Why D&O risk matters

Directors and Officers Liability (D&O) Insurance is all about corporate governance and financial risk. If directors or officers are subject to a claim arising from the performance of their regular duties for the organization, an indemnification agreement obligates the organization to cover the associated costs: defence and damages. The D&O insurance policy provides financial backing for the organization to ensure it can deliver on its indemnification agreements with its directors and officers.

In the event of loss resulting from such claims, D&O insuring clauses are designed to provide:

-

Reimbursement for individual directors and officers when the organization is unable or not allowed to indemnify them e.g. in the case of insolvency.

-

Reimbursement for the organization when it needs to indemnify its directors or officers.

When looking to provide D&O insurance for an organization, the role of the insurance underwriter is to assess risk and provide insuring terms that reflect their assessment of the risk.

Reviewing an organization’s financial statements is an important part of the underwriter’s risk assessment. When reading and analyzing financial statements underwriters may uncover potential risks or behaviors that could indicate an increased chance of a claim. Claims may arise from disclosure errors, divestiture decisions, inaccurate or incomplete reporting, or, for example, making decisions that are not in the company’s best interest. Underwriters also need to assess the possibility that the organization may not be able to provide indemnification should a claim arise.

5 Ways Financial Statements Deliver D&O Risk Insight

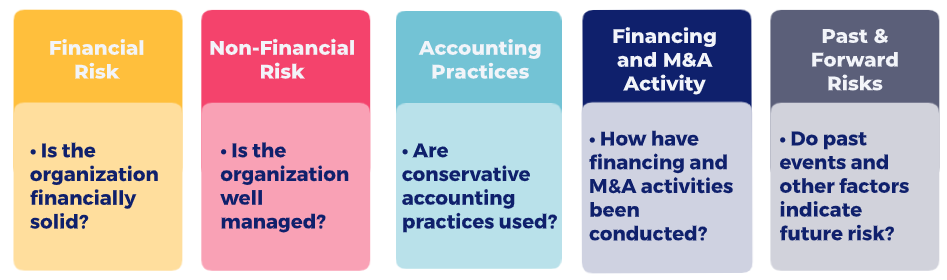

Here are 5 key D&O underwriting considerations that demand an in-depth analysis of the financial statements:

5 Ways financial statements deliver D&O risk insight

1. Financial Risk

Does the organization have sufficient cash or credit to fund operations and pay any debt obligations?

Understanding the organization’s financial position is critical. This requires examining and analyzing the Balance Sheet, the Income Statement, and the Cash Flow Statement.

Underwriters need to understand the organization’s trajectory and long term viability. To do so they will dig beyond assessing liquidity risk and look at revenue, expenses, and expense ratios. They will also look for long-term clients and seek answers to questions such as:

-

Is the organization soundly financed?

-

Can the organization pay its bills on time?

-

What are the organization’s capital and expenditure requirements to continue to operate?

-

Is the organization in growth mode, mature, or are revenues declining?

2. Non-Financial Risk

Does the organization have a solid management team and is the organization well managed?

D&O policies protect the financial assets of directors and officers of the insured organization in the event of a claim against the directors and officers arising from their own decisions and actions in their roles. Without a face-to-face meeting between the underwriter and the directors and officers, how does the underwriter assess the management team?

When evaluating an organization’s management and governance, underwriters often seek out publicly available information. This might include online searches of the organization itself, individual executives, news stories, and for public corporations, regulatory filings.

The annual and quarterly reports of publicly-traded organizations include a section entitled “Management Discussion and Analysis” (MD&A). This is where you’ll find the thoughts and opinions of management. Here they present highlights and commentary on the financial statements and discuss the key risks facing the organization and how they are mitigating and managing those risks. This is also where management discusses the upcoming year, outlining future goals and approaches to new projects. Underwriters read this section carefully to evaluate how the organization is being run and management’s ability to make sound decisions.

3. Accounting Practices

Does the organization take a conservative approach in its financial accounting?

Publicly traded companies in the United States must follow Generally Accepted Accounting Principles (GAAP) when preparing their financial statements. Under GAAP however, there is room for judgment. Some organizations take a more conservative approach than do others in applying these principles. Underwriters seek to understand the organization’s accounting policies and practices and will ask questions such as:

-

When are revenues recognized?

-

How does the organization value assets?

-

What is the quality of the assets and are the valuations realistic?

-

Does the size of the dividend paid to shareholders make sense?

-

What is the quality of the reported earnings?

4. Financing and Merger and Acquisition (M&A) activity

How have past financing and M&A events been conducted?

Financing and merger and acquisition activities can often lead to claims so underwriters will specifically look to assess what has happened to date in this regard. For any acquisition, the underwriter will want to know how the deal was structured and financed. A quick look at the Cash Flow Statement will tell the underwriter if the company has paid cash for investments or issued shares. They’ll also want to know about earnout provisions as well as the role or involvement of former owners and managers moving forward.

Another consideration is the relative size of any acquisition. Most D&O policies include an acquisition threshold in the policy. The acquisition threshold is typically set at 10% to 30% requiring that the insurance company be notified if the total assets of the acquired company exceed the noted threshold of the purchasing company. The insurance policy spells out details on the acquisition threshold percentage and calculation under the terms and conditions section. Automatic coverage may be granted for the newly acquired or created entity, for a limited time period (60 or 90 days) to allow for the insured to notify the insurance company.

D&O claims can take a long time to come to the surface and it is the policy that is in place when the claim against the directors is made that responds. Therefore, unless a ‘prior acts’ exclusion is applied in the D&O policy, the new policy will respond to any future claims that may arise from wrongful acts that happened in the past. Because of this the underwriter will want to know what type of representations have been made and will take a close look at past transactions.

5. Past and Forward risks

What past events and other factors indicate future risk?

Mergers and acquisitions represent past or moving forward risks. Aside from M&A activity, there are other events the organization may have already experienced that might lead to a claim such as earnings disappointments, for example, a product failure or management scandal. The underwriter will take ‘one-time’ events such as these into account.

Likewise, forward risks also impact the underwriter’s assessment and the underwriting terms they provide. For an organization, depending on a single supplier or customer, or having a single product line are examples of forward risks that could affect the future revenues of the company. Similarly, debt covenants or agreements that the organization might have breached could attract litigation from creditors. Disproportionate or egregious executive compensation or related party transactions are also factors to consider as they might attract shareholder litigation.