Captive insurance is an arrangement in which a business procures insurance coverage through an insurance company that it owns and operates. This insurance provider, known as the captive, exists solely to provide coverage to its parent company, or to a small group of companies. While the concept can be confusing to those outside the industry, understanding the benefits of captive insurance—like greater control, tailored coverage, and potential cost savings—can make it clear why more businesses are considering this alternative to traditional insurance.

In this article, we’ll break it all down and explore both the advantages and drawbacks of setting up a captive insurance company:

What is a Captive insurance company?

Let’s start with the bare-bones definition.

A captive insurance company (or simply, a captive) is an insurance company established by a business for the purpose of insuring that business’ risks.

Unlike a traditional commercial insurance company that will issue policies to any company that fits its client profile, a captive only provides coverage to its parent company. In fact, that’s where it gets its name – it is beholden (or captive) to a single client.

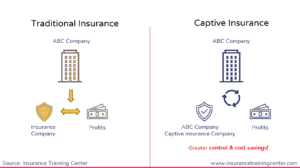

How a ‘Captive’ differs from traditional insurance

Now, it’s not just the exclusivity that makes captive insurance different. It’s also the relationship between the insurer and the insured.

When a business purchases coverage from a third-party insurance company, it becomes one of its policyholders. In this case, the terms are largely dictated by the insurer. They decide what risks they’re willing to insure and what exclusions are part of the policy.

Of course, the business is free to shop around and find the policy that best meets their needs. But they can’t dictate how the insurance company is run or shape their policy offerings in any meaningful way.

With a captive insurer, the parent company isn’t simply a policyholder. It also owns and controls the captive.

Control and customization

That control means the parent company has a say in what risks the captive will cover. In fact, captive insurance companies are sometimes created specifically to cover risks that third-party insurers are reluctant to take on.

Captives can also design customized policies that specifically target the various risks their parent company takes on, some of which may not be adequately covered by standard policies offered by third-party insurers.

Ownership

As the owner, the parent company also gets to benefit from the captive’s profitability. Profits earned by the captive can be directed back to the parent company.

The parent company can also have a say in how the captive will invest its earnings, which certainly would not be the case if they were simply a policyholder.

Why not self-insure?

Captive insurance gives businesses greater control over their insurance coverage.

But why go through the trouble of creating a captive when a company could simply opt to self-insure? What is the point of creating an entire company to back the risks instead of simply relying on capital reserves to cover the cost of losses?

Self-insurance is sort of like creating an emergency fund. It involves creating a cash reserve that can be dipped into when the business experiences a loss.

Like captive insurance, this approach gives companies a great amount of control over how they manage risks. Since they’re covering the losses themselves, there are no restrictions or policy exclusions to worry about. They also retain full control over the unused funds and can choose to reinvest them.

However, there are still a few reasons a business might opt to create a captive insurance company instead of insuring its own risks.

A captive isn’t simply an organization that holds onto the parent company’s funds until they incur a loss. It also provides a few advantages that are not available to the self-insured.

Tax advantages

Captives can offer many tax advantages, depending on where the captive is domiciled and where the parent company resides. Be sure to consult your tax expert for a breakdown of the specific ways a captive could benefit your business.

Access to reinsurance coverage

As insurance companies, captives are also able to purchase reinsurance. Reinsurance is essentially insurance for insurers – if an insurance company faces financial trouble due to an excessive amount of claims payouts, the reinsurer steps in to cover them and ensure they remain solvent.

Companies that self-insure don’t have access to reinsurance coverage, so if their losses far exceed the funds they set aside to cover them, they might have no recourse beyond bankruptcy.

Group captives

While some captives have a single parent company, others are owned and controlled by a small group of companies.

These group captives allow the parent companies to essentially pool their risks and share the liabilities. This lessens the burden on each individual company and allows a distribution of risks that would not be available if each of them self-insured.

However, it should be noted that coverage limits are aggregated as well. This means that one company sustaining a loss that reaches the limit will leave the other members of the group without any remaining coverage for any subsequent losses they may incur.

Drawbacks of establishing a captive insurance company

As we have seen, there are a number of advantages to getting insurance from a captive rather than purchasing a policy from a third-party insurer or opting to self-insure.

However, there are also drawbacks. Any business that is considering forming a captive insurance company should weigh these cons before making the decision.

Financial commitment

Establishing a captive isn’t as simple as filling out some paperwork and hiring someone to oversee daily operations. It requires a substantial up-front investment in time, resources, and finances.

First, the parent company must meet capitalization requirements to ensure it has the funds needed to create and run a captive insurance company. This amount will vary based on a few factors, such as the amount of anticipated risk, and can range from $100,000 to over $1,000,000. Wherever it falls, that amount can be prohibitive for most companies.

There are also various expenses just to get things started. This includes conducting a feasibility study to ensure that forming a captive is a good choice, hiring consultants to help with the process, and paying local domicile fees as well as the legal fees associated with forming a captive.

Naturally, the expenses don’t stop once the captive is up and running. There are ongoing administrative costs to worry about. Although it insures a single company (or a small group of companies), the captive is still a full-blown insurance company. That means it needs to be staffed with insurance professionals of various specialties, conduct annual audits, and take on all the other costs that come with maintaining an insurer..

While captives can offer savings in the form of lower premiums, these can be offset if the operating costs grow too large. In those cases, a captive insurance company becomes a burden rather than a benefit.

Financial risks

If an insurance company falls on hard times, those financial strains are the insurer’s problem, not the policyholders’.

With a captive, however, the policyholder is also the owner. As a result, any financial trouble that befalls the captive can also affect the parent company.

If the captive fails to appropriately price risks or suffers a series of unwise investments, it may no longer be able to cover its operating costs. When that happens, those expenses become the responsibility of the parent company.

Political changes

Captives are registered in captive domiciles – jurisdictions like Bermuda or the Cayman Islands that have favorable regulatory conditions. This allows the parent company to insure themselves against risks at a lower cost while also enjoying some tax benefits.

However, there is always a risk that those conditions may change – and could change quickly. Political turmoil, new legislation, and tightening regulatory controls, and changes to the domicile’s credit rating can all cause problems for the captive and the parent company that relies on it.

Captives: A great option (for some companies)

Captives were once associated with large, Fortune 500 companies – organizations that had the size and capital to not only take on the burden of insuring themselves, but create an organization for the sole purpose of doing so.

Now, it’s becoming increasingly common for mid-sized companies to get in on the captive game. And it’s easy to see why. The flexibility, cost savings, and potential profitability make forming a captive insurance company a very attractive prospect.

However, it’s not a solution that fits every organization. Prohibitive capitalization requirements, hefty setup costs, and additional administrative burdens are all reasons why some companies might opt to go the traditional route and simply purchase a policy from a third-party insurer – or even insure the risk themselves.

Forming a captive can be a costly and complicated choice. But for a growing number of businesses, it is becoming the right one.

Key takeaways

- A captive insurer lets a business cover its own risks through a company it owns and controls.

- Captives give businesses control over coverage, pricing, and investment decisions.

- Companies use captives to insure hard-to-cover risks and reduce insurance costs.

- Captives can access reinsurance and offer potential tax benefits.

- Group captives spread risk across multiple companies with shared ownership.

- Self-insurance gives control but lacks the financial tools captives provide.

- Starting a captive requires major upfront costs and ongoing management.

- Financial missteps in the captive directly impact the parent company.

- Changes in regulations or political climates can disrupt captive operations.