Media liability insurance protects an organization against loss from claims arising from the content it creates, publishes, or distributes, both online and off. As organizations move more of their communications and operations to the internet, media liability becomes a bigger risk for everyone. This article explores media liability risk and the insurance options available to protect against financial loss from such claims.

Intro to Media Liability

Media Liability refers to the legal risk an organization faces when it creates and distributes content; whether through digital platforms like websites and social media, or traditional formats such as print, television, and radio. It involves the potential obligation to compensate others for harm caused by that content. That harm could include things such as reputational damage, privacy violations, or intellectual property infringement.

Different types of media are not inherently harmful themselves, but they are capable of causing issues based on what is shared. Any organization that publishes or shares content, even a single blog post or social media image, can face legal exposure.

Do you know what coverage is available on a cyber policy, in addition to media liability?

Learn more

What is Media liability insurance?

Media liability insurance is a form of errors and omissions insurance that protects an organization against financial loss from claims arising from the content it creates, publishes, or distributes. This could include online content such as text, images, audio, video, or user-generated content posted on websites, blogs, social media, or other online platforms. It may also include content distributed through traditional channels such as signage, brochures, TV or radio commercials, print advertisements, flyers, press releases, etc.

Occurrence vs. Claims-made: Why it matters

Media liability policies can be structured on either an occurrence or a claims-made basis. Here’s the difference:

-

Occurrence policies cover events that happen during the policy period, regardless of when a claim is filed. For example, if your organization infringed on a copyright in 2021 but the lawsuit is filed in 2023, an occurrence-based policy from 2021 would respond.

-

Claims-made policies, by contrast, cover claims made during the policy period, regardless of when the alleged wrongful act occurred.

In today’s insurance market, media liability policies are increasingly written on a claims-made basis. This structure helps insurers manage “long-tail” risk, which is common with media claims that may arise years after content is published.

Claims-made policies come with stricter reporting requirements. Many require notice of a claim—or even potential claim—within a short window (sometimes as little as 30 days). Failing to notify the insurer within that timeframe can jeopardize coverage.

What does media liability insurance cover?

Risks typically covered under media liability insurance

Defamation, libel, and slander — Claims for publishing alleged false or damaging statements about an individual or entity.

Invasion of privacy — Sharing private facts or using someone’s likeness without consent.

Copyright infringement — Using copyrighted material like images, music, text or video without proper permission or licensing.

Trademark infringement and trade dress violations — Improper use of logos, brand names, or design elements that cause confusion with another brand.

Plagiarism or misappropriation of content — Republishing or copying content without proper credit or rights.

Risks that are sometimes covered

While media liability insurance commonly does not cover the following risks, coverage may be available for purchase a policy extension or endorsement.

Third-party/user-generated content — This may be covered if the policy includeds specific UGC protections.

Regulatory violations — Usually excluded unless specific privacy or compliance cover is added (e.g., HIPAA, GDPR).

Satire / Parody risks — Covered only if it does not cross into intentional harm or defamation. Often subjective.

Exclusions and limitations

While media liability coverage can offer meaningful protection, it’s equally important to understand what it doesn’t cover. Overlooking exclusions or narrow definitions can leave an organization vulnerable despite having a policy in place. Here are some common limitations and exclusions to watch for:

Patent and Trade Secret Infringement — Policies generally exclude coverage for claims involving the infringement of patents or the misappropriation of trade secrets. These are typically considered higher-risk, technical IP violations that fall outside the scope of standard media liability protections.

Intentional or Malicious Acts — If a claim arises from content published with actual malice, knowledge of falsity, or intent to cause harm, it is likely to be excluded. While coverage often applies to negligence or unintentional errors, it won’t protect against knowingly defamatory or infringing content.

Breach of Contract or Regulatory Violations — Claims based solely on contractual obligations (e.g., violating a licensing agreement or advertising contract) are often excluded. Additionally, if the content violates specific advertising standards, privacy regulations, or industry rules, the policy may not respond unless explicitly stated.

Traditional Print Publications — Some policies narrowly define “media” to include only digital or electronic content. That means anything published in physical form, like brochures, posters, or printed newsletters, may not be covered unless an endorsement is added.

Prior Acts or Known Issues — Any content-related issues known to the insured before the policy inception date (especially if a claim seems likely) may be excluded under the policy’s prior knowledge or retroactive date provisions.

Professional services exclusions:— Some policies limit coverage for companies that provide marketing, PR, or design services.

