Reading Time: 3.5 Minutes

SWOT analysis for insurance – learn how to use this valuable planning tool

For many of us, January means post-holiday blues, cutting alcohol or sweets from your diet, and perhaps exercising more than you did the entire year prior. It also involves planning for the upcoming year. Executives and senior management’s agendas are booked solid with countless meetings. Hours will be spent on SWOT analysis to set a strategy for the upcoming year. Objectives, tactics, and implementation plans will eventually trickle down to every employee.

Whether you are “at the table” or not for these meetings, you can plan for the upcoming year and make it a fruitful one. January is a great time to develop a plan and think strategically about personal goals and how you will overcome challenges. It’s the time to lay the groundwork, adjusting as required throughout the year.

What is SWOT analysis, and why is it useful?

SWOT Analysis is a strategic framework that leaders use to assess Strengths, Weaknesses, Opportunities, and Threats of a plan or project. The analysis accounts for both internal and external factors, supposedly allowing for better business decisions. A traditional application of the model focuses on strengths to maximize the opportunity and bring awareness to weaknesses to minimize threats. While this is valuable, there is an alternate application that may yield a deeper analysis.

Optimizing SWOT analysis for the insurance industry

One shortfall of SWOT Analysis for insurance is applying the model only at the start of the year. The insurance industry is incredibly dynamic. Insurers don’t wait until January to exit markets or put up rates. Mergers and acquisitions seldom happen at the start of the year, and competitors pop up in every corner throughout the year!

Considering the number of moving parts in this industry, we should carve out time to review and adjust the SWOT analysis regularly. The January plan is only a start – we can only see so far into the tunnel by January 15th.

The second shortfall, and perhaps the most common one I’ve seen, is getting stuck on strengths and weaknesses. Weaknesses can be strengths, and strengths can be weaknesses, depending on the circumstances. For example, a boutique broker may list “small company” as a weakness when evaluating its marketing footprint in comparison to a national brokerage. However, a “small company” may be agile and thus better able to foster a creative environment capable of launching an innovative marketing campaign.

Strategic planning hinges on one’s ability to use their strengths and weaknesses to combat threats and seize opportunities. A Harvard Business Review article by Michael D. Watkins on SWOT analysis, suggests applying TOWS rather than SWOT. I agree with his argument.

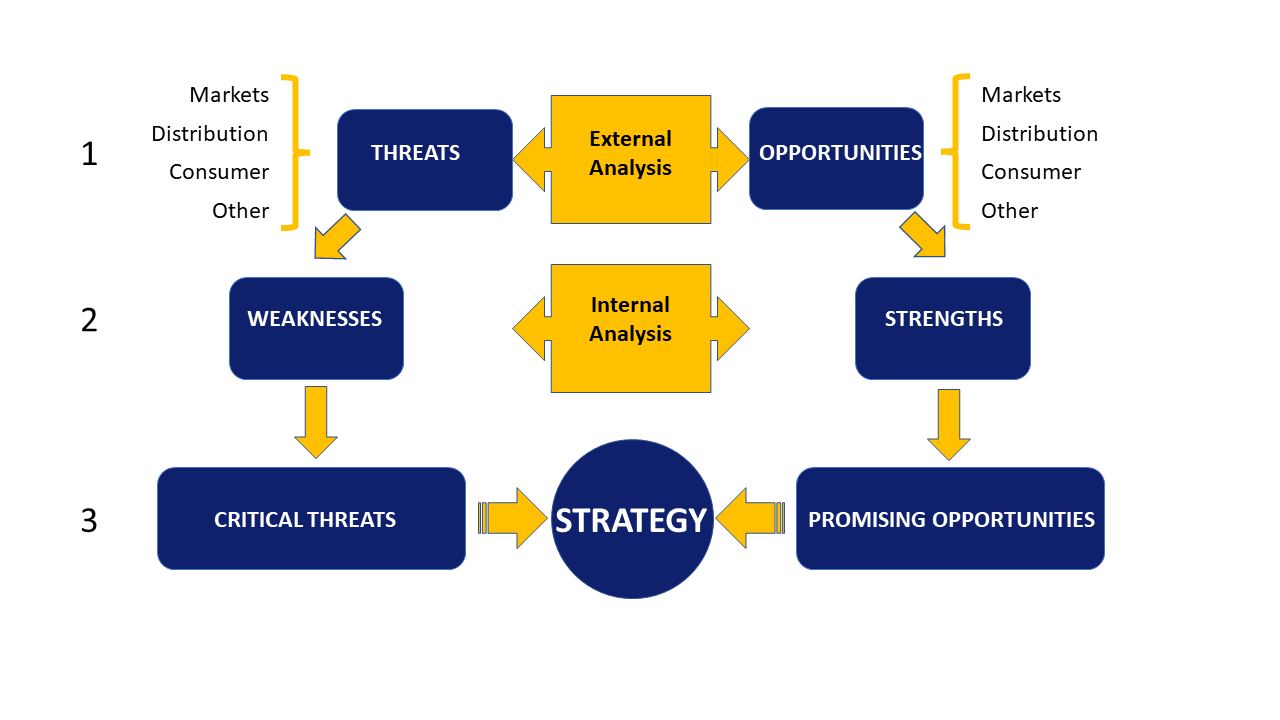

Considering how complex the insurance industry is, I believe Watkin’s application of the model allows for a more in-depth analysis that takes us away from the already known weaknesses and strengths and instead focuses first on external conditions. Professor Watkin’s suggestion is to start by analyzing Threats and Opportunities to identify relevant strengths and weaknesses afterward.

TOWS instead of SWOT

In my adaptation of his diagram for the insurance industry, I take the analysis one step further for a dive into consumer behavior, distribution, markets, and others (such as claims adjusters or other industry partners) for a systematic analysis.

How to TOWS instead of SWOT?

1. Scan the environment around you, starting with markets, distribution channels, and consumer behaviour for threats, such as:

-

- Emerging competitors

- Outdated products or services

- Upward pressure on rates affecting client retention

and opportunities such as:

-

- Underserved sectors

- Coverage or new product needs due to regulatory changes

- Areas with fewer competitors

2. Once you have identified threats and opportunities, make a list of your strengths and weaknesses specific to the identified external and internal factors. What strengths can you tap into to seize on opportunities? Examples of strengths are:

-

- Qualities that separate you from the competition

- Knowledge or skillset that makes you stand out

- Other tangible advantages such as technology platforms, a strong network, intellectual property, or access to other internal resources.

Apply the same thought process to weaknesses to identify limitations that could get in the way of making a positive impact.

3. As illustrated in the diagram, once you have identified critical threats and promising opportunities, you will be able to set a strategy that speaks to the challenges and opportunities you currently face in the market. Your strategy should be supported with specific objectives and tactics you can put into action, including daily activities that will lead you to achieve your goals.

Regardless of your role within the industry, or how far removed you are from the management team, I challenge you to give TOWS some thought. This exercise will provide you with greater insight into your role and how you will be able to stand out within and outside your company. Moreover, when a mandate does trickle down from senior management, you’ll be better equipped to align your strategy to that of the organization and make a positive contribution.

References:

Watkins, M.D. (2007, March 27). From SWOT to TOWS: Answering a Reader’s Strategy Question. Retrieved from https://hbr.org/2007/03/from-swot-to-tows-answering-a-readers-strategy-question.