Employee dishonesty is a major problem for organizations. Crime committed by employees is complex because it is about human behavior. Fortunately, there are steps an organization can and should take to limit risk. Nevertheless, we cannot totally eliminate the risk because we need employees and we need to trust them to carry out their duties. That’s why organizations also buy commercial crime insurance (which includes “employee dishonesty coverage”) to limit the negative financial consequences of crime when it does happen and to ensure that crime cannot and will not hurt the long-term viability of the organization.

Continue reading below to learn important information about employee dishonesty, why it happens, and what you can do about it.

1. Employee dishonesty is a common problem

The most common source of commercial crime insurance claims is loss from crimes committed by employees. The volume of these crimes is high and the size of the typical loss is large. In a report by the Association of Certified Fraud Examiners (ACFE) based on their 2019 study, the median loss worldwide was USD125,000 per case. 21% of the employee crime cases had a loss of more than one million US dollars.

View the ACFE 2020 Report (based on the 2019 study)

2. Employee dishonesty is a people issue

A particular challenge with employee dishonesty is its complex nature. It’s about people and the relationship between employee and employer. Simply adding an extra lock to the door won’t prevent all employee crimes. Employees are a trusted part of an organization. They have access to inventory, payroll, financial statements, vendor account details and more. And they need the access in order to do their jobs.

So, has trust been misplaced?

Management places the greatest level of trust with senior staff and those who’ve been with the organization for a long time but the crime facts show a stark reality. According to the ACFE study, the higher the employee rank, the greater the median loss. Also, the longer the employee tenure, the greater the median loss.

Watch a video about The Nature of Employee Crime

3. Employees commit crimes for lots of different reasons

The motivation for employee crime is as varied as the employees themselves. Sometimes it is as simple as, “Because they can”. Of the 2504 cases reviewed in the ACFE study, 42% of the fraudsters were living beyond their means while 26% were having financial difficulties. Were greed and need their main motivation for committing crimes against their employers? Did they have addictions to feed? Were they disgruntled and seeking revenge? OR, did they just see an opportunity that was simply too hard to resist?

Employee dishonesty occurs when opportunities are presented. Especially when there are no checks and balances in place for prevention. Crime happens when risk management procedures are overlooked. It also happens when too much trust is placed on individuals. Small organizations with long-term, trusted employees can be very susceptible to crime. This is because trust and long-term employment are often used as a substitute for segregation of duties and strong internal controls.

Watch real-life Employee Dishonesty Examples

Small business owners and managers also tend to trust their employees on a more personal level, since they have more contact with them. Small organizations have less personnel and may also lack the resources needed to enact adequate risk management procedures such as auditing policies and vigorous hiring practices.

4. Steps to take to combat employee dishonesty

To combat employee dishonesty, organizations need to start by looking at their human resources and operational controls.

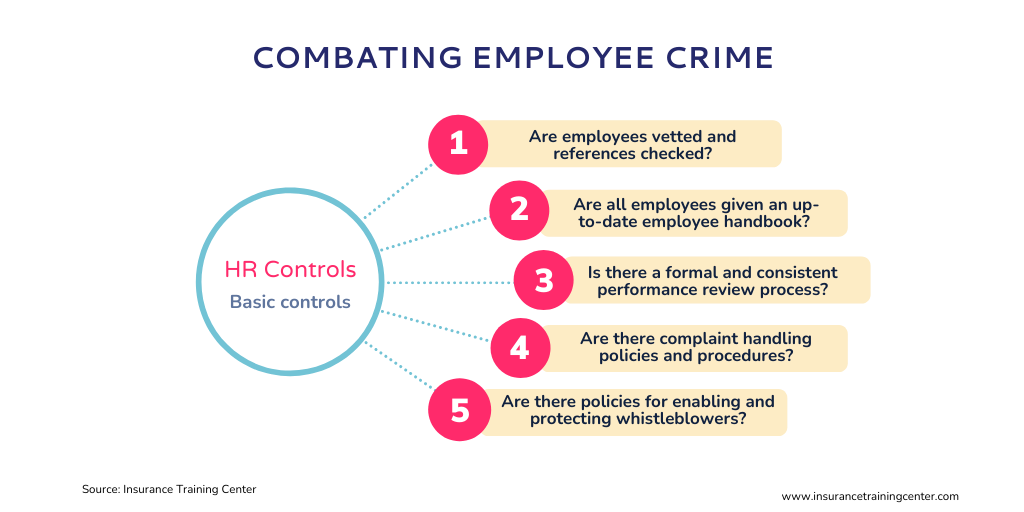

Human resources controls

Employee dishonesty is a people problem and disgruntled employees are easily tempted. Organizations should work with human resources to reduce people management ambiguity and inconsistencies that can frustrate employees.

For example:

- When hiring, are employees vetted and references checked?

- Is an up-to-date employee handbook provided to all employees?

- Is there a formal and consistent process for performance reviews to limit feelings on unfair treatment?

- Are there policies and procedures in place to direct employees and management on the handling of complaints?

- Do you have policies for enabling and protecting whistleblowers?

Regardless of the motivation behind the crime, making crime challenging to execute can go a long way to combating crime and the associated losses. This requires putting policies, procedures and controls in place. The key to combating crime, especially employee crime, is through dual control of duties. Too much responsibility and trust in one individual can lead to a loss as crime can easily go unobserved.

Operational controls

Operational controls are applicable to any organization.

For example:

- Segregation of duties, especially around payroll and accounts receivable

- Formalized vendor management processes

- Request bids from more than one supplier and dual review contracts

- Strong funds transfer controls

- A whistleblower hotline or mailbox

- An independent internal audit function

This is not an exhaustive list but it does give an idea of what approach organizations need to take to reduce the opportunity for crime.

5. Employee dishonesty coverage limits loss from employee crime

According to the ACFE study, 54%[1] of the 2504 organizations victimized did not recover any of their losses. While large organizations may be able to absorb the occasional loss, for smaller organizations, a loss of that size can be devastating – especially if it’s not a one-time event.

Commercial crime insurance is a type of property insurance for commercial organizations. It’s designed specifically to cover the loss that an organization suffers from damage to, or destruction or disappearance of, its own property as a direct result of crime.

Commercial crime insurance policies cover both crimes committed against the organization by its employees and crimes committed against the organization by those who are not employees. Crimes committed by employees are commonly covered under an employee theft or employee dishonesty insuring agreement (often referred to as ’employee dishonesty coverage).

Even if an organization is not ready to buy commercial crime insurance, completing a commercial crime insurance application form is a great idea to help you analyze your organization’s risk. These forms ask for information about your organization and illustrate where the insurer looks to assess the organization’s crime risk.

Then, when you are ready to buy, look for insurance companies that have loss control departments. These insurers work with their clients, helping to audit what controls they have in place and make suggestions for improvement to prevent loss.

[1] Source ACFE, Report to the Nations 2020