Purchasing media liability coverage

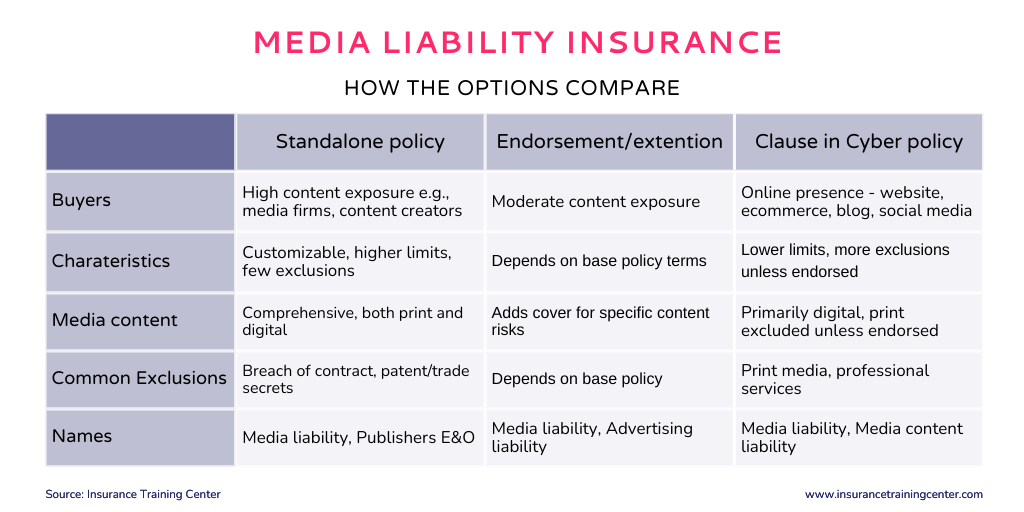

Media liability coverage is available in the insurance marketplace as a stand-alone policy, as an extension or endorsement to a base policy such as commercial general liability, and as an insuring clause within some cyber insurance policies.

Traditionally, standalone media liability policies are designed for publishers or broadcasters, offering comprehensive coverage for organizations for which media content is core to their business. As nearly every business engages in some form of online publishing, whether it’s maintaining a website or posting on LinkedIn, the relevance of this coverage has expanded well beyond media and advertising companies. Media liability coverage on a cyber policy typically focuses on digital media exposure.

Here’s a closer look at the options:

Standalone media liability policy

Organizations whose core business involves creating and distributing content, such as publishers, broadcasters, media outlets, marketing agencies, and PR firms, typically purchase standalone media liability policies. This type of policy provides comprehensive protection that covers both print and digital content, typically with higher limits and fewer exclusions than other policy types. It’s highly customizable and well-suited to organizations with significant media exposure. Coverage usually includes defamation, copyright and trademark infringement, invasion of privacy, plagiarism, and advertising injury. Look for terms such as “Media Liability,” “Publishers E&O,” or “Broadcasters E&O.”

Endorsement or extension

A media liability endorsement or extension is an add-on to another insurance policy, such as a general liability or E&O policy. This option is best for businesses that don’t specialize in media but still engage in occasional publishing or content production. The endorsement provides moderate coverage and generally mirrors the limitations of the base policy to which it is attached. These endorsements can offer protection for digital or print content, depending on the underlying policy terms. Customization is typically limited. Look for terms like “Media Liability Endorsement” or “Advertising Injury Extension”. Exclusions often depend on the base policy, and may include regulatory violations, user-generated content risks, or professional services.

Media liability on a cyber policy

Some cyber insurance policies include media liability as standard insuring agreement. It’s especially useful solution for organizations that operate online (e.g., ecommerce) and those that maintain websites, post on social media, or distribute digital marketing content. Media liability coverage on a cyber policy usually focuses on digital content only, excluding print media unless that is specifically endorsed. To find this cover on a cyber insurance policy, look for terms such as “Multimedia Liability” or “Media Content Liability.” Typical exclusions include print content, professional services, regulatory violations, and claims related to known issues or prior acts.

Case example: Copyright trouble from a blog post

A boutique marketing agency published a blog using an image found online. They believed it was royalty-free. A few weeks later, the image owner filed a copyright infringement claim. Legal fees and a settlement exceeded $35,000. Their cyber policy’s media liability coverage helped cover the loss.

Who needs media liability coverage?

Nearly every organization engages in some form of online publishing, such as maintaining a website or posting on LinkedIn. Thus, the relevance of this coverage has expanded well beyond media and advertising companies. Here are some examples of businesses that benefit significantly from this coverage:

Marketing and Advertising Firms — These organizations routinely create and distribute content on behalf of clients, making them especially vulnerable to copyright, trademark, or defamation claims. Even minor errors—such as using a stock photo beyond its license scope—can lead to costly disputes.

Tech and SaaS Companies — These businesses often maintain robust digital footprints, including blogs, knowledge bases, and user forums. They may also host user-generated content, opening the door to liability if inappropriate or infringing material is published.

Retail and E-commerce Brands — With extensive digital marketing, product descriptions, social media promotions, and customer reviews, e-commerce companies face a surprising range of media liability risks. A claim can arise from a misused logo, a product ad that references a competitor, or even customer-posted content.

Healthcare, Legal, and Professional Services Firms —Professionals who share insights through newsletters, webinars, or educational content can unintentionally publish material that’s inaccurate, improperly cited, or privacy-invading—especially in highly regulated industries.

Any Business with a Strong Online Presence — If your organization uses websites, social platforms, or email marketing to promote its brand or engage with the public, media liability risks are already on your radar—whether you realize it or not.

Ultimately, the question isn’t if your organization needs media liability coverage. The question is how much and how well-tailored that coverage is to your business model. Even small firms can face six-figure claims tied to media content, especially if they require legal defence.

Key takeaways

- Media liability coverage protects against content risks like defamation and copyright claims.

- Coverage terms vary – read policy definitions and exclusions closely.

- Claims-made policies have strict reporting deadlines — track notice requirements to avoid coverage gaps.

- Buying options include standalone, endorsement or extension, and, as part of a cyber insurance policy.

- Most organizations need this coverage, even those outside the media industry.

- Work with a broker to ensure the policy fits your risk profile and publishing activity.

More…