these may be already included within the policy’s standard set of insuring agreements. It’s important that the buyer be aware of the available options and be willing to ask if they need something that is not initially on offer.

- Retired directors’ and officers’ coverage

- Outside director liability coverage. For those serving as directors / officers at an outside organizaiton at the direction of the insured organization.

- Employed lawyer wrongful act coverage

- Crisis management expense coverage

- Derivative demand evaluation expenses

- Extended reporting period

- Employment Practices Liability Insurance

Coverage exclusions

Insuring agreements state what the policy intends to cover. This coverage is subject to the policy’s exclusions, definitions, and terms and conditions. Depending on the policy terms and conditions, D&O insurance policies generally won’t cover the following:

-

- Prior or pending claims. Claims arising from prior knowledge or prior or pending litigation

- Personal conduct exclusion. Claims resulting from deliberate criminal or fraudulent acts.

- Insured vs. insured / organization vs. insured. Claims brought by an insured, or the organization, against another insured

- Exclusions for which other insurance is available

Risk and D&O insurance

D&O insurance does not mitigate the risk of claims; rather, what it does is protect the organization’s balance sheet by paying out money to cover costs incurred when something goes wrong. Insurance is not an alternative to good management but rather, it is a component of good management.

While the law many not require corporations to have D&O insurance, purchasing it may be an obligation enshrined in its corporate bylaws and directors may also demand it in their individual indemnity agreements. Either way, purchasing a D&O policy is generally a wise financial decision for both directors and officers, and the organization.

More D&O resources

- Cybersecurity and the Duty of Oversight

- NERA’s 2024 Securities Trends Report: Insights for insurance professionals

- Why directors and officers need insurance

- Wrongful Act Explained

- Directors and officers duty to manage explained

- 3 components of a D&O insurance and indemnity program

- How does D&O liability insurance work?

- Importance of Side A coverage

- Indemnification and D&O insurance – Side B coverage

- Before you join the board of a non-profit organization

- 5 ways financial statements deliver D&O risk insights

- 8 reasons to read financial statement notes