What is a Fronting Agreement (and how does it work)?

A fronting agreement is an arrangement in which a licensed, admitted insurer issues and administers an insurance policy on behalf of a captive insurer. Although the fronting insurer manages the policies and handles the claims process, it does not take on the risk – that is, the financial responsibility of paying for losses. Likewise, it does not retain the premiums collected on the policy, but passes them on to the captive.

In this article, we’ll explain the role of fronting in captive insurance and what’s included in a fronting agreement. Then we’ll go over the pros and cons of working with a fronting insurer.

First off, what is a captive?

A captive is an insurance company that is established, owned, and operated by a business (which acts as the captive’s parent company) in order to insure the risks incurred by that business.

Founding a captive gives the parent company greater control over its insurance. The captive can also provide coverage for risks that are typically excluded in standard insurance policies. Owning and operating a captive also typically reduces overall insurance costs.

Fronted vs. non-fronted captives

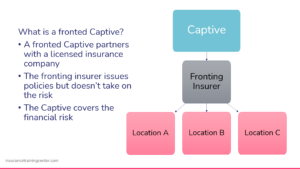

In some cases, however, the parent company may be required to purchase coverage from a licensed insurance provider, rather than acquiring it directly from the captive. To accomplish this, the captive can enter into a fronting agreement with a third-party insurance provider.

Under this arrangement, the fronting insurer essentially acts as a middleman in the transaction. They write and issue the policy, collect premiums from the parent company, and pay out claims. However, they do so without assuming many of the risks that a traditional insurer would take on. Instead, it is the captive’s responsibility to reimburse the fronting insurer for any losses incurred through the policy.

- Non-Fronted Captive: The captive handles everything itself. It issues the policy, collects premiums, and pays out claims directly to the parent company.

- Fronted Captive: The captive works with a licensed insurance company. The fronting insurer issues the policies and manages claims without taking on any of the losses.

Note that the parent company can also use a hybrid approach. It can purchase insurance directly from their captive in certain domiciles but use a fronting insurer in other locations.

The fronting agreement

The fronting agreement is a contract between the fronting insurer and the captive. It spells out the details of the fronting arrangement.

Unlike traditional insurance coverage, in which the insurer is responsible for paying out claims, the fronting agreement states that the claims are ultimately funded by the captive.

The fronting agreement also stipulates collateral requirements for the captive. This ensures the captive is able to handle all the losses associated with the policy. While the collateral must come from the captive itself, the fronting insurer may accept a letter of guarantee from the parent company as part of the agreement.

The captive can also purchase a policy from a reinsurer. This further ensures its ability to cover every loss that arises while the fronting agreement is in effect.

How insurance works under a fronted agreement

Here’s a clear breakdown of how fronting works in practice:

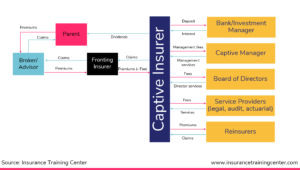

- The parent company (the insured) purchases an insurance policy from the fronting insurer (not from the captive).

- The fronting insurer issues the policy. In doing so, it assumes the associated regulatory and legal risks, and acts as the insurer of record.

- The parent company pays premiums to the fronting insurer, as it would with any other commercial insurer.

- The fronting insurer cedes the premiums (minus a fronting fee) to the captive insurer through a reinsurance agreement.

- The parent company files claims through the fronting insurer. The fronting insurer then pays out the claim directly to them, as per the terms of the policy.

- The captive is then responsible for reimbursing the claim amount back to the fronting insurer.

Benefits of a fronting agreement

A fronting agreement introduces an intermediary between the captive and its parent company. On the surface, it appears to simply shuffle money around. The fronting insurer collects premiums, only to cede them to the captive. It pays out claims, but then gets reimbursed by the captive.

So why go through the trouble?

Well, there are a few reasons. Here are the major ones.

- Regulatory Compliance: Since the fronting insurer is a licensed insurance company, working with them allows the parent company to meet more stringent regulatory requirements.

- Broader Ability to Insure: The fronting insurer can issue policies in states or countries where the captive is not licensed. This is useful for a parent company that operates in multiple jurisdictions and may struggle to meet its insurance needs.

- Reduced Licensing Burden: By working with a fronting insurer, the captive does not need to become licensed in every location in which its parent company operates, which can be a difficult and costly process.

- Wider Acceptance: Some clients, banks, and partners may be less comfortable with policies issued by a captive. They may be more favorable if the captive coverage is fronted by a licensed insurance provider.

Downsides of a fronting agreement

For all its benefits, there are some drawbacks to fronting a captive insurance company. Here are some of the reasons a business may decide to stick with a non-fronted captive.

- Collateral Requirements: As part of a fronting agreement, the captive must put some collateral on the line. Typically, this will be substantial and represent an amount greater than the projected losses covered by the policy.

- Higher Costs: The fronting insurer requires payment for issuing and administering policies on behalf of the captive. The exact fronting fees will depend on a few factors, such as the captive’s financial strength. Generally, they range somewhere between 5 to 15% of the premiums collected through the policy.

- Less Control: Working with a fronting insurer means relinquishing control over the policy. A non-fronted captive has the freedom to make claims decisions without any outside interference. A fronted captive, however, must leave the process up to the fronting insurer.

Key takeaways:

- A fronting agreement allows a captive insurer to access broader markets and meet regulatory requirements by partnering with a licensed insurer to issue and administer the policy.

- In a fronted arrangement, the fronting insurer issues the policy and handles claims. However, it passes the financial risk and premiums (minus a fronting fee) to the captive through a reinsurance agreement.

- This structure allows the parent company to benefit from captive insurance even in jurisdictions where the captive is not licensed.

- Benefits of fronting include expanded geographic reach, regulatory compliance, and greater acceptance by third parties (e.g., lenders, clients).

- Drawbacks of fronting include the need for substantial collateral, additional administrative costs, and reduced control over claims handling.

Related Reads: Dive Deeper into Captive Insurance: