Businesses face many risks—from fires and theft to cyberattacks and equipment breakdowns. Insurance helps them recover when the unexpected strikes. One key type of insurance protection is first-party insurance. It protects the policy holder directly, offering financial help for its own losses.

What exactly is first-party insurance? Why is it called that, and how does it differ from other types of coverage? This article breaks it all down.

What is ‘First-Party Insurance’?

‘First-party insurance’ refers to a type of insurance that is designed to cover a business’s own direct losses from events like fire, theft, or cyberattacks. When a covered peril strikes, this type of coverage helps the insured party recover financially.

Your home property insurance policy is one example of this kind of insurance. Let’s say there is a break in. Your computer and expensive watch are stolen, and one of the sliding patio doors is smashed. First-party insurance is relatively straight forward. Under this type of policy, the insured does not need to prove that someone else was responsible. If an insured event occurs and causes damage to the policyholder, the insurer pays the policyholder directly for their loss. Meaning, your property insurer will assess the situation and compensate you accordingly.

So why is it called ‘first-party insurance’? In the insurance contract, the insured (the business) is the first party, while the insurer is the second party. If a covered peril causes damage, the insurer pays the insured directly for the loss, to the extent that it is insured by the policy. Hence the name, the protection runs directly to the policyholder.

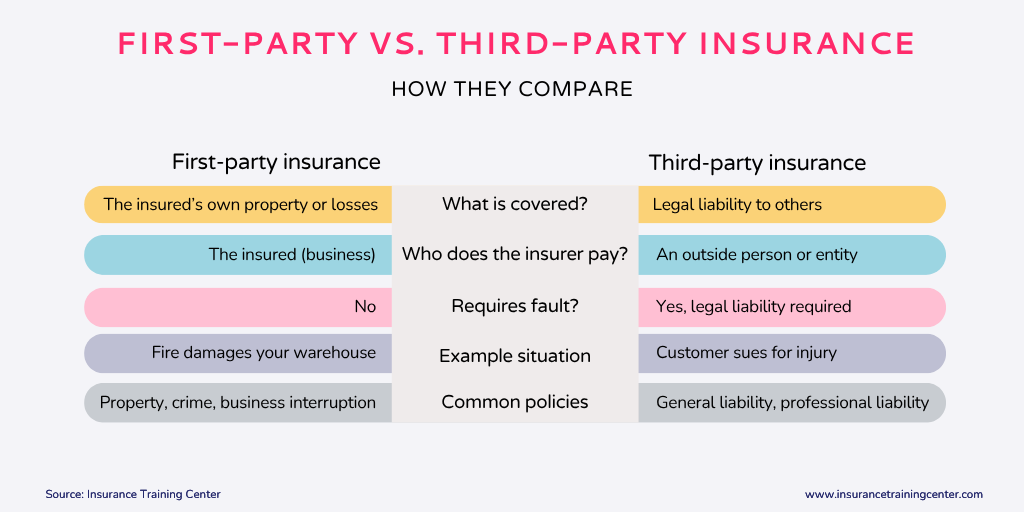

First-party vs. third-party insurance comparison

To fully understand first-party coverage, it helps to compare it with third-party insurance. In any insurance contract, the parties are typically defined as:

- First Party: The insured — the individual or business purchasing the insurance.

- Second Party: The insurer — the company providing the insurance coverage and financial protection.

- Third Party: Any outside individual or entity that is not part of the insurance contract but may be affected by the actions of the first party (e.g., a customer, pedestrian, or subcontractor).

1st party scenario

Assume that you have bought insurance for your own business. First-party insurance covers you, the policyholder, when something happens directly to your business. For example, if a fire damages your office or a hacker locks your systems with ransomware, this insurance pays you to repair the damage or recover your data. When you file a claim that claim is for your own loss. First-party claims usually do not require proving fault. Rather, they only need to prove that a covered peril occurred and directly caused the loss.

3rd party scenario

Third-party insurance, on the other hand, protects your business when someone else claims that your actions caused them harm. For example, if a customer slips in your store and gets injured, they might demand that you pay for their medical bills. In that case, you didn’t lose anything directly—but you are being held responsible. Third-party insurance helps by paying the injured person on your behalf. Third-party claims often involve legal processes to establish liability before the insurer pays out so they can take a long time. This insurance is also called ‘liability insurance’ as the loss it protects against arises from the insured’s responsibility, their legal obligation or liability to the third party.

To summarize, first-party coverage is about your own losses, while third-party coverage is about protecting you from others’ claims. Here’s a simple way to remember it:

Examples of First-Party Insurance

Personal

Property Insurance – Covers damage to the insured’s own property (homes, commercial buildings). Covers events like fire, vandalism, and some weather damage.

Auto Insurance (Collision and Comprehensive) – Repairs or replaces the insured’s vehicle.

Health Insurance – Covers medical expenses for the insured.

Life and Disability Insurance – Provides income or benefits directly to the insured or their beneficiaries.

Commercial

Commercial Property Insurance – Protects the insured’s buildings, equipment, and inventory. Covers events like fire, vandalism, and some weather damage.

Business Interruption Insurance – Covers lost income and extra costs when operations are halted due to a covered event.

Cyber Insurance (First-Party Component) – Covers direct expenses from data breaches, ransomware attacks, and system outages. Pays for recovery, business interruption, and PR.

Commercial Crime Insurance – Covers losses from theft, fraud, and forgery—often by employees.

Builder’s Risk Insurance – Protects buildings under construction. Covers theft, fire, and other physical damage during the build.

What’s with the names?

Did you notice that not one of the examples given above has the words ‘first-party’ in the insurance name? The only one that comes close is Cyber Insurance because I’ve added it in brackets after the insurance name. Why did I do that?

The majority of insurance policies purchased by individuals or businesses are first-party insurance. These policies protect the insured from direct losses and are, therefore, rather straightforward. There is no one else involved, just the insured and the insurer. In most cases, when people talk about ‘insurance,’ that’s the kind of insurance that they’re talking about, even if they don’t use the term.

We only use the term ‘first-party’ when we need to differentiate it from third-party insurance, which covers claims made by someone else against the insured. For example, general liability insurance protects your business from lawsuits, so it’s clearly different from insurance that pays you for your own damage. Now we come to cyber insurance. Cyber insurance is somewhat special in that many cyber policies include both types of insurance, rolled into one policy. That has a big impact on how the policies are structured because these two types of insurance are so very different. Learn all about cyber insurance here.

In short, first-party insurance is the default understanding of what insurance means—which is why we rarely call it that unless we’re making a technical comparison.

Key takeaways

- In first-party insurance, the insured is claiming for its own direct loss such as property damage, lost income, or stolen assets.

- In third-party insurance (liability insurance), the insured has protection for loss resulting from others’ claims. That may involve lawsuits, injuries, or damage caused to outside parties.

- First-party insurance is the default understanding of what insurance means—which is why we rarely call it that unless we’re making a technical comparison.

- A cyber insurance policy is an exception as it typically includes both types of insurance within one policy.

Learn more: